Pro Medicus And 2 Other High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

In the current Australian market landscape, the ASX 200 futures are indicating a slight dip of -0.2% amid geopolitical tensions and mixed economic signals, while unemployment remains stable at 4.1%. Against this backdrop, high growth tech stocks like Pro Medicus are garnering attention for their potential to thrive in uncertain conditions by leveraging innovation and adaptability to navigate market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.15% | 25.52% | ★★★★★★ |

| Wrkr | 56.40% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 19.89% | 69.58% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$28.92 billion.

Operations: Pro Medicus Limited generates revenue primarily through the production of integrated software applications for the healthcare industry, totaling A$184.58 million. The company's operations span Australia, North America, and Europe, focusing on imaging software and radiology information systems for medical facilities.

Pro Medicus, a standout in the Australian tech landscape, exemplifies robust growth with its revenue and earnings forecast to expand at 22.2% and 23.5% per annum respectively, significantly outpacing the broader market's expectations. This performance is bolstered by strategic share repurchases, with a recent buyback of 28,326 shares for AUD 6.35 million enhancing shareholder value. Additionally, inclusion in the S&P International 700 and Global 1200 indices not only underscores its market relevance but also augments its visibility among global investors. The company's commitment to innovation is evident from its R&D initiatives aimed at advancing healthcare technology solutions—a sector witnessing rapid growth due to increasing demand for efficient medical services.

- Navigate through the intricacies of Pro Medicus with our comprehensive health report here.

Explore historical data to track Pro Medicus' performance over time in our Past section.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of A$8.55 billion.

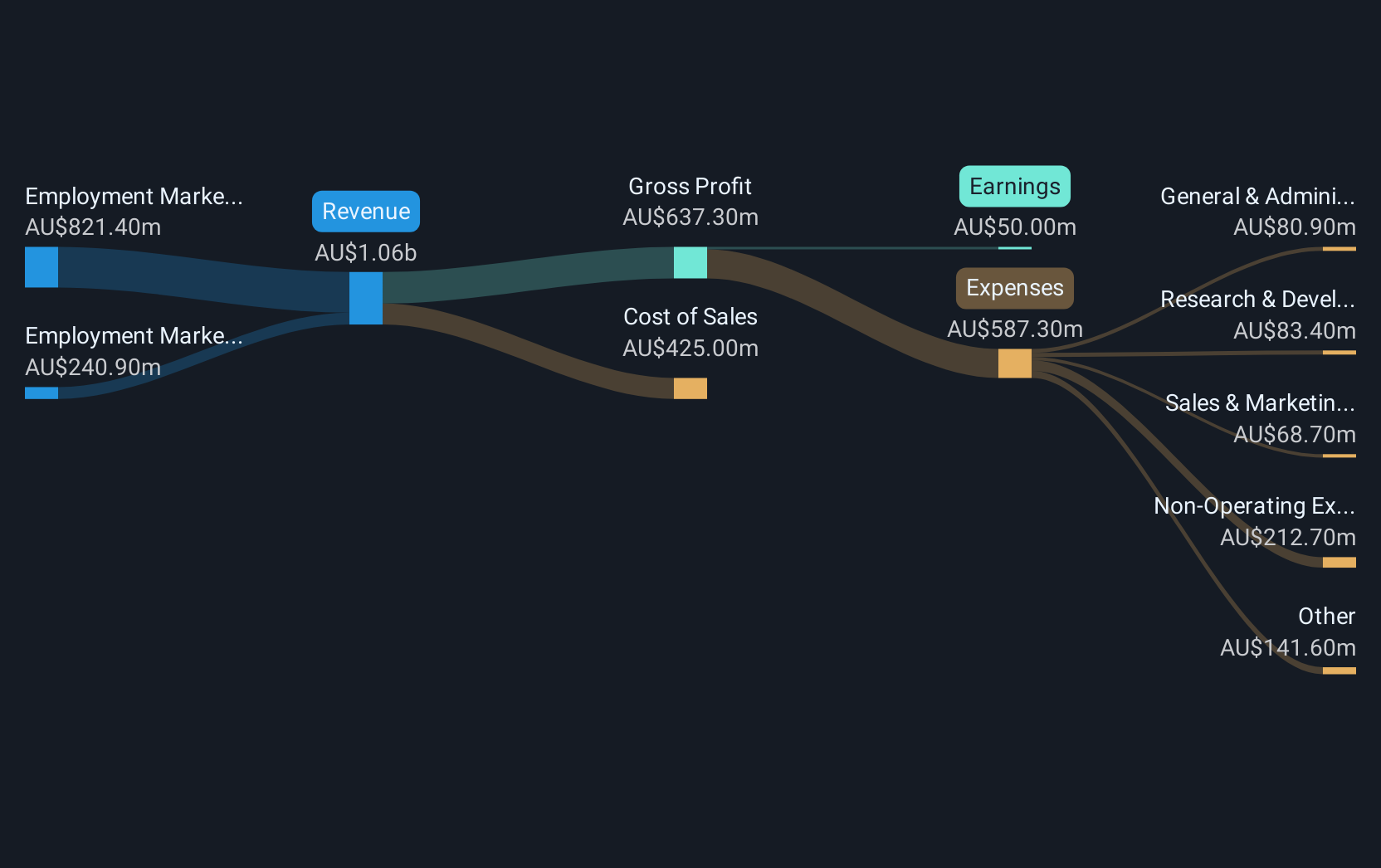

Operations: The company generates revenue primarily through its employment marketplace services, with A$821.40 million from the ANZ region and A$240.90 million from Asia.

Amidst a challenging landscape, SEEK has demonstrated resilience with its revenue and earnings poised for significant growth. Despite a substantial one-off loss of A$119.8 million last year, the company's revenue is expected to rise by 9.1% annually, outpacing the Australian market's growth of 5.6%. Furthermore, SEEK's earnings are forecasted to surge by 25.9% per year, notably higher than the market average of 11.6%. This robust financial outlook is underpinned by strategic initiatives and an Analyst/Investor Day that highlighted future prospects, reinforcing SEEK’s potential in a competitive sector.

- Unlock comprehensive insights into our analysis of SEEK stock in this health report.

Understand SEEK's track record by examining our Past report.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals for cancer and rare diseases, with a market cap of A$8.43 billion.

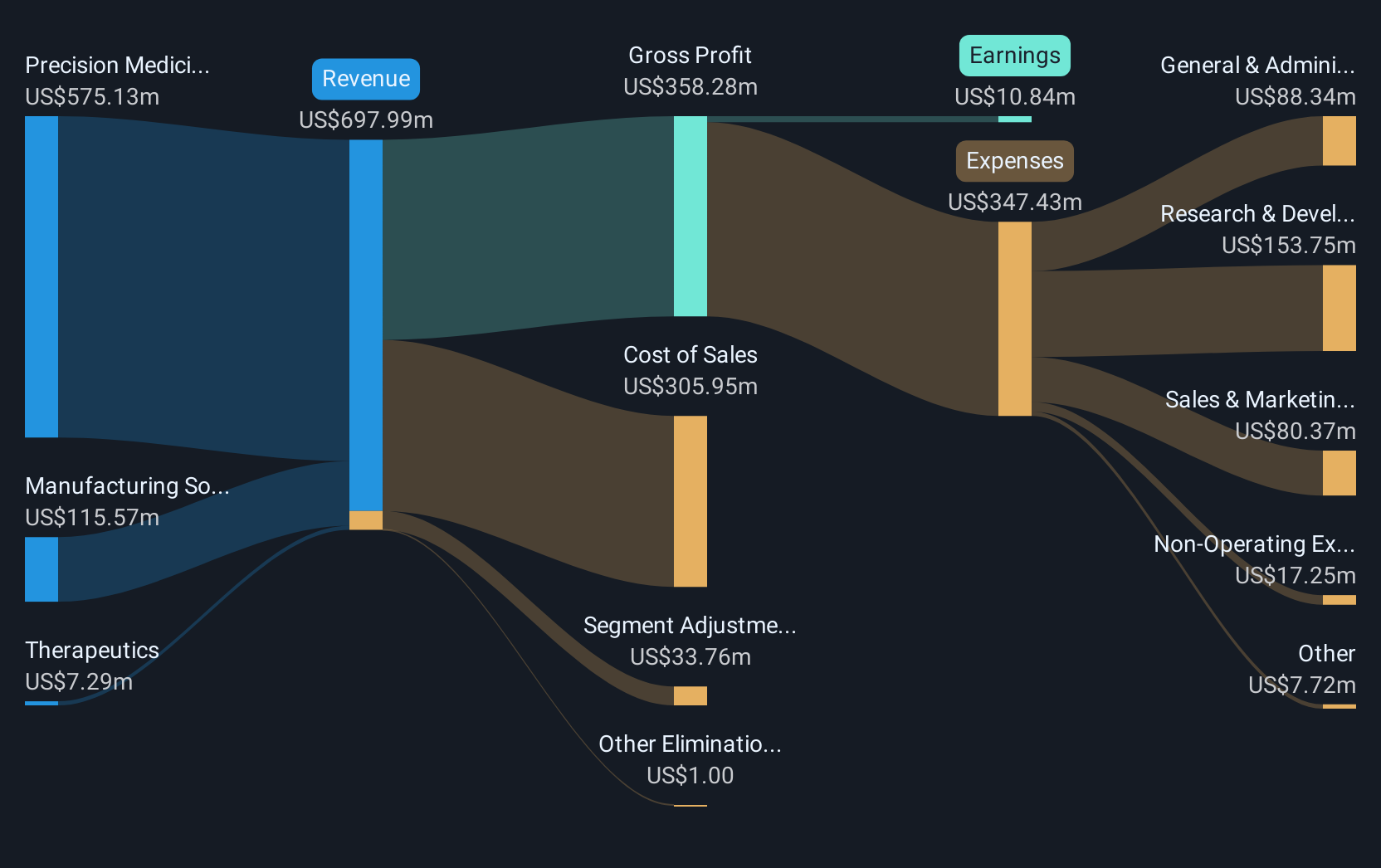

Operations: Telix Pharmaceuticals generates revenue primarily from its Precision Medicine segment, which accounts for A$771.11 million, while its Therapeutics and Manufacturing Solutions segments contribute A$9.35 million and A$2.75 million, respectively.

Telix Pharmaceuticals has demonstrated a robust trajectory in the high-growth tech sector, particularly through its innovative approaches in prostate cancer imaging. With a staggering annual earnings growth of 858% last year and an expected annual revenue increase of 19.8%, Telix outpaces the Australian market's average growth significantly. Recent strategic product launches, like the AlFluor™ platform and Illuccix®, have not only expanded its portfolio but also fortified its market position by enhancing diagnostic precision and treatment efficacy in oncology. These developments underscore Telix's commitment to advancing healthcare technology, positioning it well for sustained growth amidst evolving medical demands.

- Delve into the full analysis health report here for a deeper understanding of Telix Pharmaceuticals.

Gain insights into Telix Pharmaceuticals' past trends and performance with our Past report.

Where To Now?

- Click here to access our complete index of 47 ASX High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SEK

SEEK

Provides online employment marketplace services in Australia, New Zealand, Southeast Asia, Hong Kong, the United Kingdom, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives