- Australia

- /

- Semiconductors

- /

- ASX:WBT

Discover ASX Penny Stocks: MFF Capital Investments And 2 Other Top Contenders

Reviewed by Simply Wall St

As the Australian market navigates a mixed trading session, with materials leading and financials lagging, investors are keeping a close eye on potential opportunities amidst fluctuating sector performances. Penny stocks, though often seen as a relic of past market eras, continue to capture interest due to their potential for significant returns when backed by solid financials. In this article, we explore three penny stocks that stand out for their balance sheet strength and growth prospects in today's diverse market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.42 | A$120.37M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.84 | A$52.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.75 | A$276.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.21 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.47 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$642.88M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 410 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.77 billion.

Operations: The company's revenue segment is derived entirely from equity investment, amounting to A$631.43 million.

Market Cap: A$2.77B

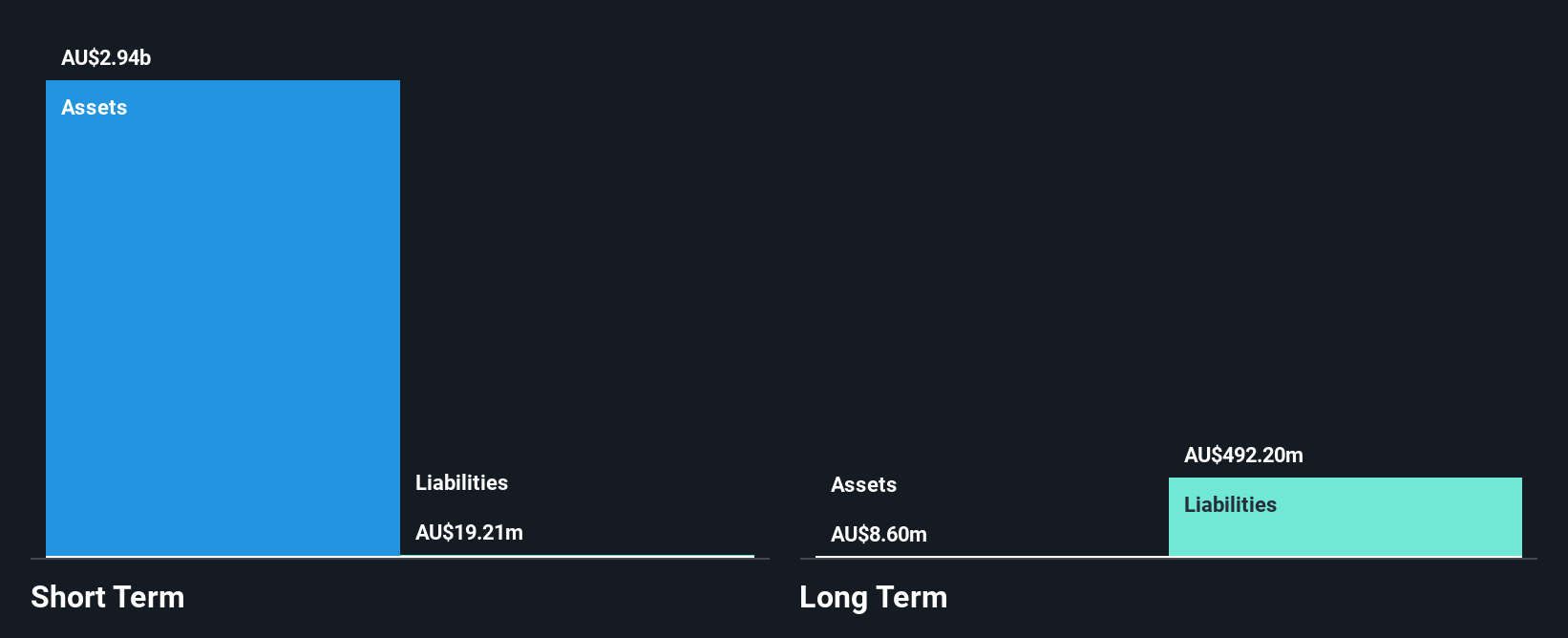

MFF Capital Investments, with a market cap of A$2.77 billion, stands out for its robust financial structure, being debt-free and having short-term assets of A$2.9 billion that comfortably cover both short-term and long-term liabilities. Despite negative earnings growth over the past year, MFF boasts high-quality earnings and stable weekly volatility at 2%. Its Return on Equity is relatively low at 17.7%, but it trades significantly below estimated fair value. The board is experienced with an average tenure of 6.5 years, though the management team is new to their roles with an average tenure of just 0.6 years.

- Click here to discover the nuances of MFF Capital Investments with our detailed analytical financial health report.

- Assess MFF Capital Investments' previous results with our detailed historical performance reports.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and others, with a market cap of A$829.01 million.

Operations: The company generates revenue of A$128.70 million from its activities in the development, manufacturing, and commercialization of NovoSorb Technology.

Market Cap: A$829.01M

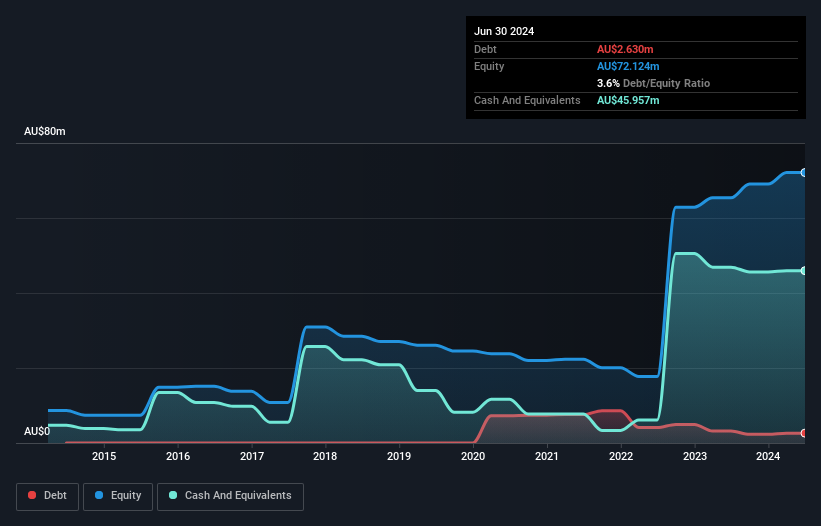

PolyNovo Limited, with a market cap of A$829.01 million, has demonstrated significant earnings growth, reporting A$13.21 million in net income for the year ended June 2025, up from A$5.3 million the previous year. The company maintains a strong financial position with more cash than debt and short-term assets of A$77.1 million exceeding both short-term and long-term liabilities. Despite its low Return on Equity at 15.9%, PolyNovo's earnings growth outpaces industry averages and is forecasted to continue expanding robustly. Recent board changes include the appointment of Robert Douglas, enhancing governance with his extensive medical device experience.

- Jump into the full analysis health report here for a deeper understanding of PolyNovo.

- Gain insights into PolyNovo's outlook and expected performance with our report on the company's earnings estimates.

Weebit Nano (ASX:WBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Weebit Nano Limited develops non-volatile memory using resistive random access memory technology based on fab-friendly materials in South Korea and the United States, with a market cap of A$808.80 million.

Operations: The company generates revenue of A$4.41 million from its Memory and Semiconductor Technology Development segment.

Market Cap: A$808.8M

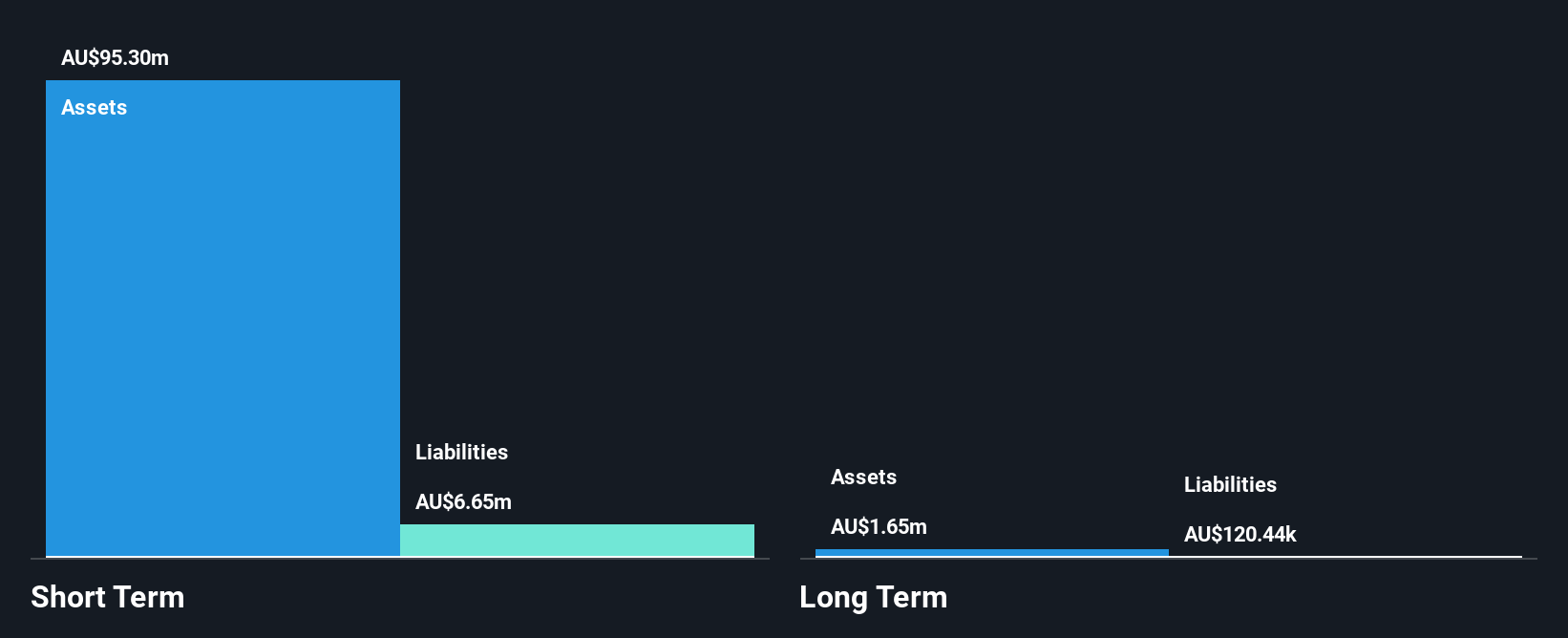

Weebit Nano, with a market cap of A$808.80 million, is pre-revenue and unprofitable but maintains a robust financial position with no debt and short-term assets of A$95.3 million exceeding liabilities. The company has sufficient cash runway for over three years despite increasing losses. Recent developments include the successful tape-out of test chips featuring its ReRAM technology at onsemi's production fab, marking progress towards volume production and potential integration into next-gen products. Additionally, Weebit's involvement with the EDGE AI FOUNDATION highlights its strategic focus on advancing edge AI technologies using its low-power memory solutions.

- Get an in-depth perspective on Weebit Nano's performance by reading our balance sheet health report here.

- Learn about Weebit Nano's future growth trajectory here.

Make It Happen

- Reveal the 410 hidden gems among our ASX Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weebit Nano might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WBT

Weebit Nano

Develops a non-volatile memory using a resistive random access memory technology based on fab-friendly materials in South Korea and the United States.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success