- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Alkane Resources Ltd's (ASX:ALK) Shares Leap 26% Yet They're Still Not Telling The Full Story

Alkane Resources Ltd (ASX:ALK) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

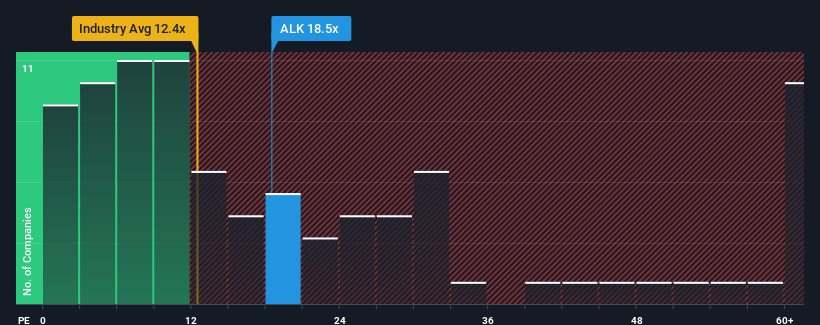

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Alkane Resources' P/E ratio of 18.5x, since the median price-to-earnings (or "P/E") ratio in Australia is also close to 20x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Alkane Resources' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Alkane Resources

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Alkane Resources' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 48% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 54% each year during the coming three years according to the five analysts following the company. With the market only predicted to deliver 18% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Alkane Resources' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Alkane Resources' P/E?

Alkane Resources appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Alkane Resources' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Alkane Resources (of which 1 is a bit concerning!) you should know about.

If you're unsure about the strength of Alkane Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives