- Australia

- /

- Metals and Mining

- /

- ASX:AAR

How Much Are Anglo Australian Resources NL (ASX:AAR) Insiders Spending On Buying Shares?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Anglo Australian Resources NL (ASX:AAR), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

View our latest analysis for Anglo Australian Resources

The Last 12 Months Of Insider Transactions At Anglo Australian Resources

In the last twelve months, the biggest single purchase by an insider was when MD & Director Marc Ducler bought AU$250k worth of shares at a price of AU$0.10 per share. Even though the purchase was made at a significantly lower price than the recent price (AU$0.15), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

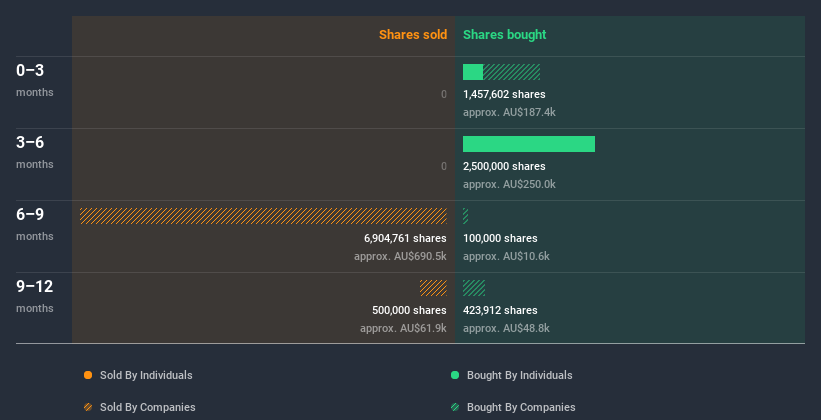

Marc Ducler bought 2.89m shares over the last 12 months at an average price of AU$0.11. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Anglo Australian Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 9.1% of Anglo Australian Resources shares, worth about AU$8.2m, according to our data. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. We do generally prefer see higher levels of insider ownership.

So What Do The Anglo Australian Resources Insider Transactions Indicate?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Anglo Australian Resources insiders are reasonably well aligned, and optimistic for the future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Anglo Australian Resources. Every company has risks, and we've spotted 4 warning signs for Anglo Australian Resources (of which 1 is significant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Anglo Australian Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:AAR

Astral Resources

Engages in the exploration and evaluation of gold properties in Western Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion