High Growth Tech Stocks in Australia Featuring Three Promising Companies

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat with a notable 3.6% gain in the Financials sector, and it is up 10% over the past year with earnings forecasted to grow by 12% annually. In this context, identifying high growth tech stocks that align with these positive market conditions can be crucial for investors looking to capitalize on robust earnings potential and sector-specific momentum.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| DUG Technology | 10.90% | 32.21% | ★★★★★☆ |

| Xero | 13.52% | 24.24% | ★★★★★☆ |

| Careteq | 24.12% | 104.18% | ★★★★★☆ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Wrkr | 33.39% | 124.86% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

| Senetas | 14.33% | 118.52% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★★

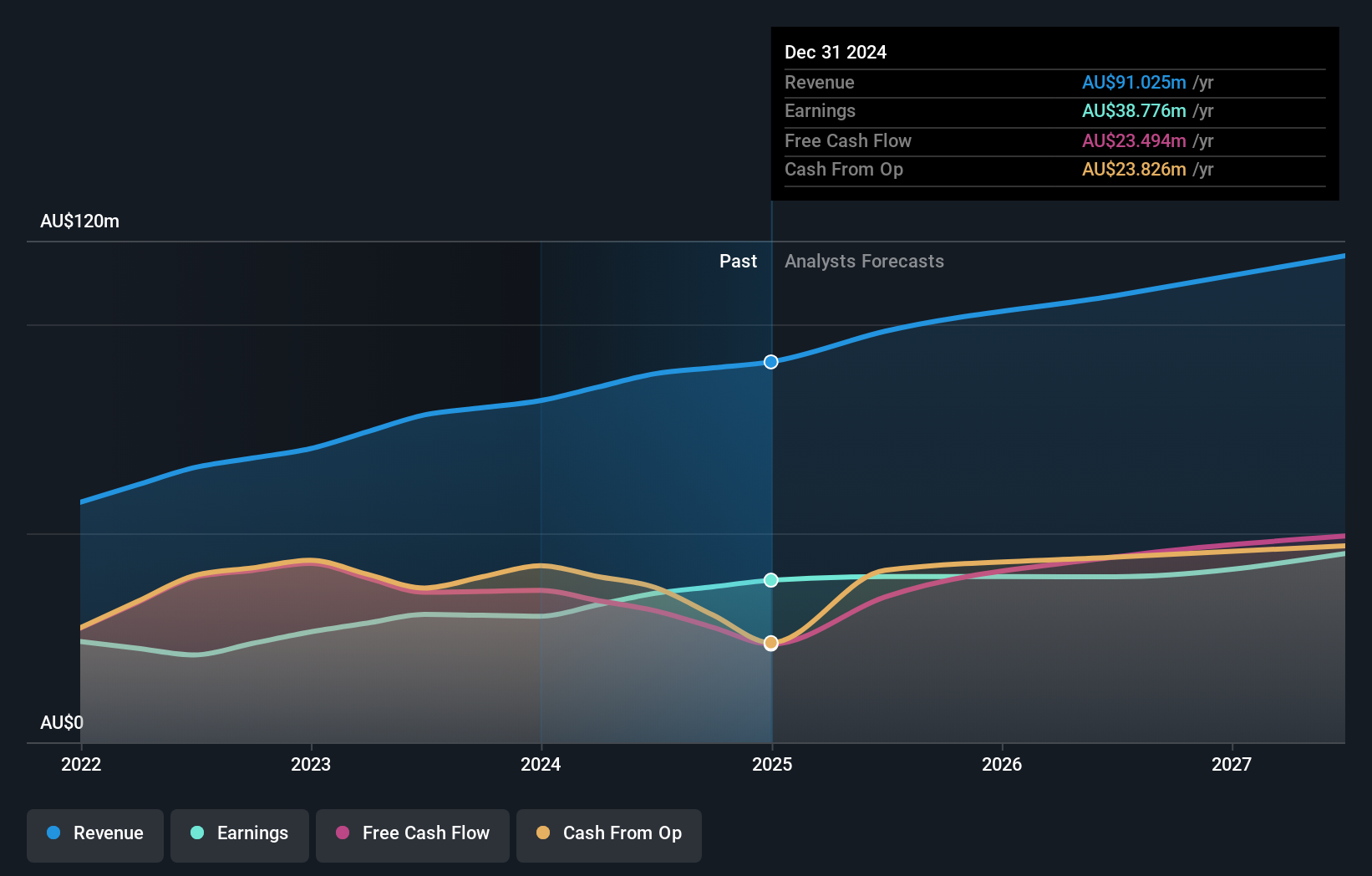

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$760.68 million.

Operations: Clinuvel Pharmaceuticals generates revenue primarily from its biopharmaceutical sector, totaling A$88.18 million. The company focuses on developing and commercializing treatments for various disorders across multiple regions, including Australia, Europe, the United States, and Switzerland.

Clinuvel Pharmaceuticals reported a revenue increase of 14.87% to AUD 95.31 million for the year ending June 30, 2024, with net income rising to AUD 35.64 million, reflecting robust financial health. The company is exploring M&A opportunities and has significant R&D investments aimed at innovative treatments like afamelanotide for Parkinson’s Disease and vitiligo, underscoring its commitment to growth and medical advancements. Earnings are forecasted to grow at an impressive rate of 27.42% per year, outpacing the Australian market's average growth rate of 12.1%.

- Dive into the specifics of Clinuvel Pharmaceuticals here with our thorough health report.

Assess Clinuvel Pharmaceuticals' past performance with our detailed historical performance reports.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

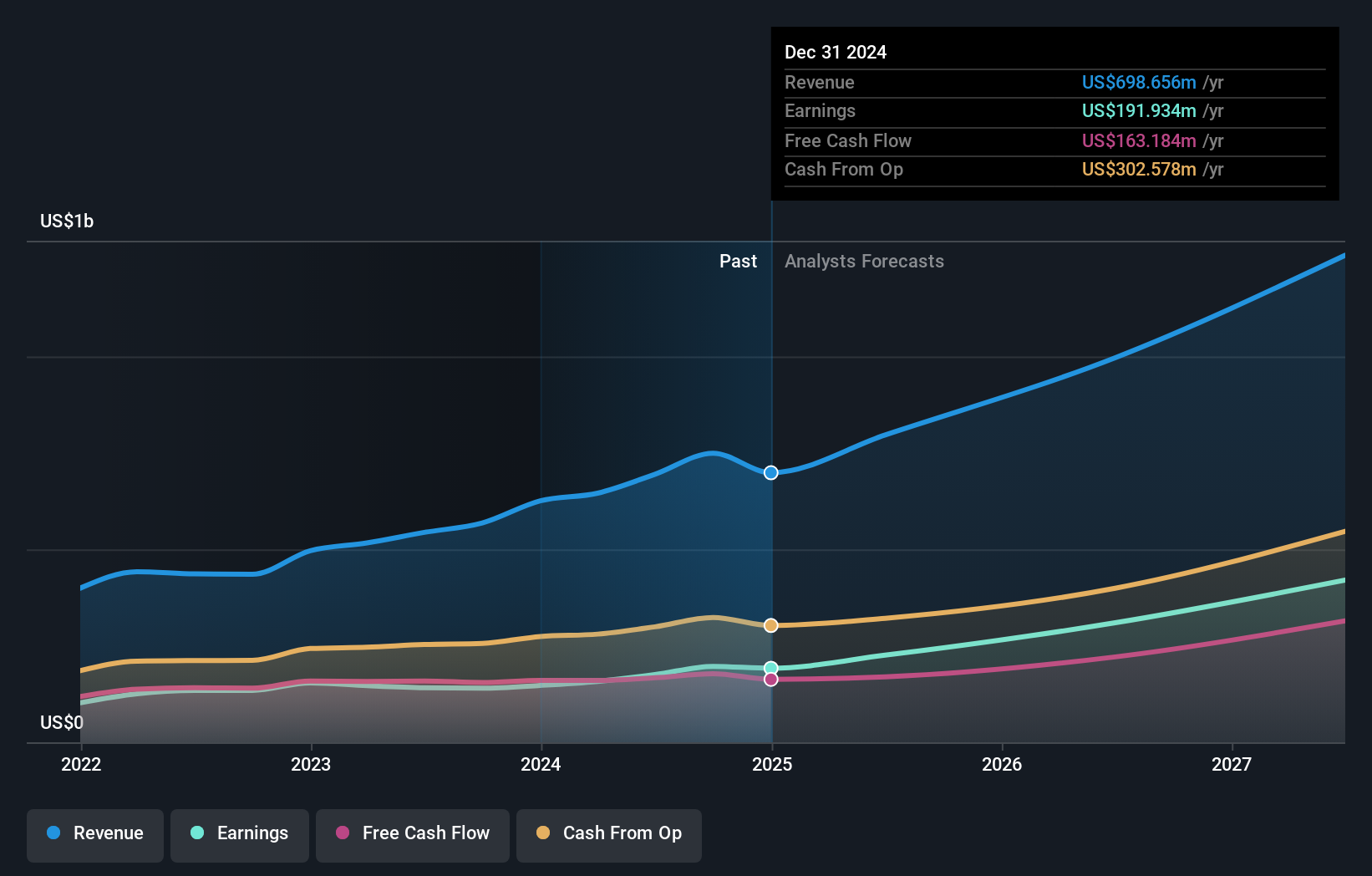

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$15.72 billion.

Operations: Pro Medicus Limited generates revenue primarily from producing integrated software applications for the healthcare industry, totaling A$161.50 million. The company's offerings are targeted at hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe.

Pro Medicus has demonstrated impressive financial performance, with earnings growth of 36.5% over the past year, outpacing the Healthcare Services industry at 13.3%. Revenue for the year ending June 30, 2024, rose to AUD 166.33 million from AUD 127.33 million previously, an increase of approximately 30%. The company’s R&D expenses have been substantial, contributing to its innovative edge in medical imaging software solutions. With a forecasted annual revenue growth rate of 16.8%, Pro Medicus is positioned well above the Australian market's average growth rate of 5.3%, reflecting strong future prospects in tech-driven healthcare advancements.

- Take a closer look at Pro Medicus' potential here in our health report.

Gain insights into Pro Medicus' past trends and performance with our Past report.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$40.42 billion.

Operations: WiseTech Global Limited generates revenue primarily from its Internet Software & Services segment, which accounted for A$1.04 billion. The company focuses on providing software solutions tailored to the logistics execution industry across multiple regions worldwide.

WiseTech Global has shown robust growth, with earnings increasing by 23.8% over the past year, significantly outpacing the Software industry’s 6.8%. Revenue surged to AUD 1.04 billion from AUD 816.8 million, reflecting a dynamic market presence and strong client base in logistics software solutions. The company’s R&D expenses are notable at AUD 161.4 million, underscoring its commitment to innovation and maintaining a competitive edge in AI-driven logistics technology. Future revenue growth is forecasted at an impressive rate of 19.1% annually, bolstered by strategic investments and expanding global operations.

- Unlock comprehensive insights into our analysis of WiseTech Global stock in this health report.

Review our historical performance report to gain insights into WiseTech Global's's past performance.

Next Steps

- Explore the 58 names from our ASX High Growth Tech and AI Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet and undervalued.