- Australia

- /

- Healthcare Services

- /

- ASX:RHC

How Ramsay Health Care's (ASX:RHC) CFO Appointment Could Shape Its Transformation and Capital Strategy

Reviewed by Sasha Jovanovic

- Ramsay Health Care appointed Anthony Neilson, former CFO of Santos, as its new Group Chief Financial Officer effective November 24, 2025, filling a key leadership vacancy following Martyn Roberts' departure in April.

- Neilson’s track record in mergers, acquisitions, and capital management is considered particularly relevant as Ramsay Health Care evaluates structural changes within its Santé business and seeks to drive its transformation agenda.

- Let's explore how Anthony Neilson’s expertise in capital management could influence Ramsay Health Care's investment narrative and transformation outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ramsay Health Care Investment Narrative Recap

For shareholders, the key narrative for Ramsay Health Care remains faith in the multiyear turnaround, anchored in operational efficiency, digital innovation, and margin recovery, especially in the wake of recent earnings pressure. The appointment of Anthony Neilson as CFO adds experienced financial stewardship, but is unlikely to materially alter near-term catalysts such as progress in the Ramsay Santé strategic review. Risks around persistent wage inflation and low tariff indexation in France continue to overshadow the outlook, with the new CFO’s influence likely to be more visible over time.

Neilson’s arrival is particularly relevant against February’s announcement of a strategic review of Ramsay's majority stake in Ramsay Santé SA. As the business faces regulatory and reimbursement headwinds in France, effective capital management and structuring will be critical factors in any outcome that seeks to maximize shareholder value.

In contrast, any upside for investors could still face setbacks if reimbursement in France remains sluggish or wage costs rise faster than expected, so it is information worth being aware of as...

Read the full narrative on Ramsay Health Care (it's free!)

Ramsay Health Care is expected to reach A$20.6 billion in revenue and A$454.0 million in earnings by 2028. This outlook relies on a 5.0% annual revenue growth rate and a substantial A$447.2 million increase in earnings from the current A$6.8 million.

Uncover how Ramsay Health Care's forecasts yield a A$37.09 fair value, a 19% upside to its current price.

Exploring Other Perspectives

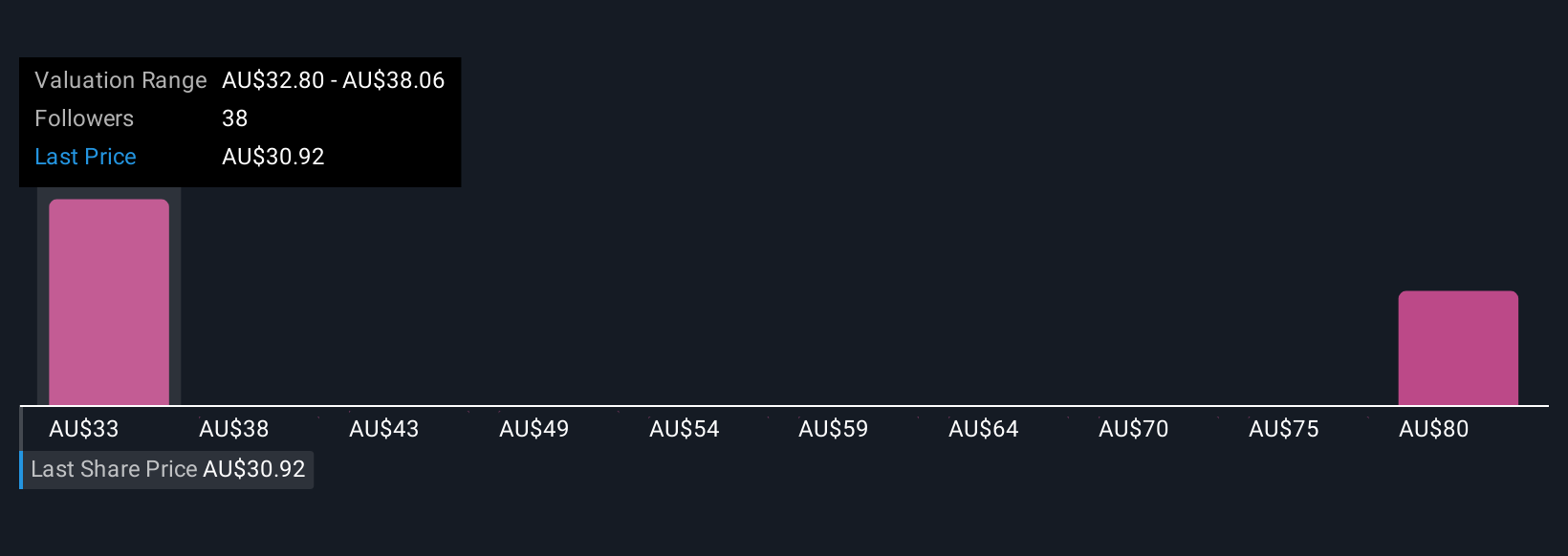

Six members of the Simply Wall St Community set Ramsay Health Care’s fair value between A$32.80 and A$86.46 per share. This wide range of views sits alongside the ongoing pressure from wage inflation and reimbursement rates, reflecting how differently investors weigh the outlook for margin recovery and operational improvement.

Explore 6 other fair value estimates on Ramsay Health Care - why the stock might be worth over 2x more than the current price!

Build Your Own Ramsay Health Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ramsay Health Care research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ramsay Health Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ramsay Health Care's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RHC

Ramsay Health Care

Owns and operates hospitals in Australia and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives