Samantha Cheetham has been the CEO of SDI Limited (ASX:SDI) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for SDI.

See our latest analysis for SDI

How Does Total Compensation For Samantha Cheetham Compare With Other Companies In The Industry?

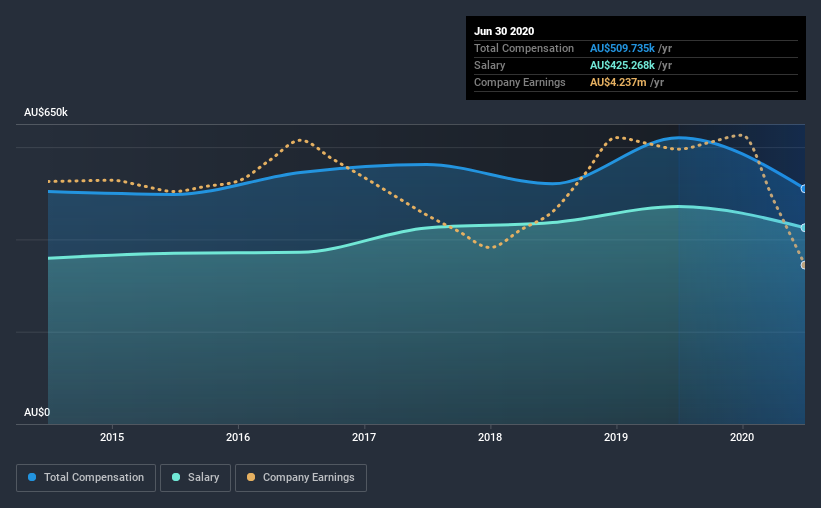

Our data indicates that SDI Limited has a market capitalization of AU$93m, and total annual CEO compensation was reported as AU$510k for the year to June 2020. That's a notable decrease of 18% on last year. In particular, the salary of AU$425.3k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below AU$260m, reported a median total CEO compensation of AU$590k. From this we gather that Samantha Cheetham is paid around the median for CEOs in the industry. Furthermore, Samantha Cheetham directly owns AU$282k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$425k | AU$471k | 83% |

| Other | AU$84k | AU$149k | 17% |

| Total Compensation | AU$510k | AU$620k | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. According to our research, SDI has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at SDI Limited's Growth Numbers

Over the last three years, SDI Limited has shrunk its earnings per share by 8.7% per year. Its revenue is down 15% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has SDI Limited Been A Good Investment?

Most shareholders would probably be pleased with SDI Limited for providing a total return of 95% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we touched on above, SDI Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This isn't great when you look at it against the backdrop of EPS growth, which has been negative for the past three years. On the other hand, shareholder returns are showing positive trends over the same time frame. We're not saying CEO compensation is too generous, but shrinking EPS is undoubtedly an issue that will have to be addressed.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 1 which doesn't sit too well with us) in SDI we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade SDI, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SDI

SDI

Engages in the research and development, manufacture, and distribution of dental restorative materials, whitening systems, and other dental materials in Australia, Europe, the United States, and Brazil.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026