- Australia

- /

- Medical Equipment

- /

- ASX:NAN

With EPS Growth And More, Nanosonics (ASX:NAN) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nanosonics (ASX:NAN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Nanosonics Growing Its Earnings Per Share?

Nanosonics has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Nanosonics' EPS shot up from AU$0.043 to AU$0.068; a result that's bound to keep shareholders happy. That's a commendable gain of 59%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Nanosonics shareholders can take confidence from the fact that EBIT margins are up from 5.0% to 9.0%, and revenue is growing. Both of which are great metrics to check off for potential growth.

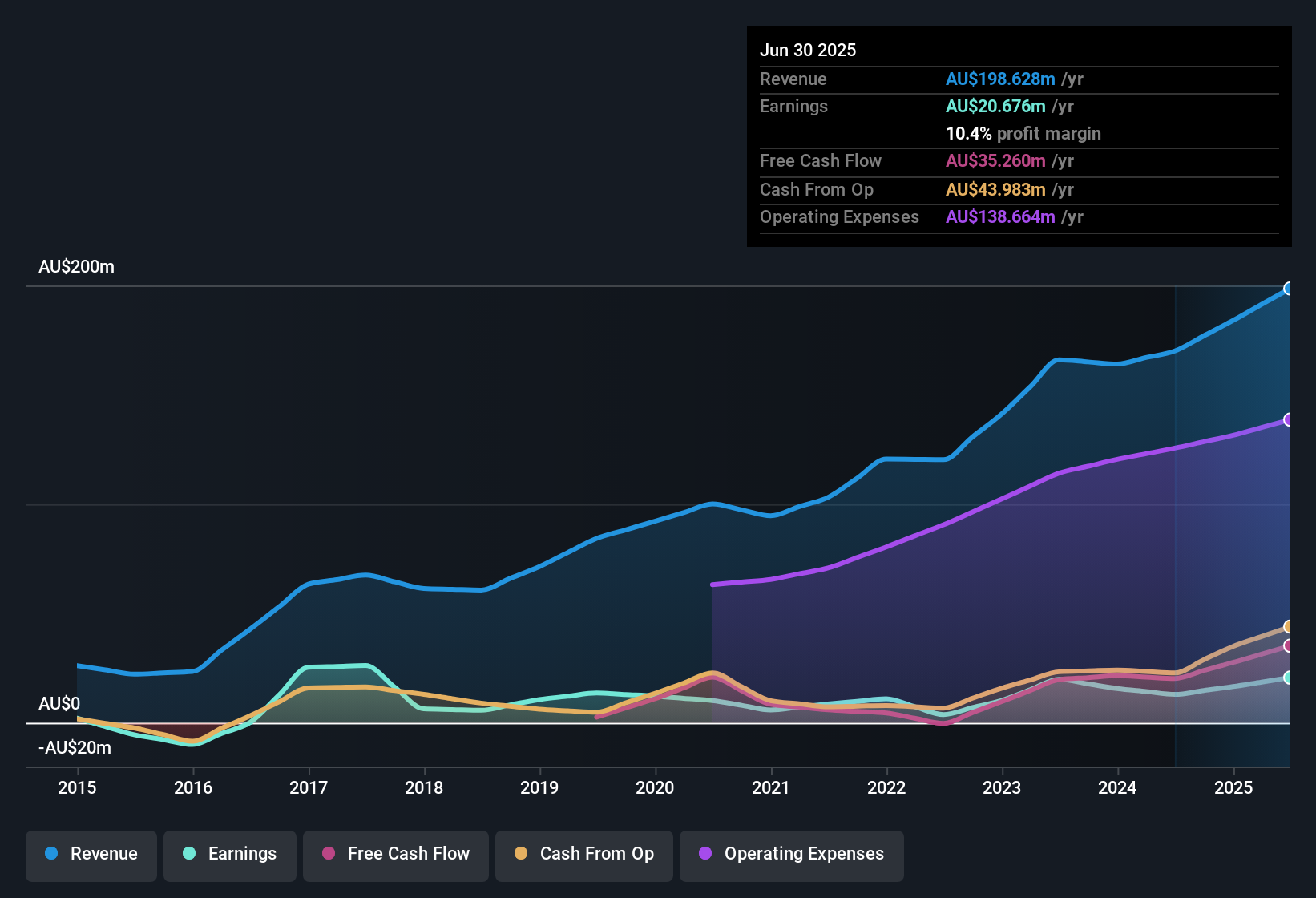

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for Nanosonics

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Nanosonics' future profits.

Are Nanosonics Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Nanosonics insiders refrain from selling stock during the year, but they also spent AU$245k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Independent Non-Executive Director, Gerard Dalbosco, who made the biggest single acquisition, paying AU$87k for shares at about AU$4.36 each.

Along with the insider buying, another encouraging sign for Nanosonics is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth AU$200m. This totals to 15% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Nanosonics To Your Watchlist?

For growth investors, Nanosonics' raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Of course, profit growth is one thing but it's even better if Nanosonics is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Nanosonics, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NAN

Nanosonics

Operates as an infection prevention company in Australia, North America, Europe, the United Kingdom, the Middle East, and Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives