- Australia

- /

- Metals and Mining

- /

- ASX:BCB

Bowen Coking Coal Limited Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

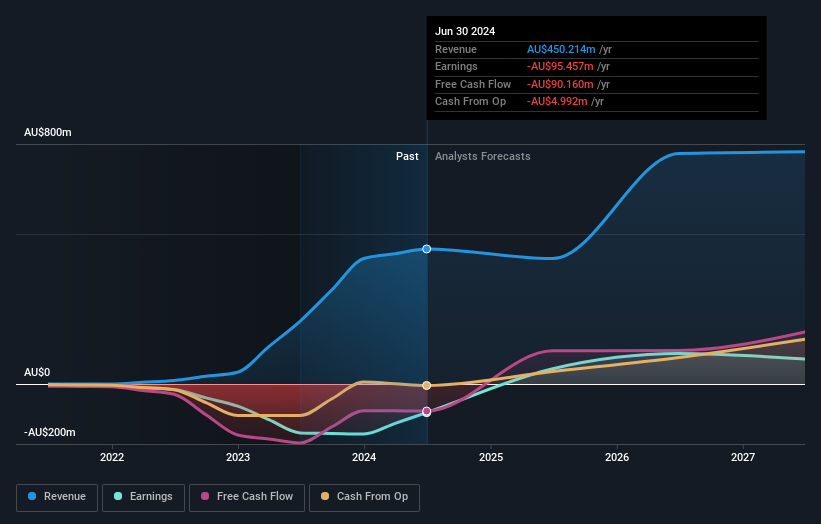

The yearly results for Bowen Coking Coal Limited (ASX:BCB) were released last week, making it a good time to revisit its performance. Revenues fell 7.9% short of expectations, at AU$450m. Earnings correspondingly dipped, with Bowen Coking Coal reporting a statutory loss of AU$0.037 per share, whereas the analysts had previously modelled a profit in this period. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Bowen Coking Coal

Taking into account the latest results, the current consensus, from the three analysts covering Bowen Coking Coal, is for revenues of AU$418.0m in 2025. This implies a small 7.2% reduction in Bowen Coking Coal's revenue over the past 12 months. Bowen Coking Coal is also expected to turn profitable, with statutory earnings of AU$0.008 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of AU$654.0m and earnings per share (EPS) of AU$0.059 in 2025. It looks like sentiment has declined substantially in the aftermath of these results, with a pretty serious reduction to revenue estimates and a pretty serious reduction to earnings per share numbers as well.

It'll come as no surprise then, to learn that the analysts have cut their price target 22% to AU$0.22. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Bowen Coking Coal analyst has a price target of AU$0.40 per share, while the most pessimistic values it at AU$0.05. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that revenue is expected to reverse, with a forecast 7.2% annualised decline to the end of 2025. That is a notable change from historical growth of 86% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 1.7% per year. It's pretty clear that Bowen Coking Coal's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Bowen Coking Coal going out to 2027, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 4 warning signs for Bowen Coking Coal you should be aware of, and 1 of them makes us a bit uncomfortable.

Valuation is complex, but we're here to simplify it.

Discover if Bowen Coking Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BCB

Bowen Coking Coal

Engages in the exploration, development, and production of metallurgical coal in Australia.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success