- Australia

- /

- Medical Equipment

- /

- ASX:PNV

ASX Growth Leaders With High Insider Ownership

Reviewed by Simply Wall St

As the Australian market navigates a landscape shaped by steady interest rates and fluctuating sector performances, investors are keenly observing opportunities in growth companies that demonstrate resilience and potential. In this context, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations, aligning well with current market conditions where strategic insights and strong fundamentals are highly valued.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.1% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IperionX (ASX:IPX) | 18.2% | 96.3% |

| Image Resources (ASX:IMA) | 22.2% | 92.5% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 17.9% | 49.9% |

| BlinkLab (ASX:BB1) | 35.5% | 101.4% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.1% | 121.1% |

Here we highlight a subset of our preferred stocks from the screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$815.49 million.

Operations: The company generates revenue primarily from its funds management segment, amounting to A$119.38 million.

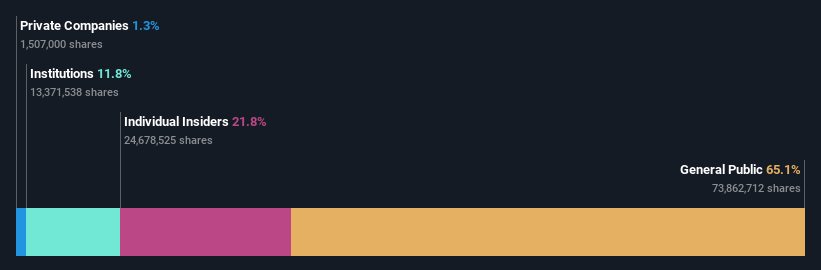

Insider Ownership: 21.8%

Australian Ethical Investment has shown strong growth, with earnings increasing by 75.1% over the past year and revenue reaching A$119.38 million, up from A$100.49 million previously. Forecasts suggest revenue will grow at 10.4% annually, outpacing the broader Australian market's 5.6%. Earnings are expected to rise by 18.3% annually, surpassing market averages of 10.9%. The company's Return on Equity is projected to be very high at 59.2% in three years, indicating robust financial performance potential despite no recent insider trading activity noted.

- Click here and access our complete growth analysis report to understand the dynamics of Australian Ethical Investment.

- Upon reviewing our latest valuation report, Australian Ethical Investment's share price might be too optimistic.

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several international markets, with a market cap of A$984.45 million.

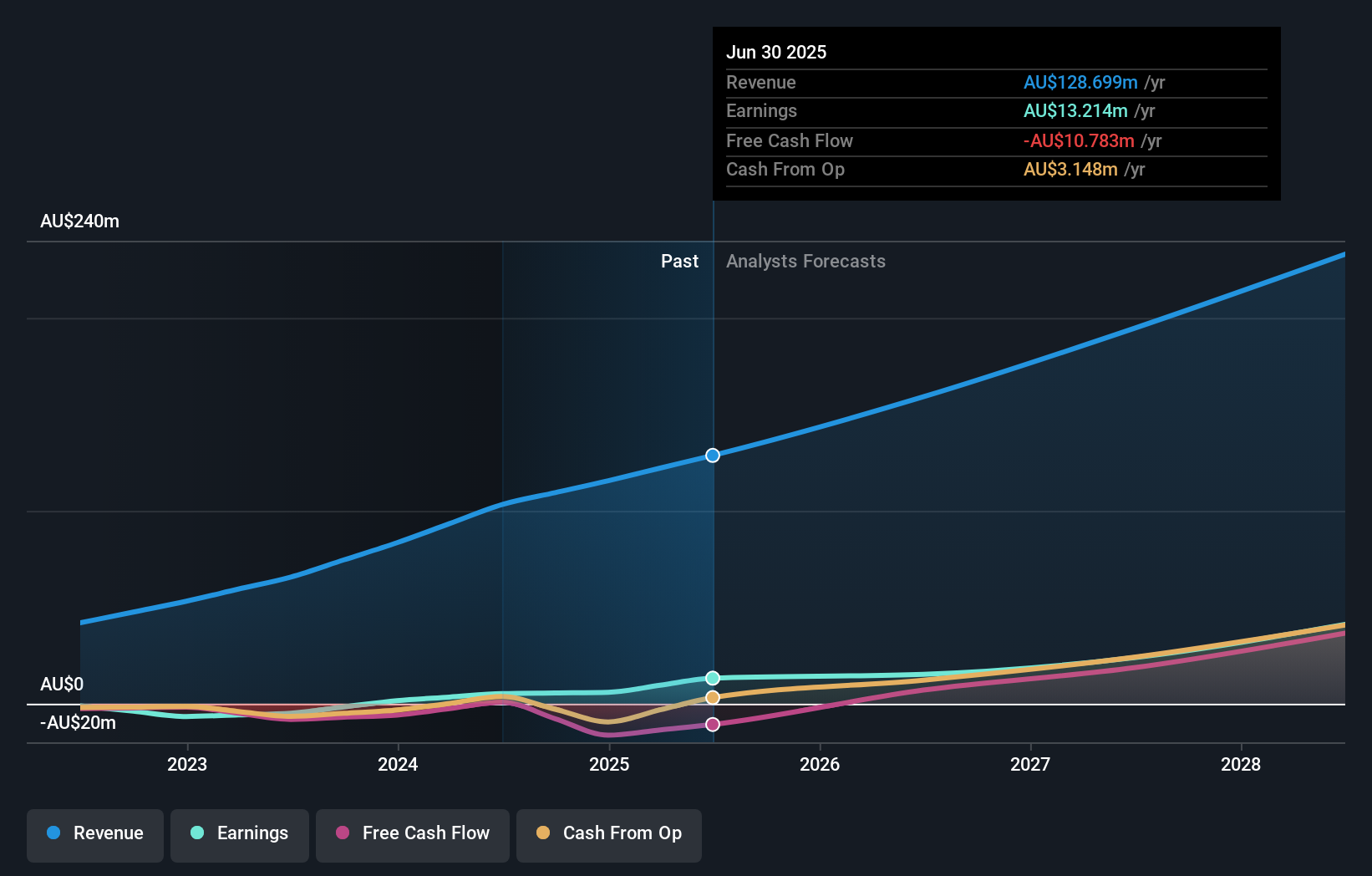

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of its NovoSorb Technology, amounting to A$128.70 million.

Insider Ownership: 10.5%

PolyNovo has demonstrated significant growth, with earnings rising by 151.2% over the past year and revenue reaching A$129.19 million. Insiders have been actively purchasing shares, indicating confidence in future prospects. Despite being dropped from the S&P/ASX 200 Index, forecasts suggest revenue will grow at 14.6% annually, outpacing the Australian market's average of 5.6%. Earnings are expected to increase by 27% annually, supported by a high forecasted Return on Equity of 22.9%.

- Get an in-depth perspective on PolyNovo's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that PolyNovo is trading beyond its estimated value.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.08 billion.

Operations: The company generates revenue through the provision of investment management services, amounting to A$245.45 million.

Insider Ownership: 24.7%

Regal Partners is poised for growth, with earnings projected to rise significantly by 32.4% annually, surpassing the Australian market average. Despite a recent decline in profit margins and revenue, the company trades at a discount of 26.4% below its estimated fair value. Insider activity shows more shares bought than sold recently, reflecting some confidence despite significant sales earlier. Additionally, Regal's inclusion in the S&P/ASX indices highlights its market relevance and potential investor interest.

- Take a closer look at Regal Partners' potential here in our earnings growth report.

- Our valuation report unveils the possibility Regal Partners' shares may be trading at a discount.

Where To Now?

- Click here to access our complete index of 110 Fast Growing ASX Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in Australia, New Zealand, the United States, the United Kingdom, Ireland, Singapore, India, and Hong Kong.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives