- Australia

- /

- Medical Equipment

- /

- ASX:NXS

Further Upside For Next Science Limited (ASX:NXS) Shares Could Introduce Price Risks After 26% Bounce

Next Science Limited (ASX:NXS) shares have continued their recent momentum with a 26% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

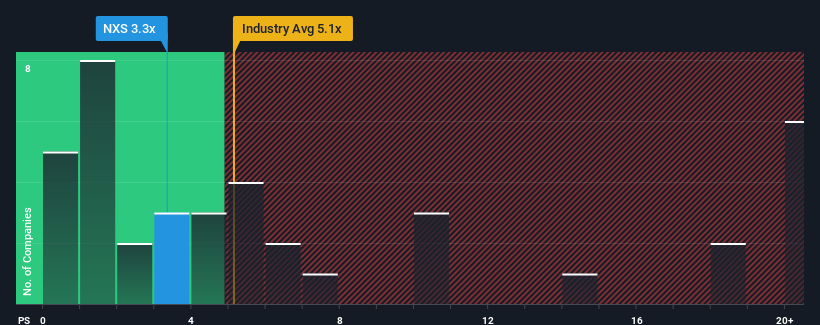

In spite of the firm bounce in price, Next Science's price-to-sales (or "P/S") ratio of 3.3x might still make it look like a buy right now compared to the Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 5.1x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Next Science

What Does Next Science's P/S Mean For Shareholders?

Recent times have been advantageous for Next Science as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Next Science will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Next Science?

Next Science's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 89%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 32% each year as estimated by the two analysts watching the company. With the industry only predicted to deliver 10% each year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Next Science's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Next Science's P/S Mean For Investors?

Despite Next Science's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Next Science's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 5 warning signs for Next Science (1 shouldn't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Next Science, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Next Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXS

Next Science

Engages in the research, development, and commercialization of technologies that resolve the issues in human health caused by biofilms, incumbent bacteria, fungus, viruses, and infections in North America, Australia, and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives