- Australia

- /

- Metals and Mining

- /

- ASX:ARL

ASX Penny Stocks: Ardea Resources And Two More Small-Cap Opportunities

Reviewed by Simply Wall St

The Australian market is poised for a challenging start to the week, with shares expected to open down amid global uncertainties fueled by recent tensions between the U.S. administration and the Federal Reserve, as well as ongoing trade disputes with China. In such volatile times, investors often look towards penny stocks—an investment area that, despite its dated terminology, remains relevant for those seeking growth opportunities in smaller or newer companies. By focusing on stocks with strong financial health and potential for long-term growth, investors can uncover hidden gems that offer both stability and upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.10 | A$154.99M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.58 | A$74.53M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.35 | A$362.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.84 | A$475.28M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.19 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.795 | A$603.41M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.47 | A$1.13B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.3825 | A$44.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 984 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ardea Resources (ASX:ARL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ardea Resources Limited is a battery mineral company operating in Australia with a market capitalization of A$87.86 million.

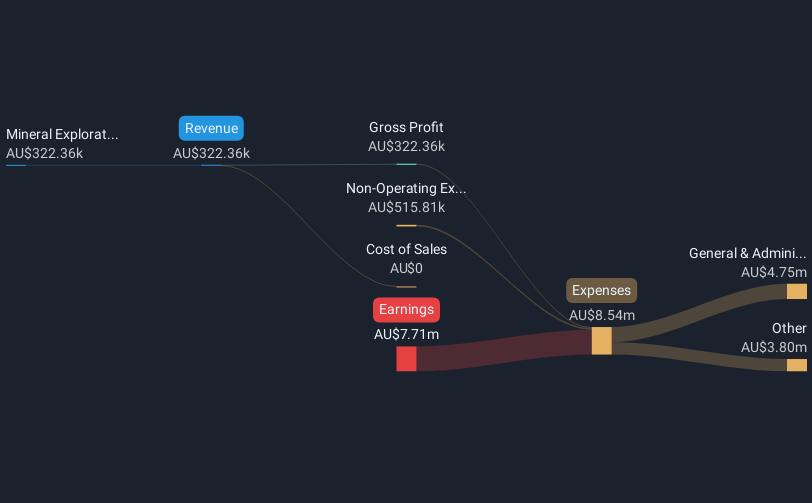

Operations: The company's revenue is derived from its Mineral Exploration and Development segment, amounting to A$0.08 million.

Market Cap: A$87.86M

Ardea Resources, a pre-revenue battery mineral company with a market cap of A$87.86 million, recently filed for a follow-on equity offering of A$4.61 million, which may help extend its cash runway beyond the current 11 months. Despite having satisfactory debt levels with a net debt to equity ratio of 12.3%, the company faces challenges such as unprofitability and declining earnings over five years at an annual rate of 31%. The board is relatively inexperienced with an average tenure of 1.8 years, though management shows more stability at 3.2 years tenure.

- Unlock comprehensive insights into our analysis of Ardea Resources stock in this financial health report.

- Gain insights into Ardea Resources' past trends and performance with our report on the company's historical track record.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited is involved in the exploration, development, and mining of mineral tenements in Western Australia, with a market cap of A$218.64 million.

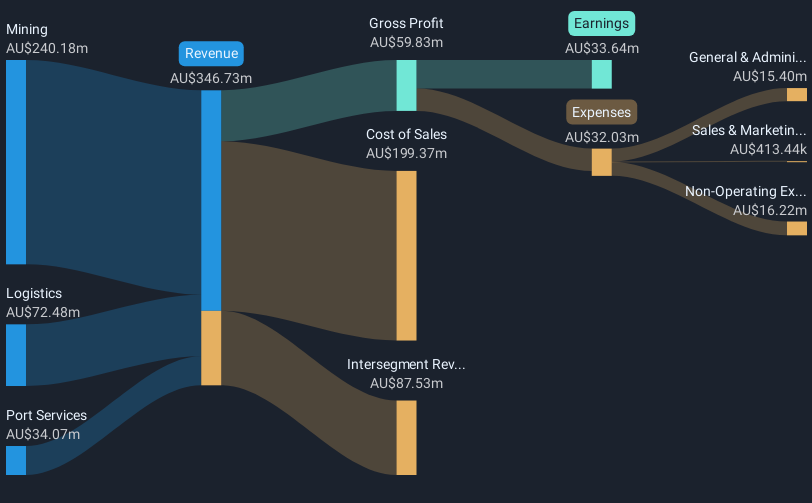

Operations: The company generates revenue from its Mining segment with A$244.98 million, Logistics at A$84.02 million, and Port Services contributing A$40.44 million.

Market Cap: A$218.64M

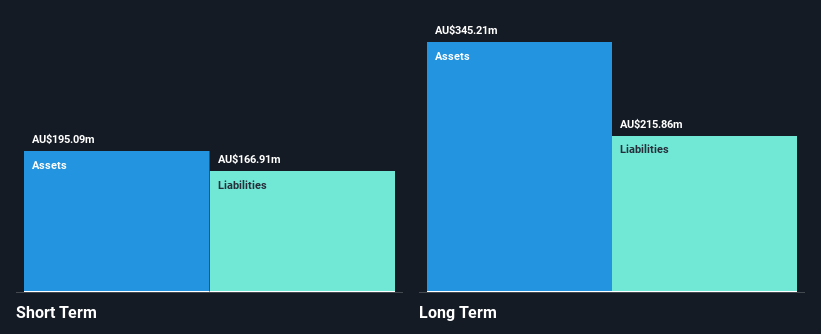

Fenix Resources, with a market cap of A$218.64 million, has shown mixed financial performance and strategic developments. The company reported half-year sales of A$130.97 million but saw a significant drop in net income to A$1.87 million from the previous year’s A$22.05 million, reflecting decreased profit margins at 5.1%. Despite recent negative earnings growth, Fenix's debt is well-covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 22.4 times interest expenses. Recent site works for the Beebyn-W11 Iron Ore Mine indicate potential revenue expansion as they aim for a production run rate of 4Mtpa during 2025.

- Dive into the specifics of Fenix Resources here with our thorough balance sheet health report.

- Evaluate Fenix Resources' prospects by accessing our earnings growth report.

Lindsay Australia (ASX:LAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates in the transport, logistics, and rural supply sectors serving food processing, food services, fresh produce, and horticulture industries across Australia with a market cap of A$206.22 million.

Operations: The company's revenue is primarily derived from its Transport segment at A$573.35 million, followed by Rural at A$160.92 million and Hunters at A$100.09 million, with Corporate contributing A$5.15 million.

Market Cap: A$206.22M

Lindsay Australia Limited, with a market cap of A$206.22 million, has demonstrated stable yet cautious financial performance. Recent earnings for the half-year ended December 2024 showed sales of A$427.77 million and net income of A$14.66 million, reflecting a decline from the previous year. The company's debt is well-covered by operating cash flow, and interest payments are adequately managed with EBIT coverage at 3.8 times interest expenses. Despite low profit margins and negative earnings growth over the past year, Lindsay's stock trades at a favorable P/E ratio of 8.6x compared to the broader Australian market average of 17.1x, suggesting potential value opportunities for investors interested in penny stocks within this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Lindsay Australia.

- Understand Lindsay Australia's earnings outlook by examining our growth report.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 981 more companies for you to explore.Click here to unveil our expertly curated list of 984 ASX Penny Stocks.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARL

Slight risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion