- Australia

- /

- Metals and Mining

- /

- ASX:BGD

Companies Like Barton Gold Holdings (ASX:BGD) Are In A Position To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Barton Gold Holdings (ASX:BGD) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Barton Gold Holdings

When Might Barton Gold Holdings Run Out Of Money?

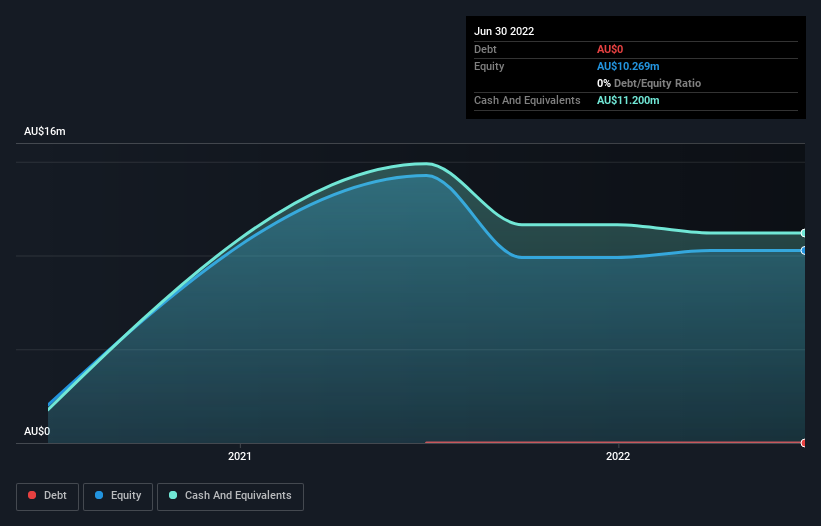

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2022, Barton Gold Holdings had cash of AU$11m and no debt. Importantly, its cash burn was AU$4.4m over the trailing twelve months. So it had a cash runway of about 2.6 years from June 2022. That's decent, giving the company a couple years to develop its business. Depicted below, you can see how its cash holdings have changed over time.

How Is Barton Gold Holdings' Cash Burn Changing Over Time?

Although Barton Gold Holdings reported revenue of AU$1.0m last year, it didn't actually have any revenue from operations. To us, that makes it a pre-revenue company, so we'll look to its cash burn trajectory as an assessment of its cash burn situation. With cash burn dropping by 17% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Admittedly, we're a bit cautious of Barton Gold Holdings due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Barton Gold Holdings To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Barton Gold Holdings to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Barton Gold Holdings has a market capitalisation of AU$43m and burnt through AU$4.4m last year, which is 10% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Barton Gold Holdings' Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Barton Gold Holdings is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. On this analysis its cash burn reduction was its weakest feature, but we are not concerned about it. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Separately, we looked at different risks affecting the company and spotted 2 warning signs for Barton Gold Holdings (of which 1 can't be ignored!) you should know about.

Of course Barton Gold Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Barton Gold Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BGD

Barton Gold Holdings

Engages in the exploration and development of mineral properties in Australia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success