Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:TYX

Kuniko Leads The Charge With 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian stock market is experiencing a remarkable upswing, with the ASX200 reaching new heights, driven by strong performances in sectors like Health Care and Discretionary. Amidst this backdrop, investors are increasingly interested in exploring opportunities beyond the mainstream indices. Penny stocks, often associated with smaller or newer companies, offer an intriguing mix of affordability and potential growth when backed by robust financials. In this article, we explore three noteworthy penny stocks on the ASX that stand out for their financial strength and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.795 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$330.52M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.36M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.37 | A$111.24M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$808.63M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.03 | A$114.16M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.96 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kuniko (ASX:KNI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kuniko Limited focuses on exploring mineral properties for electromobility in Norway and Canada, with a market cap of A$18.66 million.

Operations: Kuniko Limited has not reported any specific revenue segments.

Market Cap: A$18.66M

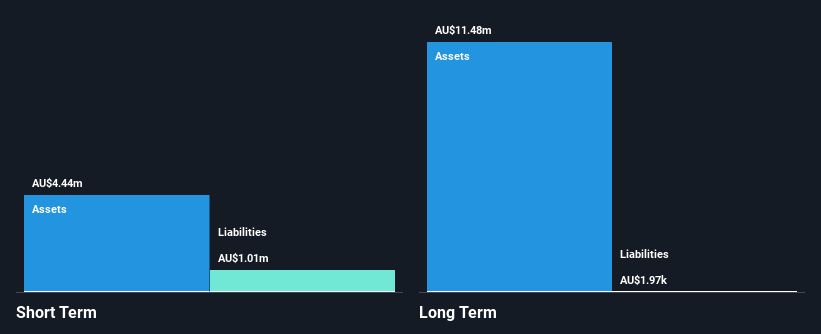

Kuniko Limited, with a market cap of A$18.66 million, is a pre-revenue company focused on mineral exploration for electromobility in Norway and Canada. Despite being debt-free and having short-term assets exceeding liabilities, Kuniko faces challenges with less than a year of cash runway based on current free cash flow. The company reported a reduced net loss of A$1.16 million for the half-year ended June 30, 2024, compared to the previous year. Its share price remains highly volatile and its management team is relatively experienced with an average tenure of 2.6 years.

- Jump into the full analysis health report here for a deeper understanding of Kuniko.

- Evaluate Kuniko's historical performance by accessing our past performance report.

Star Combo Pharma (ASX:S66)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Star Combo Pharma Limited is involved in the manufacturing and distribution of health food products and nutritional supplements in Australia and China, with a market cap of A$18.91 million.

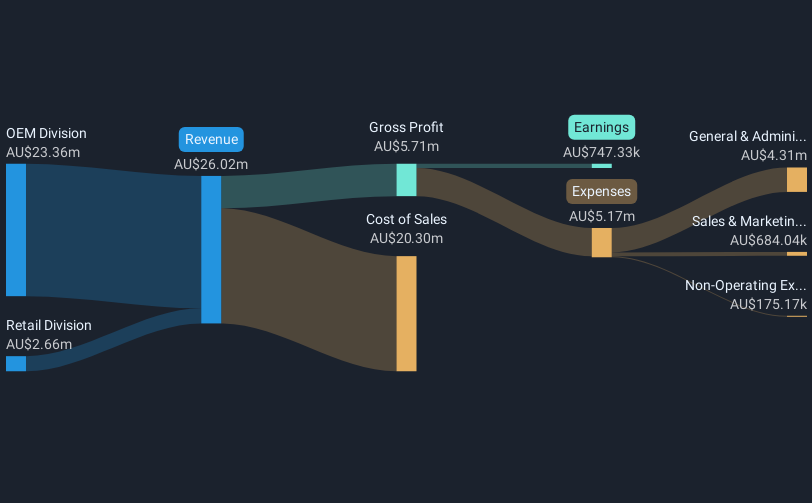

Operations: The company generates revenue from its OEM Division, which contributes A$23.36 million, and its Retail Division, which adds A$2.66 million.

Market Cap: A$18.91M

Star Combo Pharma Limited, with a market cap of A$18.91 million, has transitioned to profitability in the past year, supported by its OEM and Retail Divisions generating A$23.36 million and A$2.66 million respectively. The company maintains a healthy financial position with short-term assets of A$18.4 million exceeding both its short-term and long-term liabilities, while also having more cash than total debt. Despite low return on equity at 2.2%, Star Combo's debt-to-equity ratio has notably decreased over five years from 0.3% to 0.03%. Upcoming events include an earnings release on December 4, 2024.

- Dive into the specifics of Star Combo Pharma here with our thorough balance sheet health report.

- Assess Star Combo Pharma's previous results with our detailed historical performance reports.

Tyranna Resources (ASX:TYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyranna Resources Limited is engaged in the exploration and development of mineral properties both in Australia and internationally, with a market cap of A$13.15 million.

Operations: The company's revenue is primarily derived from its exploration activities in Angola, generating A$0.06 million.

Market Cap: A$13.15M

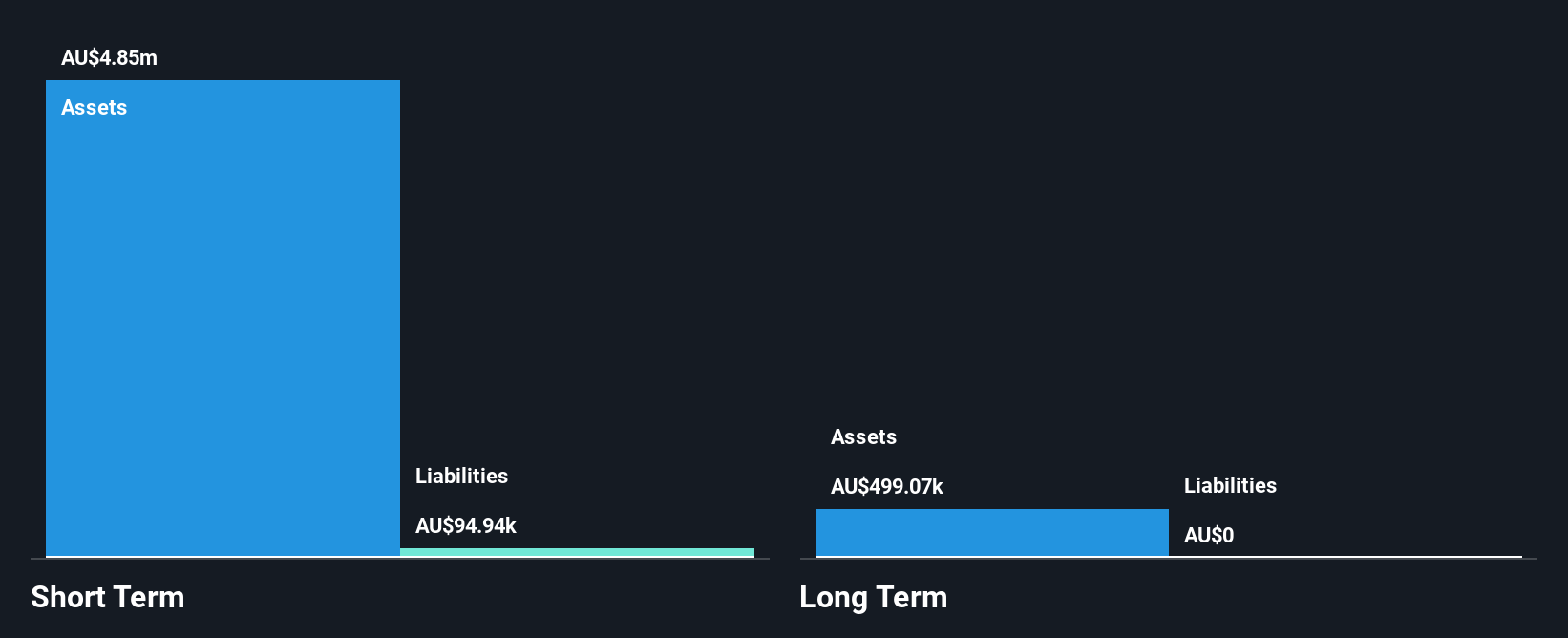

Tyranna Resources, with a market cap of A$13.15 million, is pre-revenue and currently unprofitable, reporting a net loss of A$42.47 million for the year ending June 2024. Despite its financial challenges, the company remains debt-free and has sufficient cash runway for at least one year based on current free cash flow trends. The management team is experienced with an average tenure of five years; however, the board's shorter average tenure suggests less experience in governance. Tyranna's share price has been highly volatile recently, indicating potential investment risk typical among penny stocks.

- Click here to discover the nuances of Tyranna Resources with our detailed analytical financial health report.

- Gain insights into Tyranna Resources' past trends and performance with our report on the company's historical track record.

Next Steps

- Jump into our full catalog of 1,044 ASX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyranna Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TYX

Tyranna Resources

Explores for and develops mineral properties in Australia and internationally.