- Australia

- /

- Capital Markets

- /

- ASX:SWF

Spotlight On Ardea Resources And 2 Other Prominent ASX Penny Stocks

Reviewed by Simply Wall St

The ASX200 is set to open 0.46% higher today, mirroring a mixed performance on Wall Street after inflation figures met expectations, which has increased the likelihood of a Federal Reserve rate cut in December. In such a climate, identifying stocks with potential for growth can be crucial for investors seeking opportunities at lower price points. While the term "penny stocks" may seem outdated, these smaller or newer companies continue to offer significant potential when supported by strong financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.93 | A$314.24M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.49 | A$1.7B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.00 | A$133.27M | ★★★★★★ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ardea Resources (ASX:ARL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ardea Resources Limited is an Australian company focused on battery minerals, with a market capitalization of A$81.87 million.

Operations: The company's revenue is primarily derived from its Mineral Exploration and Development segment, totaling A$0.32 million.

Market Cap: A$81.87M

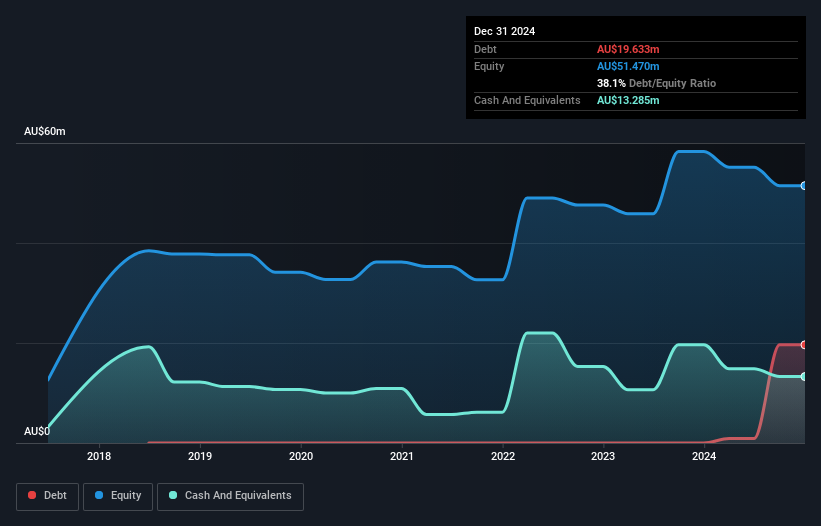

Ardea Resources, with a market cap of A$81.87 million, is pre-revenue and focuses on battery minerals. The company has more cash than total debt and short-term assets of A$16 million exceed both short- and long-term liabilities. However, shareholders have faced dilution with shares outstanding increasing by 2.6% over the past year. Despite having a seasoned management team, Ardea remains unprofitable with losses widening to A$7.71 million for the year ending June 30, 2024. While its cash runway is sufficient for over a year under stable conditions, declining free cash flow may shorten this period significantly.

- Click to explore a detailed breakdown of our findings in Ardea Resources' financial health report.

- Understand Ardea Resources' track record by examining our performance history report.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Big River Industries Limited, with a market cap of A$114.40 million, operates in the manufacture, distribution, and retail of timber and building products across Australia and New Zealand.

Operations: The company's revenue is divided into two main segments: Panels, generating A$123.58 million, and Construction, contributing A$291.09 million.

Market Cap: A$114.4M

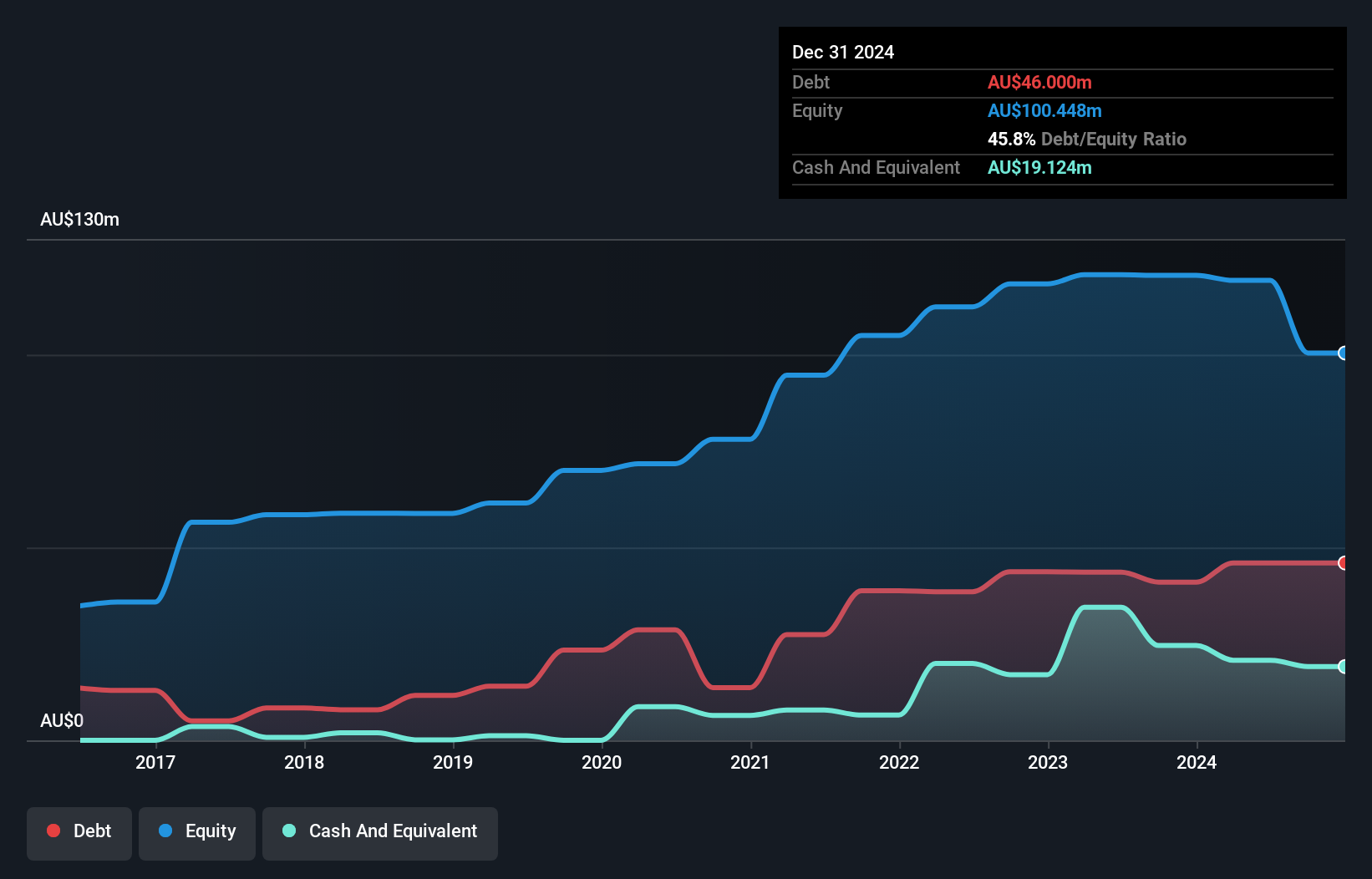

Big River Industries, with a market cap of A$114.40 million, has seen its debt-to-equity ratio rise over the past five years but maintains satisfactory net debt levels. The company's short-term assets comfortably cover both short- and long-term liabilities, indicating solid liquidity. Despite a challenging year with negative earnings growth and declining profit margins from 4.9% to 1.9%, Big River's operating cash flow adequately covers its debt obligations, and interest payments are well covered by EBIT at 3.1 times coverage. Trading below estimated fair value suggests potential for investment appeal despite recent shareholder dilution and an unstable dividend track record.

- Navigate through the intricacies of Big River Industries with our comprehensive balance sheet health report here.

- Explore Big River Industries' analyst forecasts in our growth report.

SelfWealth (ASX:SWF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SelfWealth Limited provides online share trading services on the Australian, United States, and Hong Kong stock exchanges with a market cap of A$47.30 million.

Operations: The company generates revenue primarily from brokerage services, amounting to A$27.54 million.

Market Cap: A$47.3M

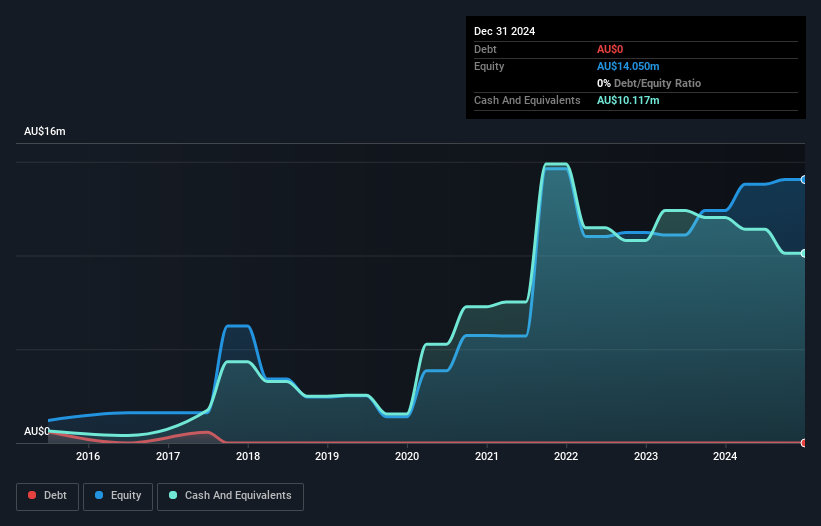

SelfWealth Limited, with a market cap of A$47.30 million, has reported significant earnings growth of 3596.2% over the past year, surpassing its five-year average and industry benchmarks. The company is debt-free and boasts a high return on equity at 24.8%, supported by strong net profit margins of 12.4%. Despite experiencing increased share price volatility recently, SelfWealth maintains solid liquidity with short-term assets exceeding liabilities and no meaningful shareholder dilution in the past year. Recent developments include a buyback completion and an acquisition proposal from Bell Financial Group valued at A$51 million or A$0.22 per share.

- Take a closer look at SelfWealth's potential here in our financial health report.

- Evaluate SelfWealth's historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 1,036 ASX Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SWF

SelfWealth

Engages in online share trading services on the Australian, the United States, and Hong Kong stock exchanges.

Outstanding track record with flawless balance sheet.