Over the last 7 days, the Australian market has risen 2.5%, driven by gains of 4.5% in one sector, and over the past 12 months, it is up 11% with earnings forecast to grow by 13% annually. In this favorable environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Telix Pharmaceuticals | 20.85% | 38.76% | ★★★★★★ |

| Megaport | 16.19% | 35.55% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.48% | 26.75% | ★★★★★★ |

| Infomedia | 7.86% | 27.83% | ★★★★★☆ |

| Doctor Care Anywhere Group | 23.44% | 96.41% | ★★★★★★ |

| DUG Technology | 15.32% | 42.38% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Mesoblast | 45.22% | 49.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| SiteMinder | 20.26% | 70.41% | ★★★★★☆ |

Click here to see the full list of 52 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies healthcare imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe, with a market cap of A$15.66 billion.

Operations: Pro Medicus Limited generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$161.50 million. The company operates across Australia, North America, and Europe, focusing on hospitals, imaging centers, and healthcare groups.

Pro Medicus reported impressive earnings for the full year ending June 30, 2024, with net income reaching AUD 82.79 million, up from AUD 60.65 million the previous year. Revenue growth of 16.8% per year is forecasted to outpace the Australian market's average of 5.3%, while earnings are expected to grow at an annual rate of 18.6%. The company has also increased its dividend by 33.3%, reflecting strong financial health and commitment to shareholders. Investing heavily in R&D, Pro Medicus spent a significant portion on innovation and development, ensuring continued advancement in their medical imaging software solutions. This focus on R&D underpins their competitive edge in healthcare technology and supports robust future growth prospects within the industry.

- Click here and access our complete health analysis report to understand the dynamics of Pro Medicus.

Explore historical data to track Pro Medicus' performance over time in our Past section.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited, with a market cap of A$28.49 billion, operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam and other international markets.

Operations: REA Group generates revenue primarily from online property advertising, with significant contributions from Australia (A$1.25 billion) and financial services (A$320.60 million). The company also has a notable presence in India, contributing A$103.10 million to its revenue stream.

REA Group, a prominent player in the Australian tech sector, reported net income of AUD 302.8 million for the year ending June 30, 2024, down from AUD 356.1 million the previous year due to a significant one-off loss of AUD 155 million. Despite this setback, REA's earnings are forecasted to grow at an annual rate of 17.7%, outpacing the Australian market average of 13%. The company has also announced a final dividend increase by 23% to fully franked 102 cents per share. Investing heavily in R&D with expenditures contributing significantly to their innovative real estate platforms ensures sustained competitive advantage and future growth prospects within their industry segment.

- Delve into the full analysis health report here for a deeper understanding of REA Group.

Understand REA Group's track record by examining our Past report.

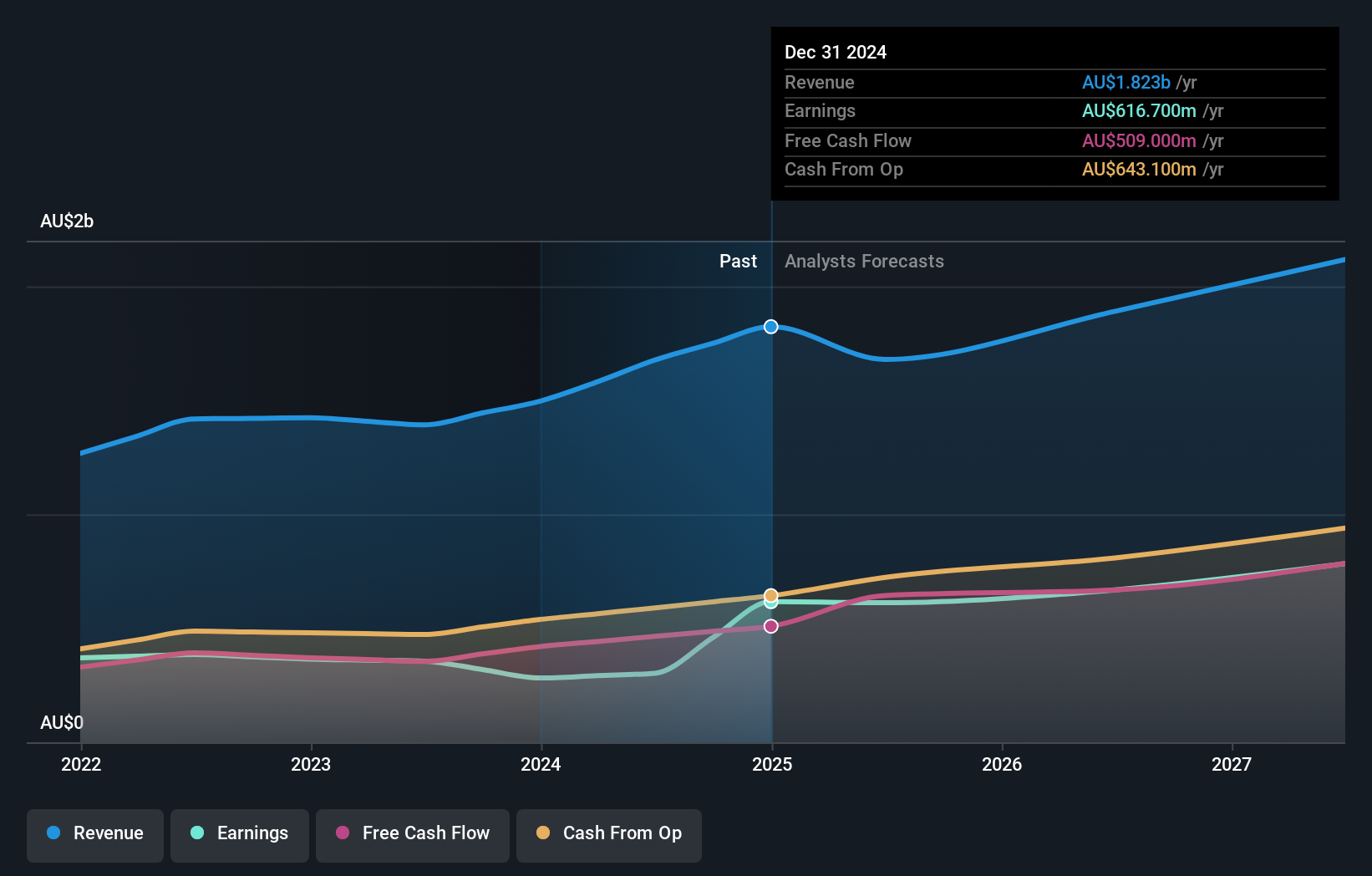

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xero Limited, together with its subsidiaries, is a software as a service company that provides online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally, with a market cap of A$21.62 billion.

Operations: Xero Limited generates revenue primarily through providing online solutions for small businesses and their advisors, amounting to NZ$1.71 billion. The company operates internationally, with a significant presence in Australia and New Zealand.

Xero's recent launch of Xero Inventory Plus highlights its commitment to enhancing small business operations, integrating with Amazon's FBA and Shopify for seamless inventory management. The company reported a revenue increase to NZD 1.71 billion and net income of NZD 174.64 million for the year ending March 31, 2024, reflecting a significant turnaround from the previous year's loss. With forecasted earnings growth of 24.1% annually and R&D expenses contributing substantially to innovation, Xero is poised for continued expansion in the tech sector.

- Dive into the specifics of Xero here with our thorough health report.

Assess Xero's past performance with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 52 ASX High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

A software as a service company, provides online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally.

Flawless balance sheet with high growth potential.