- Australia

- /

- Metals and Mining

- /

- ASX:AIS

A Look at Aeris Resources (ASX:AIS) Valuation Following Turnaround to Profitability and Higher Sales

Reviewed by Simply Wall St

If you have been tracking Aeris Resources (ASX:AIS), the latest earnings announcement might have made you stop and reconsider your next move. The company just swung from a net loss last year to a net profit for the year ended June 30, 2025, with revenues also up compared to the prior year. Shifting gears from red to black is always an attention-grabber for investors wondering whether a genuine turnaround is underway or just a temporary lift.

This earnings reversal, coupled with improved sales, seems to have sparked a surge in interest around the stock. Over the past year, shares are up just over 103%, and gains have accelerated over the past month and quarter. However, when looking at the bigger picture, the stock’s three-year and five-year returns are still in negative territory, suggesting a mixed longer-term track record despite this recent momentum.

With Aeris Resources turning profitable and the share price rallying in response, some investors may be considering whether the current valuation is finally catching up with fundamentals or if there could be more room for upside if the market is underestimating future growth.

Most Popular Narrative: 7.3% Overvalued

According to the most widely followed narrative, Aeris Resources is currently viewed as slightly overvalued, trading above its calculated fair value when key future growth drivers and risk factors are considered under a 7.3% discount rate.

The development of the Murrawombie Pit is expected to generate significant cash flow over the next 12 to 18 months, due to higher-grade ore and increased production levels. This will positively impact revenue and operating cash flows as the pit reaches full operational capacity.

Want to know the bold financial assumptions that are boosting Aeris’s fair value? The real twist is how this narrative expects future operating strength and margin shifts to justify a premium valuation. Numbers that could surprise you. Are these forecasts too optimistic or right on target?

Result: Fair Value of $0.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks such as project delays or declining commodity prices could quickly undermine the optimism around Aeris Resources's recent turnaround story.

Find out about the key risks to this Aeris Resources narrative.Another View: Peer Comparison Paints a Different Picture

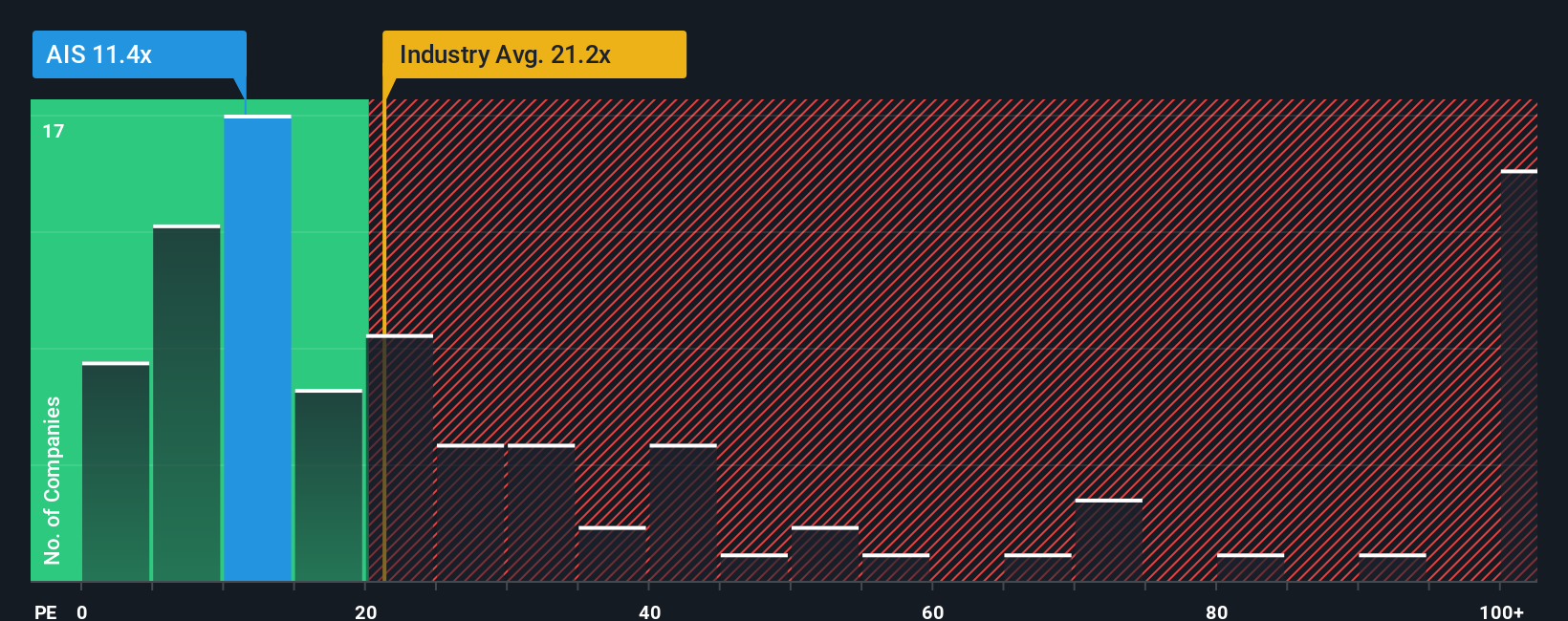

Looking at Aeris Resources through the lens of a simple earnings ratio, the company actually seems cheap compared to most of its industry rivals. This method delivers a more upbeat story than the previous fair value estimate. Could the value case be stronger than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Aeris Resources to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Aeris Resources Narrative

Feel free to dive into the data and shape your own view. If you have a different perspective, you can easily craft your own narrative in just minutes with Do it your way.

A great starting point for your Aeris Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

You owe it to yourself to unlock more opportunities. The Simply Wall Street Screener is packed with investment angles you’ll want on your radar before your next move. Missing out could mean leaving growth or income on the table.

- Supercharge your portfolio by targeting companies benefiting from breakthroughs in healthcare and artificial intelligence with our healthcare AI stocks.

- Tap into overlooked opportunities by zeroing in on shares trading below their intrinsic value using our undervalued stocks based on cash flows.

- Capitalize on steady returns by finding reliable stocks with high yields so you don’t miss quality income ideas, starting right here with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:AIS

Aeris Resources

Explores, produces, and sells precious metals in Australia.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives