The Australian stock market is showing resilience, with shares gaining even as U.S. markets face volatility due to ongoing trade discussions and mixed earnings reports. In this environment, growth companies with high insider ownership can be particularly appealing, as insider stakes often signal confidence in a company's future prospects amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 90.7% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 10.8% | 31.4% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| Elsight (ASX:ELS) | 17.4% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

We're going to check out a few of the best picks from our screener tool.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$792.80 million.

Operations: The company generates revenue from its Funds Management segment, totaling A$119.38 million.

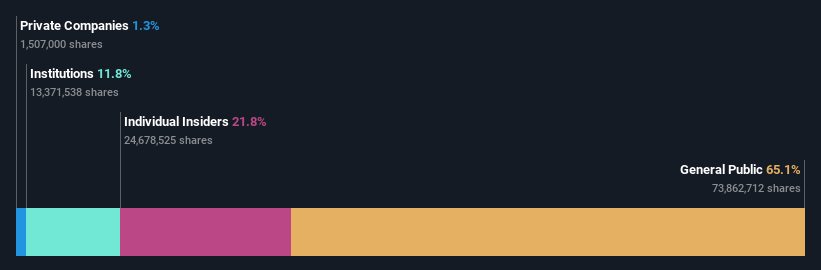

Insider Ownership: 22.5%

Australian Ethical Investment is experiencing robust growth, with earnings forecasted to rise 18.3% annually, outpacing the broader Australian market's 11.7%. Despite slower revenue growth of 10.4%, it still surpasses the market average of 5.9%. The company reported a significant increase in net income to A$20.2 million for FY2025 from A$11.53 million the previous year, highlighting strong financial performance without substantial insider trading activity over recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Australian Ethical Investment.

- Our valuation report unveils the possibility Australian Ethical Investment's shares may be trading at a premium.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$577.31 million.

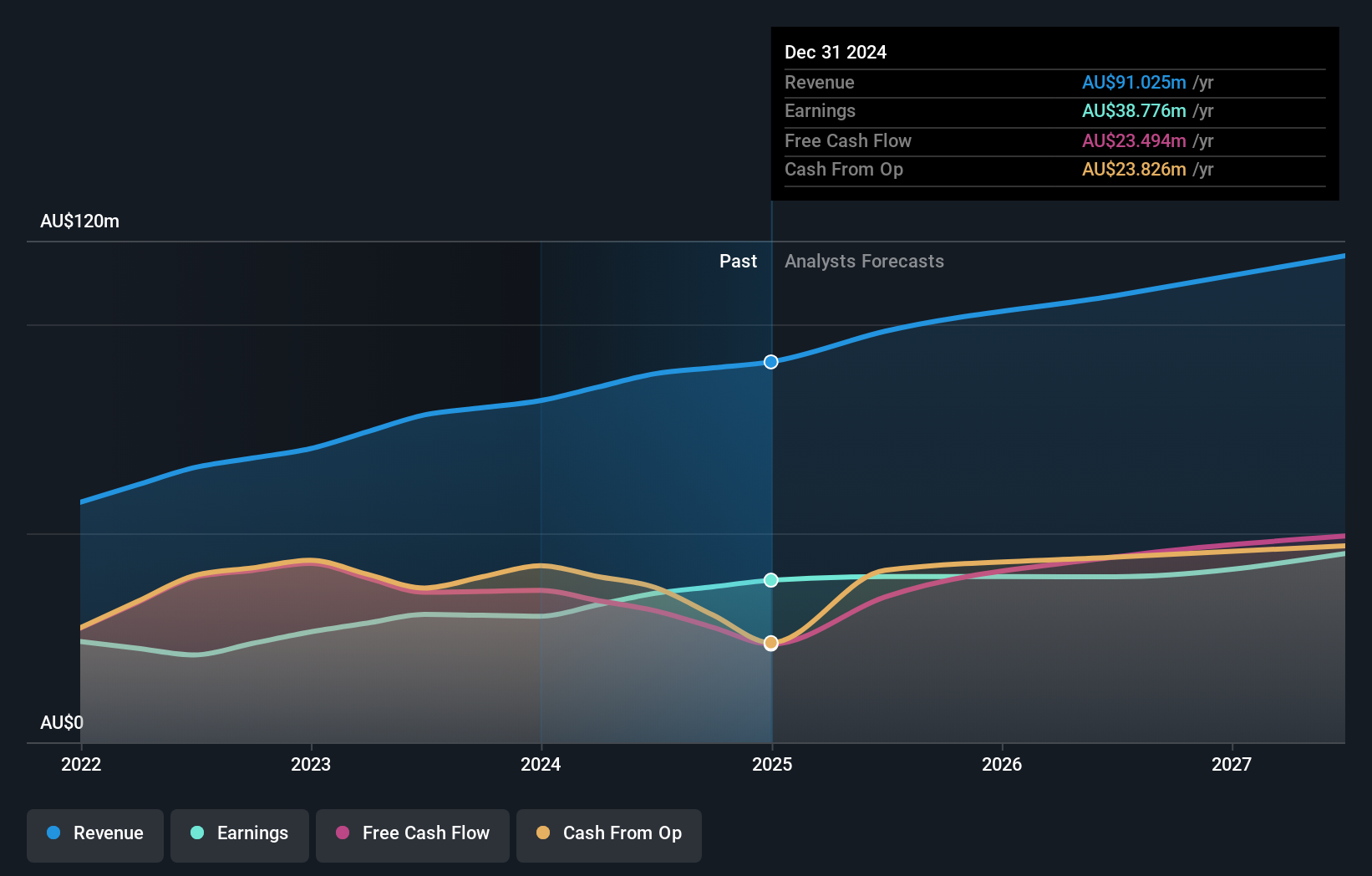

Operations: The company's revenue is primarily generated from its Biopharmaceutical Sector, amounting to A$95.02 million.

Insider Ownership: 10.3%

Clinuvel Pharmaceuticals demonstrates strong growth potential, with earnings expected to rise 26.15% annually, surpassing the Australian market's average. Revenue is forecast to grow at 22% per year. Despite trading below fair value estimates and having no recent insider trading activity, Clinuvel maintains a disciplined approach to acquisitions in North America, prioritizing high-return opportunities. Recent executive changes and consistent profitability underscore its operational resilience and strategic focus on expanding its pipeline while maintaining financial prudence.

- Dive into the specifics of Clinuvel Pharmaceuticals here with our thorough growth forecast report.

- Our valuation report unveils the possibility Clinuvel Pharmaceuticals' shares may be trading at a discount.

Regis Healthcare (ASX:REG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market capitalization of A$2.24 billion.

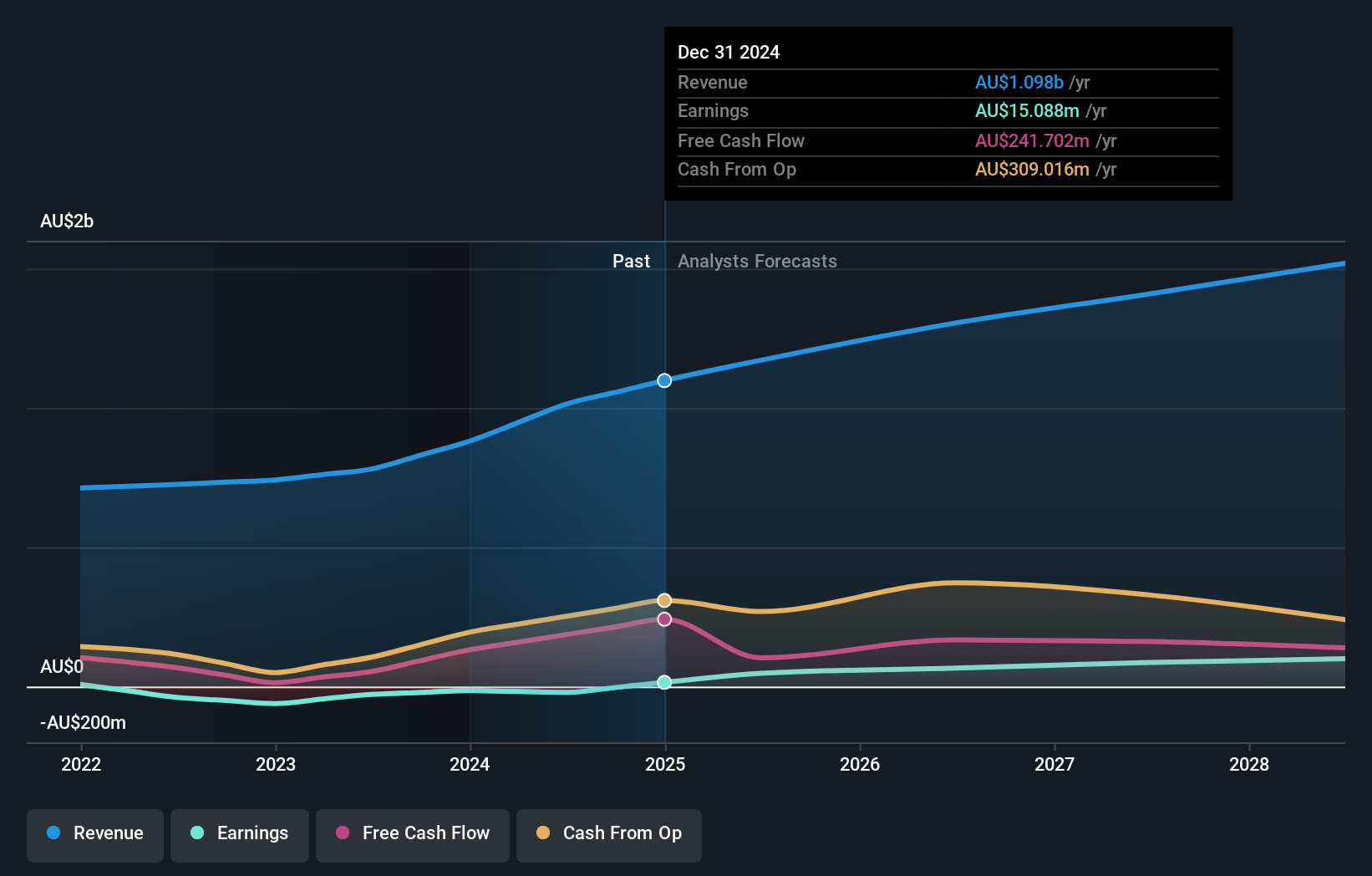

Operations: The company's revenue primarily comes from its residential aged care, home care, and retirement living services in Australia, totaling A$1.16 billion.

Insider Ownership: 38.6%

Regis Healthcare shows promising growth potential with earnings forecasted to grow at 19.1% annually, outpacing the Australian market's average of 11.7%. The company recently turned profitable, reporting a net income of A$48.95 million for the year ending June 2025, compared to a loss previously. Substantial insider buying over the past three months indicates confidence in its future prospects. Despite trading significantly below fair value estimates, Regis is positioned for steady revenue growth and high return on equity projections.

- Click to explore a detailed breakdown of our findings in Regis Healthcare's earnings growth report.

- In light of our recent valuation report, it seems possible that Regis Healthcare is trading behind its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 109 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives