The Australian market is grappling with a rise in inflation, now at 3.2%, which has pushed it outside the Reserve Bank of Australia's target band and dampened hopes for imminent interest rate cuts. Amidst this backdrop, investors are keenly eyeing growth companies with high insider ownership on the ASX, as these stocks often demonstrate strong alignment between management and shareholder interests, potentially offering resilience in uncertain economic conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 89.9% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| Elsight (ASX:ELS) | 17.4% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

Let's review some notable picks from our screened stocks.

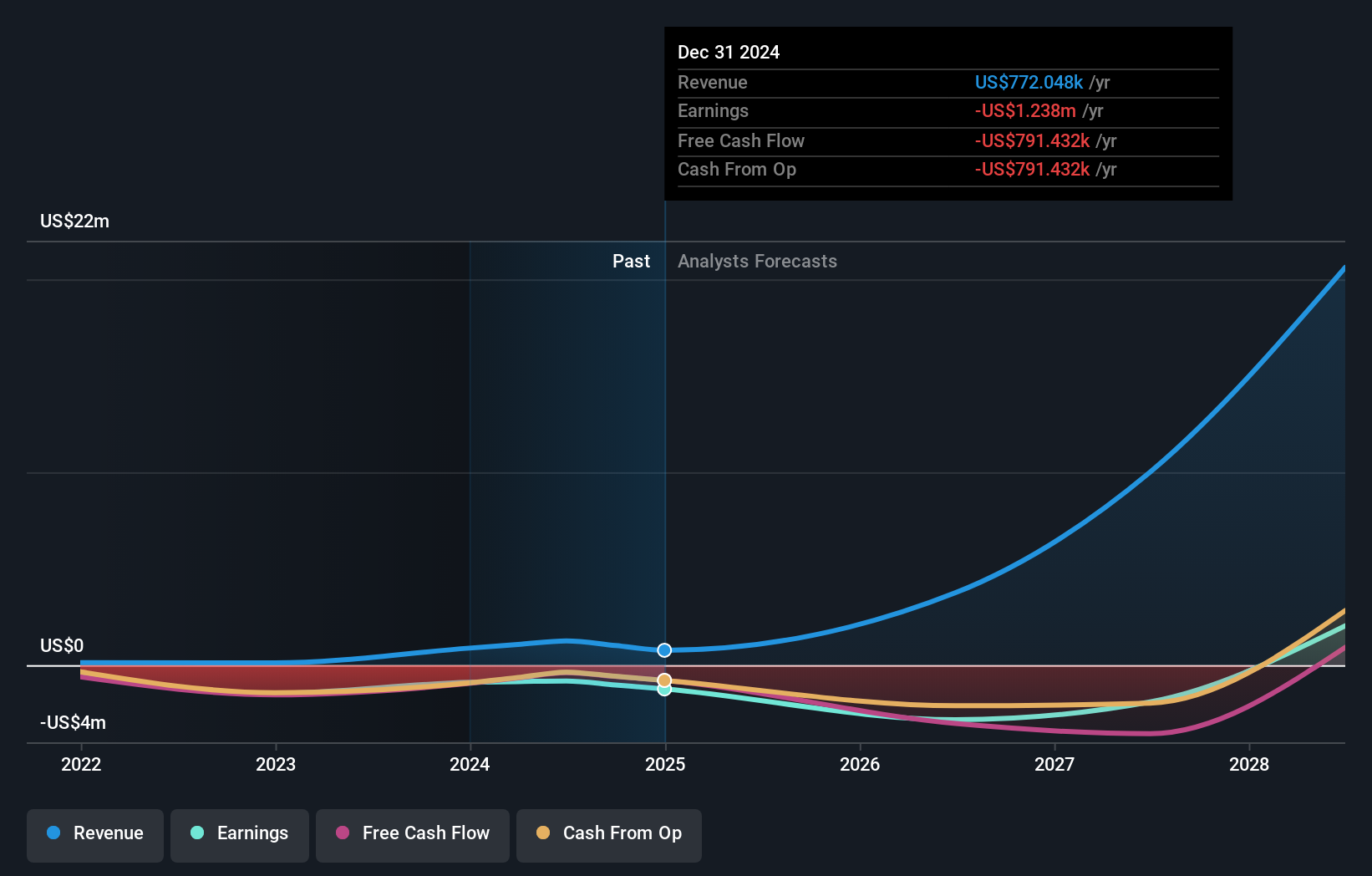

Metal Powder Works (ASX:MPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Metal Powder Works Limited specializes in producing metal powders for additive manufacturing and other advanced applications, with a market cap of A$459.60 million.

Operations: The company's revenue primarily comes from the Metal Processors and Fabrication segment, which generated $0.77 million.

Insider Ownership: 26.5%

Earnings Growth Forecast: 41.2% p.a.

Metal Powder Works, with high insider ownership, is poised for substantial growth. Recent inclusion in the S&P/ASX All Ordinaries and Emerging Companies Indexes highlights its market recognition. Despite current unprofitability and negative equity, forecasts suggest a significant revenue increase of 59.9% annually, outpacing the Australian market. A recent A$15 million equity offering supports expansion efforts. The company's innovative DirectPowderTM unit secured a contract with the U.S. Navy, potentially boosting future revenues further.

- Navigate through the intricacies of Metal Powder Works with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Metal Powder Works implies its share price may be too high.

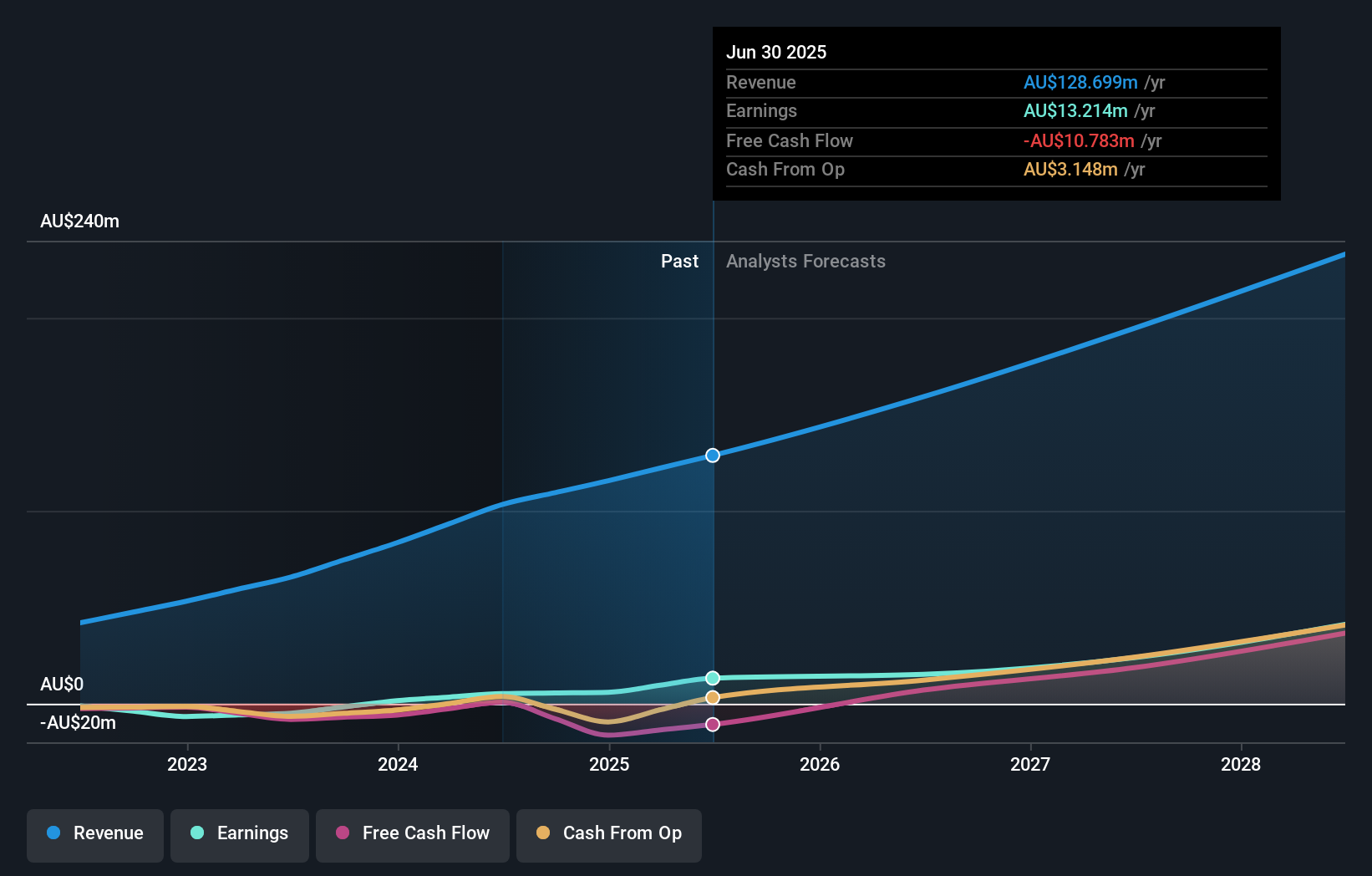

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several international markets, with a market cap of A$939.55 million.

Operations: PolyNovo's revenue primarily comes from the development, manufacturing, and commercialization of NovoSorb Technology, generating A$128.70 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 27.4% p.a.

PolyNovo demonstrates strong growth potential with high insider ownership and no substantial insider selling in recent months. Earnings are forecast to grow significantly at 27.4% annually, surpassing the Australian market's average. Despite a slower revenue growth rate of 14.8%, it remains above the market average. The company trades below its estimated fair value by 18.3%. Recent board appointments, including Robert Douglas with extensive industry experience, may enhance strategic direction amid its removal from the S&P/ASX 200 Index.

- Click to explore a detailed breakdown of our findings in PolyNovo's earnings growth report.

- Our comprehensive valuation report raises the possibility that PolyNovo is priced higher than what may be justified by its financials.

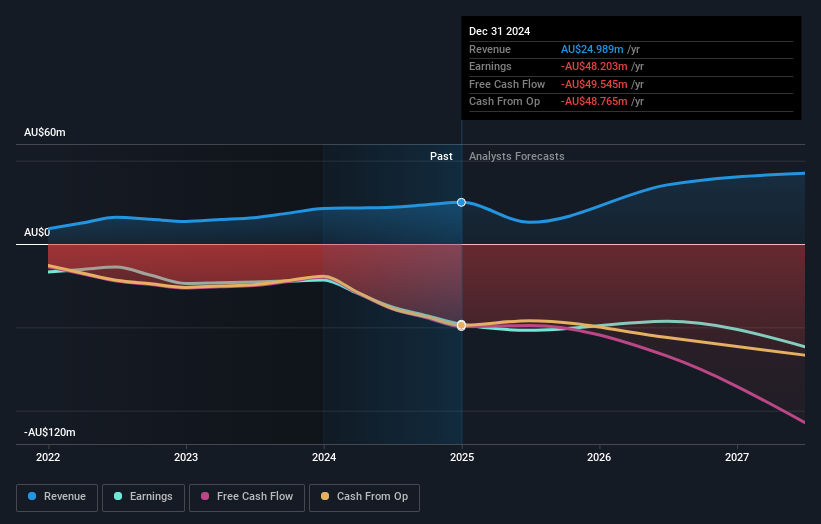

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is an Australian drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases, with a market capitalization of A$699.91 million.

Operations: The company's revenue segment is primarily derived from its activities in the discovery and development of novel RNA therapeutics, amounting to A$23.49 million.

Insider Ownership: 38.3%

Earnings Growth Forecast: 24.4% p.a.

PYC Therapeutics, trading significantly below its estimated fair value, shows growth potential with high insider ownership. The company forecasts a 24.4% annual earnings growth and expects to become profitable within three years. Despite auditor concerns about its going concern status, recent board changes aim to bolster strategic direction in drug development. Revenue is projected to grow at 10.3% annually, outpacing the broader Australian market's average but remains slower than high-growth benchmarks.

- Get an in-depth perspective on PYC Therapeutics' performance by reading our analyst estimates report here.

- The analysis detailed in our PYC Therapeutics valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Click this link to deep-dive into the 97 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives