- Australia

- /

- Transportation

- /

- ASX:KLS

3 Top Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

The market has climbed 2.5% in the last 7 days, led by the Financials sector with a gain of 4.5%. Over the past 12 months, it is up 11%, with earnings forecast to grow by 13% annually. In this favorable environment, identifying undervalued small-cap stocks with insider buying can offer significant opportunities for investors looking to capitalize on potential growth and solid fundamentals.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Healius | NA | 0.6x | 45.30% | ★★★★★☆ |

| Elders | 23.2x | 0.5x | 48.49% | ★★★★☆☆ |

| Eagers Automotive | 9.7x | 0.3x | 40.17% | ★★★★☆☆ |

| Neuren Pharmaceuticals | 12.7x | 8.6x | -50.18% | ★★★★☆☆ |

| RAM Essential Services Property Fund | NA | 6.1x | 43.18% | ★★★★☆☆ |

| Dicker Data | 23.0x | 0.8x | 7.10% | ★★★☆☆☆ |

| Codan | 31.0x | 4.5x | 30.97% | ★★★☆☆☆ |

| Deterra Royalties | 11.6x | 7.7x | 13.89% | ★★★☆☆☆ |

| Kelsian Group | 47.3x | 0.8x | 27.64% | ★★★☆☆☆ |

| Coventry Group | 297.7x | 0.5x | -0.14% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

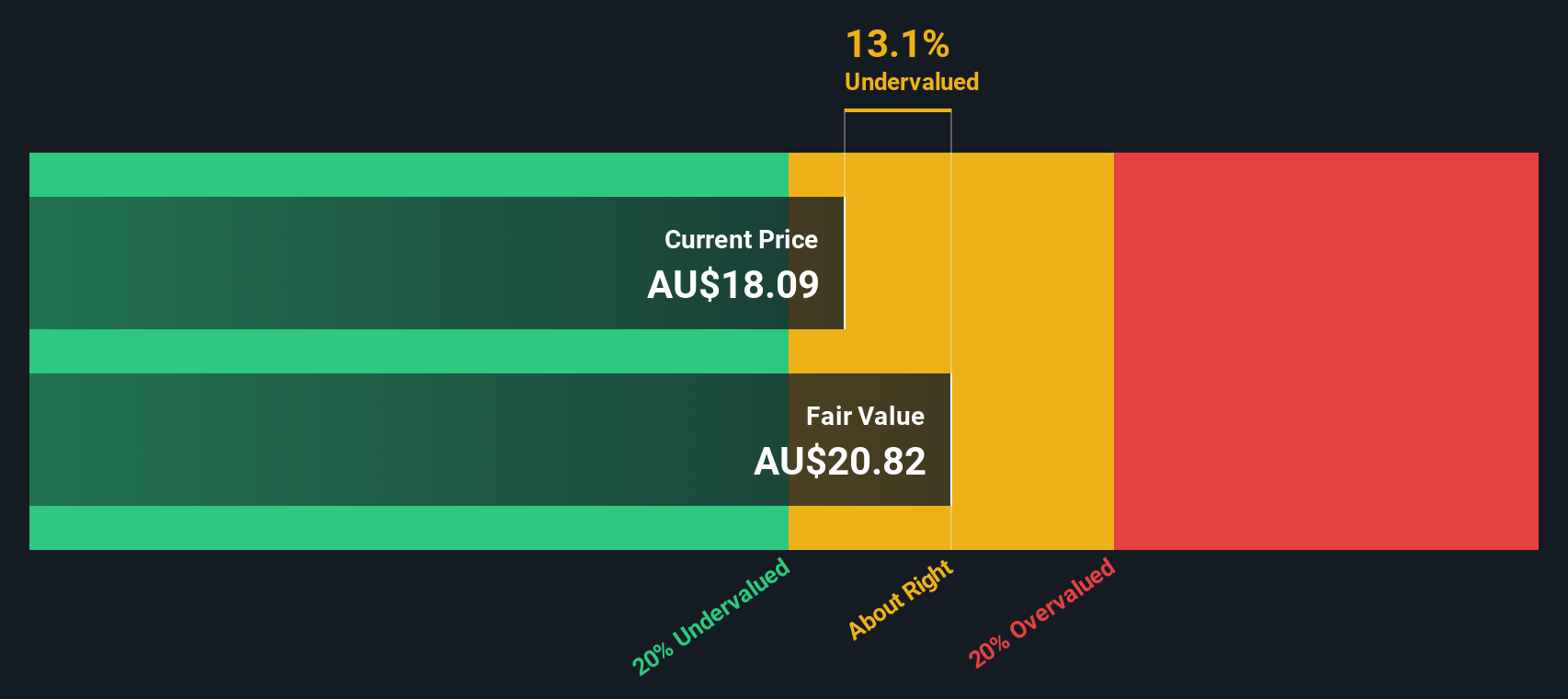

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates primarily in car retailing and has a market cap of approximately A$3.58 billion.

Operations: The company generates revenue primarily from car retailing, with a gross profit margin of 18.60% as of the latest period. Operating expenses and non-operating expenses significantly impact net income, which stands at A$281.1 million for the most recent period.

PE: 9.7x

Eagers Automotive, a small cap in Australia, recently announced a share repurchase program to buy back up to 25.8 million shares by June 2025, reflecting insider confidence. As of June 11, 2024, the company has issued 258.2 million shares. CEO Keith Thornton emphasized their commitment to exceeding revenue growth guidance for 2024 and pursuing accretive M&A opportunities. Despite high debt levels and reliance on external borrowing, Eagers forecasts annual revenue growth of 5.52%, though earnings may decline slightly by an average of 0.7% over the next three years (A$).

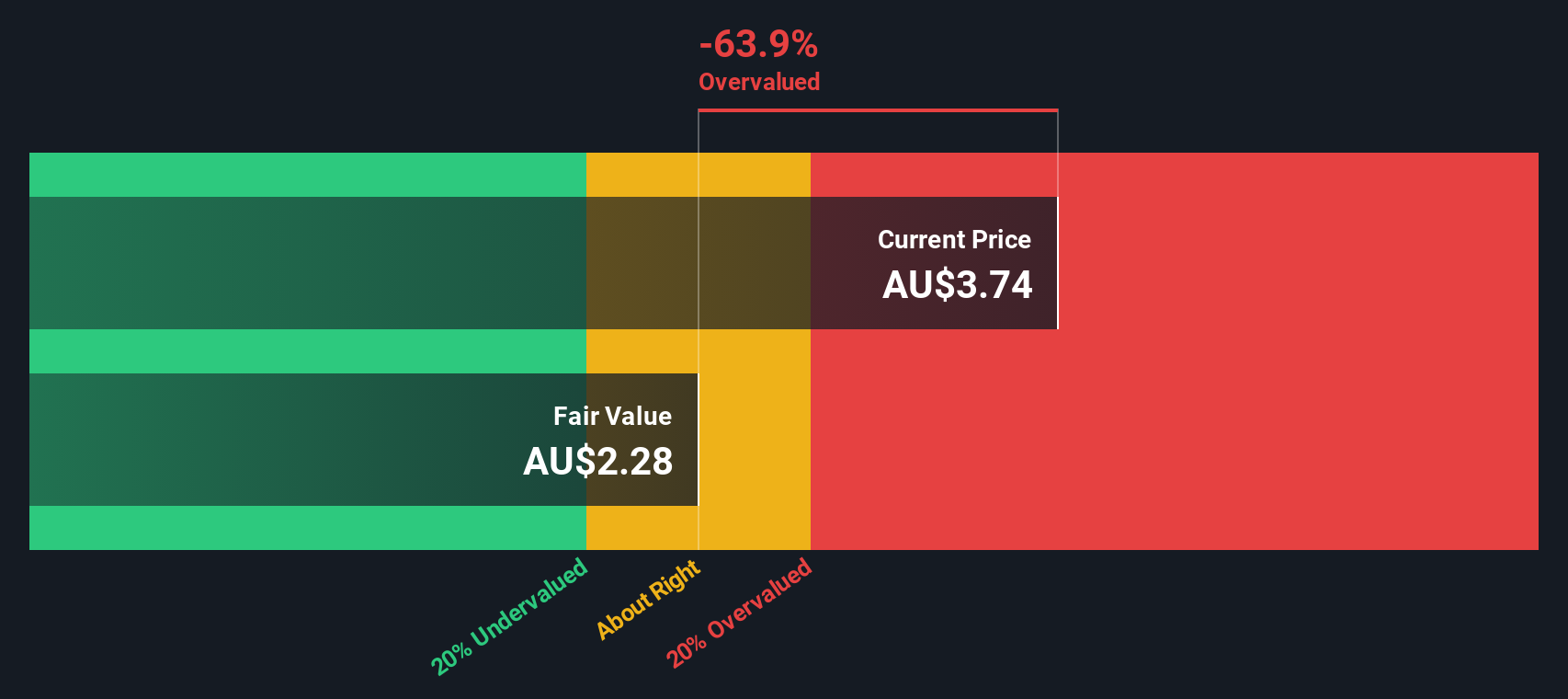

Kelsian Group (ASX:KLS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kelsian Group operates in the transportation sector, providing bus services in Australia and internationally, as well as marine and tourism services, with a market cap of A$1.51 billion.

Operations: The company generates revenue primarily through its Australian Bus, International Bus, and Marine and Tourism segments. For the period ending December 31, 2023, revenue reached A$1.73 billion with a gross profit of A$441.02 million. The net income margin was 1.71%.

PE: 47.3x

Kelsian Group, a small Australian transport company, has seen insider confidence with significant share purchases over the past year. Despite lower profit margins this year (1.7%) compared to last year's 3.8%, earnings are projected to grow by 25.53% annually. The company's reliance on external borrowing poses higher risks, but its strategic moves suggest potential for future growth in the transport sector.

- Dive into the specifics of Kelsian Group here with our thorough valuation report.

Explore historical data to track Kelsian Group's performance over time in our Past section.

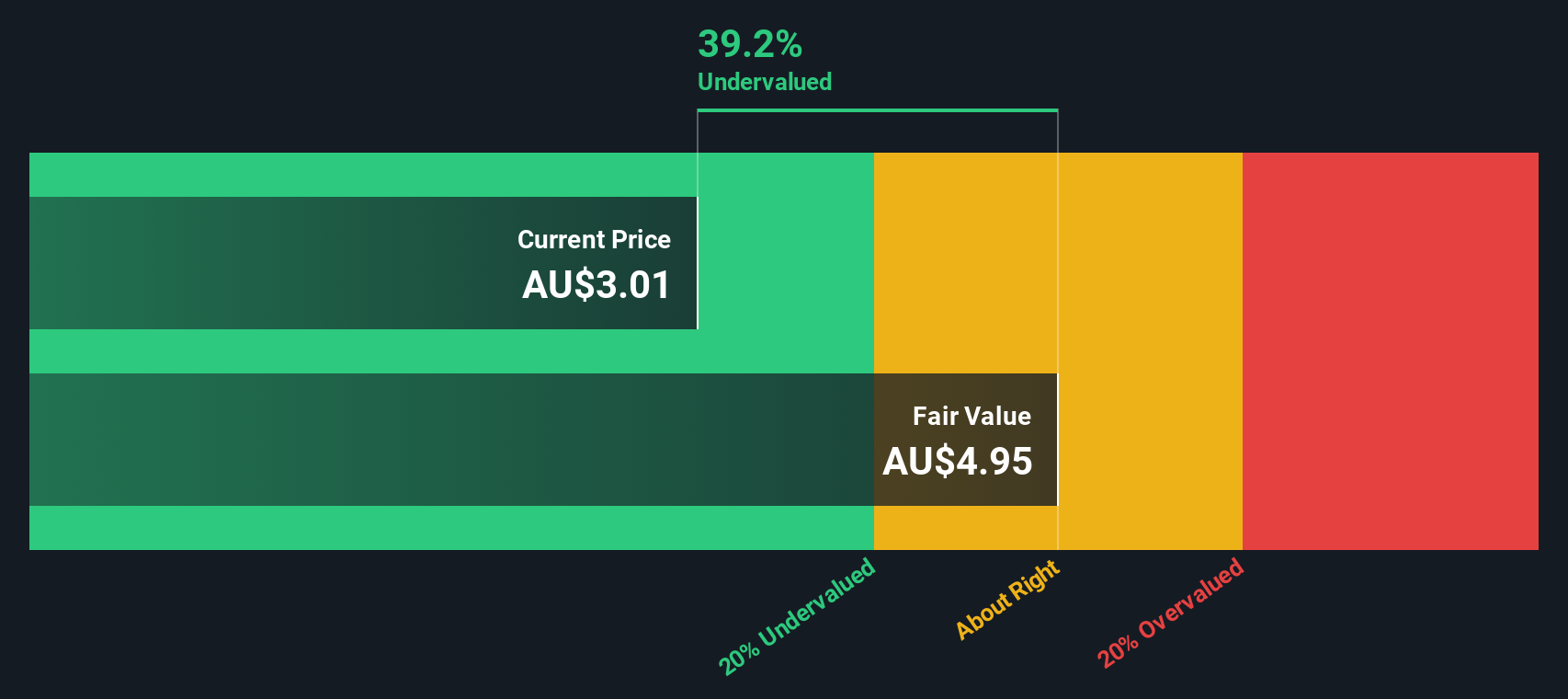

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is an Australian diversified services provider operating in the mining, civil, and urban infrastructure sectors with a market cap of approximately A$1.15 billion.

Operations: NRW Holdings generates revenue primarily from its Mining, MET, and Civil segments. For the period ending June 30, 2024, the company reported a gross profit margin of 47.99% on total revenue of A$2.92 billion and net income of A$105.10 million. Operating expenses primarily include general and administrative costs along with depreciation and amortization expenses.

PE: 15.3x

NRW Holdings, a small cap in Australia, has shown promising signs of being undervalued. They recently announced an ordinary dividend of A$0.09 per share for the six months ending June 30, 2024, payable on October 9. Revenue guidance for fiscal year 2024 remains steady at A$2.9 billion. Notably, insider confidence is evident with recent share purchases by executives over the past few months. With earnings projected to grow annually by 9.63%, NRW presents potential growth opportunities despite higher-risk external borrowing as its sole funding source.

- Get an in-depth perspective on NRW Holdings' performance by reading our valuation report here.

Assess NRW Holdings' past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Undervalued ASX Small Caps With Insider Buying screener has unearthed 11 more companies for you to explore.Click here to unveil our expertly curated list of 14 Undervalued ASX Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kelsian Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KLS

Kelsian Group

Provides land and marine transport and tourism services in Australia, the United States, Singapore, and the United Kingdom.

Reasonable growth potential slight.