The Australian market is experiencing a challenging phase, with the ASX 200 expected to open lower due to trade concerns from the U.S., while Wall Street's recent downturn has added further pressure, particularly impacting tech stocks. In this environment of economic uncertainty and fluctuating indices, identifying high growth tech stocks requires a focus on companies with strong fundamentals and resilience to navigate volatility effectively.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| WiseTech Global | 20.14% | 25.01% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| SiteMinder | 19.93% | 69.52% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Dropsuite (ASX:DSE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dropsuite Limited, with a market cap of A$418.23 million, offers cloud-based data backup and archiving solutions across Australia, Singapore, Europe, the United States, and other international markets.

Operations: Dropsuite Limited generates revenue primarily through its provision of backup services, totaling A$41.17 million. The company focuses on delivering cloud-based data protection solutions internationally, leveraging its suite of products to cater to diverse markets.

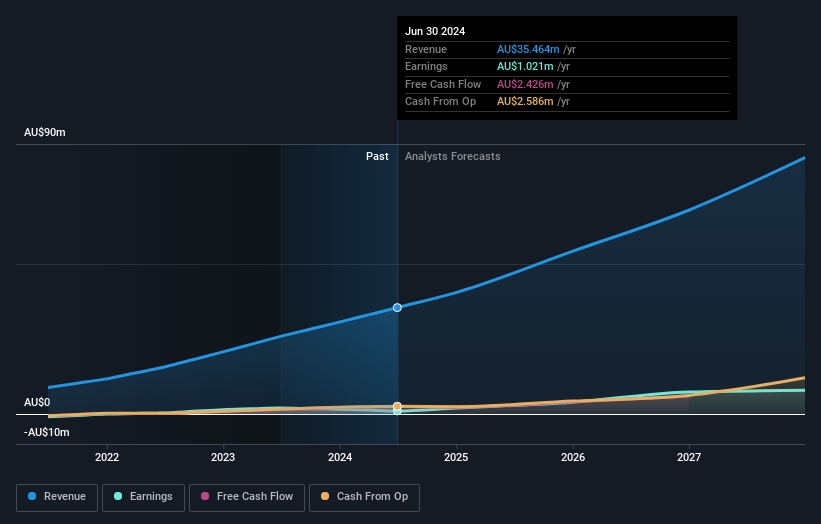

Despite recent setbacks, including being dropped from major Australian indices, Dropsuite demonstrates resilience with a robust forecast for revenue and earnings growth. The company's revenue is expected to increase by 18.8% annually, outpacing the general Australian market's growth rate of 5.5%. Furthermore, Dropsuite's projected annual earnings growth stands at an impressive 27.5%, significantly higher than the market average of 11.8%. However, it's worth noting that past performance saw a notable decline in net income from AUD 1.58 million to AUD 0.829 million year-over-year and a reduction in profit margins from 5.2% to just 2%. This juxtaposition of strong growth forecasts against recent financial contractions suggests potential volatility but also indicates possible upside if the company can leverage its market position and R&D initiatives effectively.

- Take a closer look at Dropsuite's potential here in our health report.

Gain insights into Dropsuite's historical performance by reviewing our past performance report.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★★

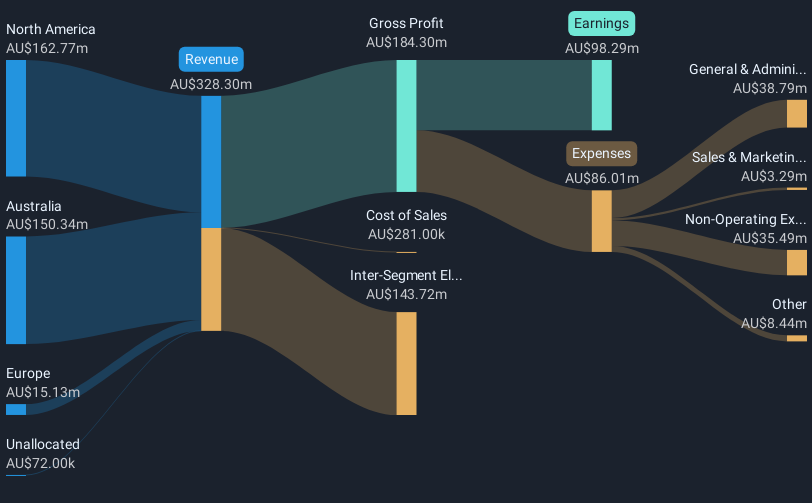

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$28.70 billion.

Operations: The company generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$184.58 million.

Pro Medicus, a standout in the Australian tech landscape, recently announced a share repurchase program that underscores its robust financial health and commitment to shareholder value. The company plans to buy back up to 10% of its issued shares by March 2026, highlighting confidence in its operational stability and future prospects. This move coincides with Pro Medicus being added to several prestigious indices, including the S&P/ASX 50 and S&P Global 1200, reflecting its growing influence and performance within the sector. With revenue growth forecasted at an impressive annual rate of 22.2% and earnings expected to surge by 23.5% annually—both metrics significantly outpacing general market trends—Pro Medicus is not just thriving; it's setting benchmarks in healthcare technology integration across global markets.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of approximately A$8.40 billion.

Operations: SEEK Limited generates revenue primarily through its online employment marketplace services, with significant contributions from the ANZ region (A$821.40 million) and Asia (A$240.90 million).

SEEK, navigating the competitive landscape of online employment services, demonstrates resilience with a notable 9.1% annual revenue growth and an impressive 26.2% expected earnings surge per year. Despite a challenging past marked by a significant one-off loss of A$119.8 million last year, the company's strategic focus on innovation is evident from its substantial investment in R&D, aligning with industry shifts towards advanced data analytics and AI-driven platforms to enhance job matching capabilities. While its return on equity is forecasted at a modest 10.7%, SEEK's proactive market strategies and robust revenue growth outpacing the Australian market average suggest promising prospects for its role in transforming recruitment through technology.

- Navigate through the intricacies of SEEK with our comprehensive health report here.

Review our historical performance report to gain insights into SEEK's's past performance.

Key Takeaways

- Get an in-depth perspective on all 49 ASX High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DSE

Dropsuite

Provides cloud-based suite of data backup and archiving solutions in Australia, Singapore, Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives