ASX Stocks Estimated To Be Up To 35.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has recently experienced a boost in sentiment, with the ASX200 up 1.3% and nearly every sector showing gains, driven by positive tech earnings from global giants like NVIDIA. This improvement comes amidst ongoing concerns about potential bubbles in the AI sector and geopolitical tensions, leaving investors eager to identify stocks that are trading below their intrinsic value as they seek opportunities for growth. In this context, undervalued stocks can offer a compelling proposition for those looking to capitalize on current market conditions while maintaining a focus on long-term fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$13.88 | A$25.75 | 46.1% |

| Symal Group (ASX:SYL) | A$2.43 | A$4.56 | 46.8% |

| Smart Parking (ASX:SPZ) | A$1.295 | A$2.26 | 42.8% |

| Regal Partners (ASX:RPL) | A$2.88 | A$4.96 | 41.9% |

| NRW Holdings (ASX:NWH) | A$5.02 | A$8.97 | 44% |

| LGI (ASX:LGI) | A$4.30 | A$7.70 | 44.1% |

| Judo Capital Holdings (ASX:JDO) | A$1.46 | A$2.44 | 40.1% |

| Immutep (ASX:IMM) | A$0.265 | A$0.49 | 45.5% |

| Guzman y Gomez (ASX:GYG) | A$22.55 | A$39.33 | 42.7% |

| CleanSpace Holdings (ASX:CSX) | A$0.69 | A$1.35 | 48.7% |

Let's review some notable picks from our screened stocks.

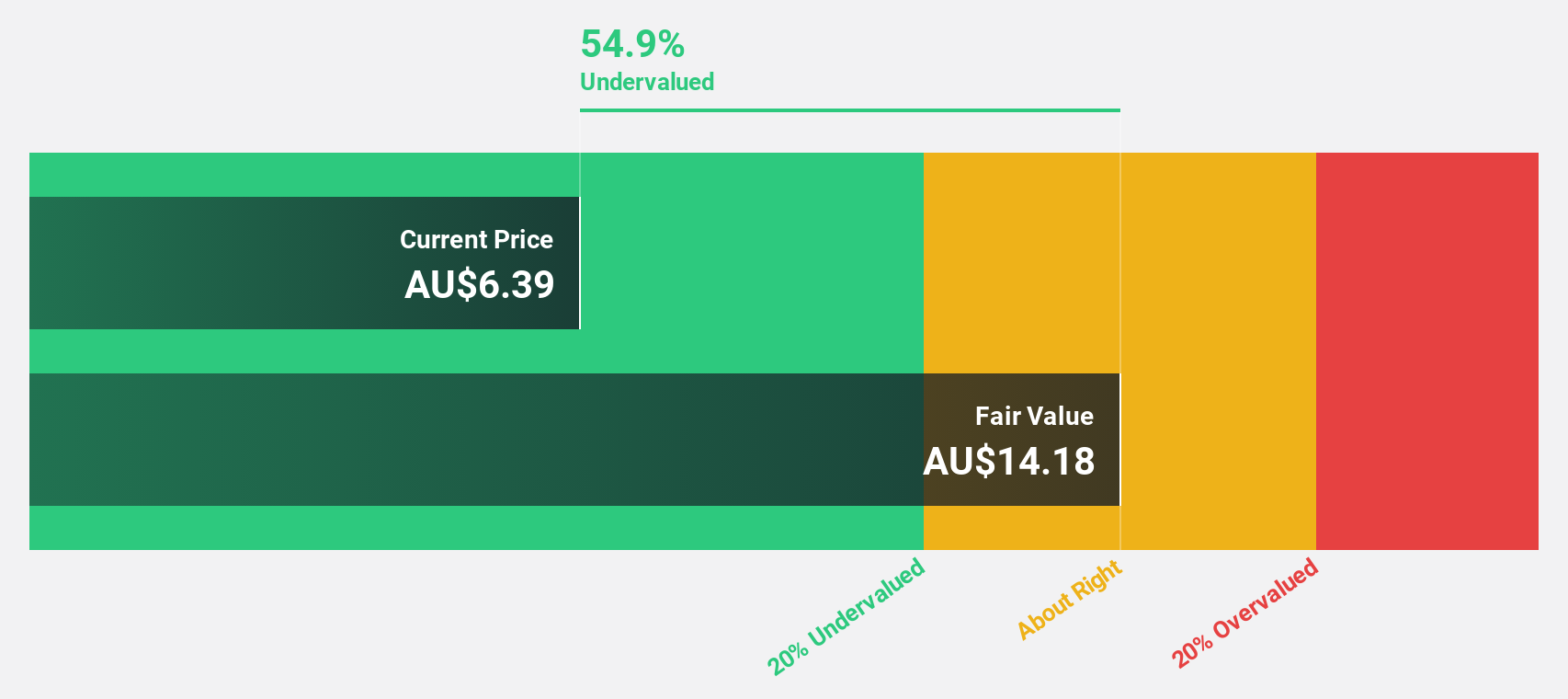

Elders (ASX:ELD)

Overview: Elders Limited provides agricultural products and services to rural and regional customers primarily in Australia, with a market cap of A$1.60 billion.

Operations: The company's revenue is derived from its Branch Network at A$2.71 billion, Wholesale Products at A$345.93 million, and Feed and Processing Services at A$148.49 million.

Estimated Discount To Fair Value: 35.6%

Elders Limited is trading at A$7.51, significantly below its estimated fair value of A$11.65, indicating potential undervaluation based on discounted cash flows. Despite a recent increase in sales to A$3.20 billion and net income to A$50.29 million, the dividend yield of 4.79% isn't well-supported by earnings or free cash flow, posing sustainability concerns. Forecasts suggest robust annual profit growth of 27.8%, outpacing the broader Australian market's expected growth rate.

- Our earnings growth report unveils the potential for significant increases in Elders' future results.

- Take a closer look at Elders' balance sheet health here in our report.

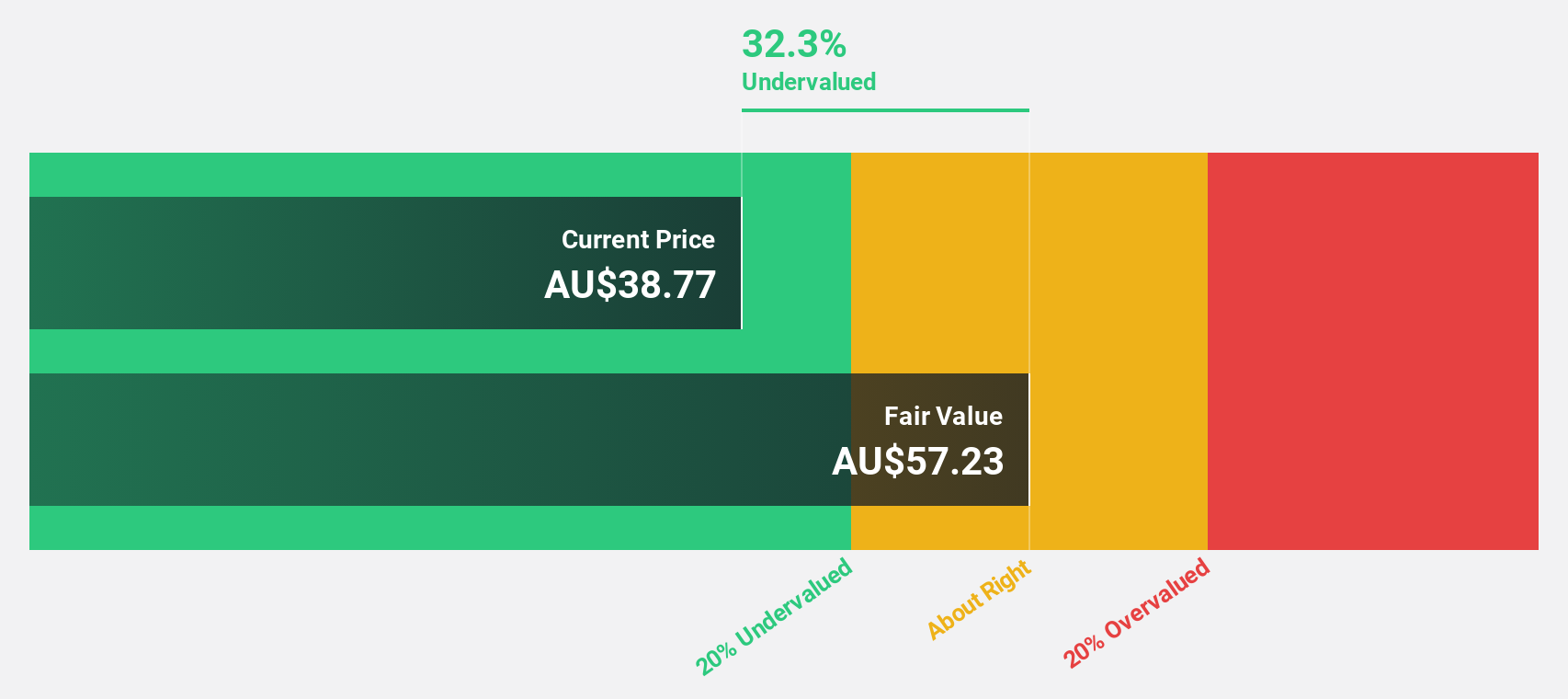

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded boards across the United States, Australia, Europe, and New Zealand with a market cap of A$16.07 billion.

Operations: The company's revenue segments include $524.40 million from Europe and $490.70 million from Australia & New Zealand.

Estimated Discount To Fair Value: 25.8%

James Hardie Industries is trading at A$27.74, over 25% below its estimated fair value of A$37.4, highlighting potential undervaluation based on cash flows. Despite a challenging year with net income dropping to US$6.8 million and a significant net loss in Q2, earnings are projected to grow significantly at 35.9% annually over the next three years, outpacing the Australian market's growth rate of 12.1%. Recent executive changes may impact strategic execution moving forward.

- Insights from our recent growth report point to a promising forecast for James Hardie Industries' business outlook.

- Delve into the full analysis health report here for a deeper understanding of James Hardie Industries.

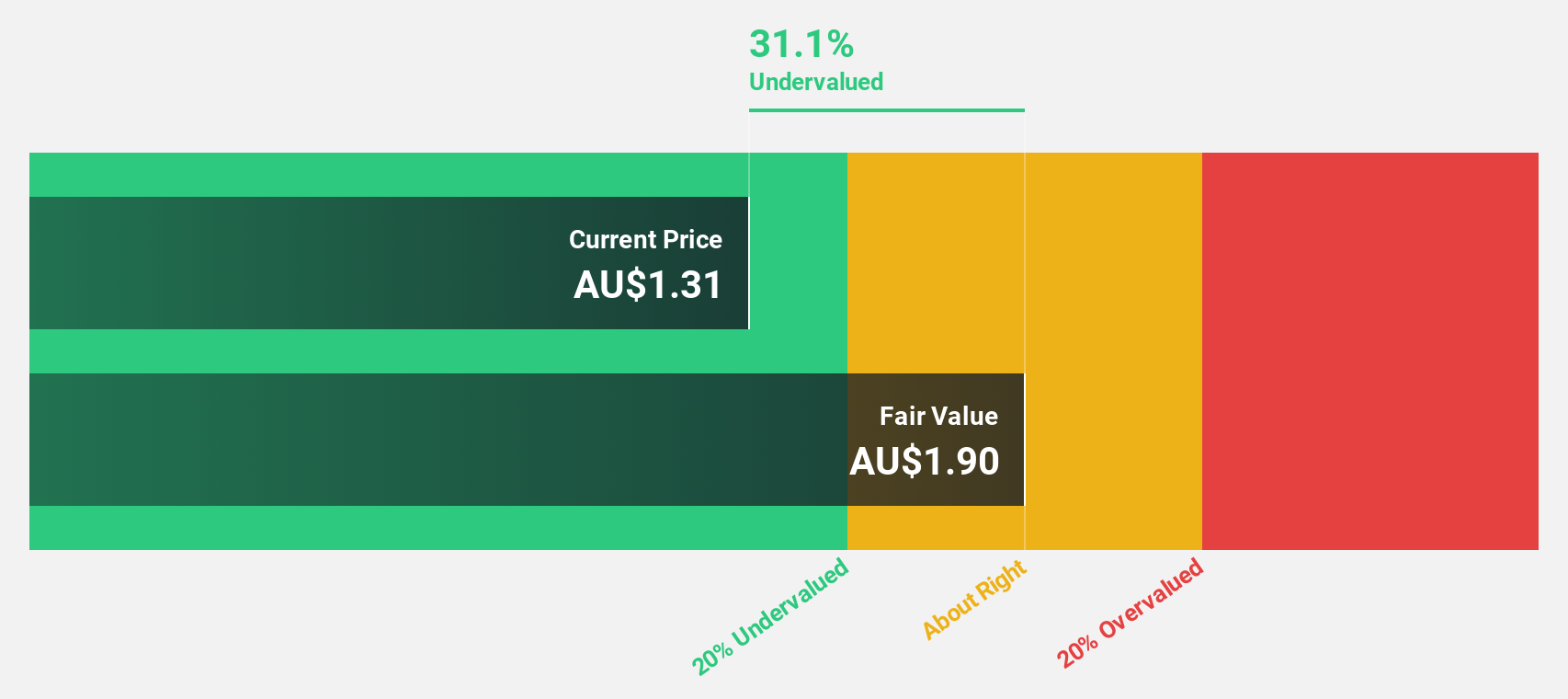

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and others, with a market cap of A$792.40 million.

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of the NovoSorb Technology, totaling A$128.70 million.

Estimated Discount To Fair Value: 29.2%

PolyNovo is trading at A$1.15, below its estimated fair value of A$1.62, suggesting potential undervaluation based on cash flows. The company reported a net income increase to A$13.21 million from the previous year, with earnings expected to grow significantly at 27.37% annually over the next three years, surpassing the Australian market's growth rate of 12.1%. Recent board changes include appointing Robert Douglas, potentially enhancing strategic oversight and governance in medical device technology.

- Our growth report here indicates PolyNovo may be poised for an improving outlook.

- Get an in-depth perspective on PolyNovo's balance sheet by reading our health report here.

Make It Happen

- Navigate through the entire inventory of 35 Undervalued ASX Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Engages in the provision of agricultural products and services to rural and regional customers primarily in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives