Stock Analysis

- Australia

- /

- Oil and Gas

- /

- ASX:LOT

Exploring Three ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Australian market has shown positive momentum, climbing 1.5% over the last week and achieving a 7.3% increase over the past year, with earnings expected to grow by 13% annually. In this context, stocks with high insider ownership can be particularly compelling as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

| SiteMinder (ASX:SDR) | 11.4% | 69.4% |

| Plenti Group (ASX:PLT) | 12.6% | 68.5% |

Let's review some notable picks from our screened stocks.

Lotus Resources (ASX:LOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotus Resources Limited is a company focused on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market capitalization of approximately A$842.36 million.

Operations: The firm primarily generates revenue through the exploration, evaluation, and development of uranium properties across Australia and Africa.

Insider Ownership: 12.3%

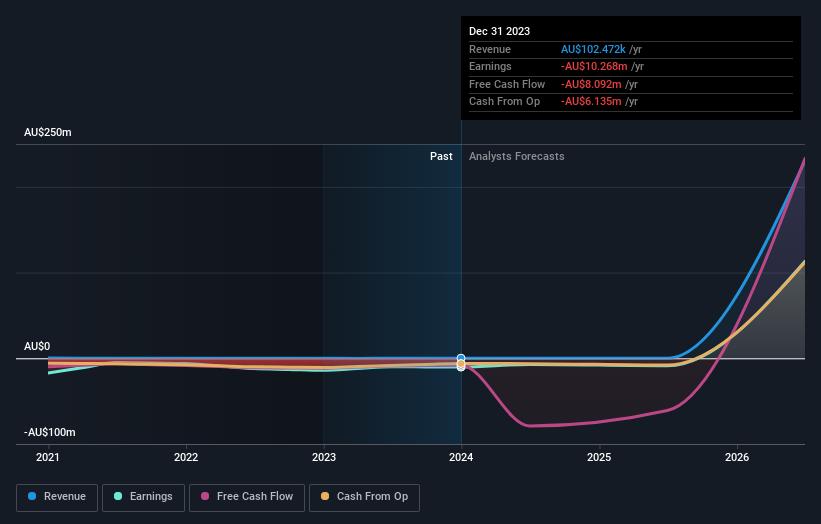

Lotus Resources, despite making less than A$102K in revenue, is on a path to profitability within three years with earnings expected to grow significantly. The company's Return on Equity is also forecasted to be very high at 70.9%. Recently, Lotus was added to the S&P/ASX Small Ordinaries and 300 Indexes, enhancing its visibility. However, it reported a net loss of A$5.54 million in the last half-year and completed a follow-on equity offering raising A$30 million at A$0.3 per share.

- Delve into the full analysis future growth report here for a deeper understanding of Lotus Resources.

- In light of our recent valuation report, it seems possible that Lotus Resources is trading beyond its estimated value.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is an infection prevention company operating both in Australia and internationally, with a market capitalization of approximately A$881.67 million.

Operations: The company generates revenue primarily from its healthcare equipment segment, totaling A$164.07 million.

Insider Ownership: 15.2%

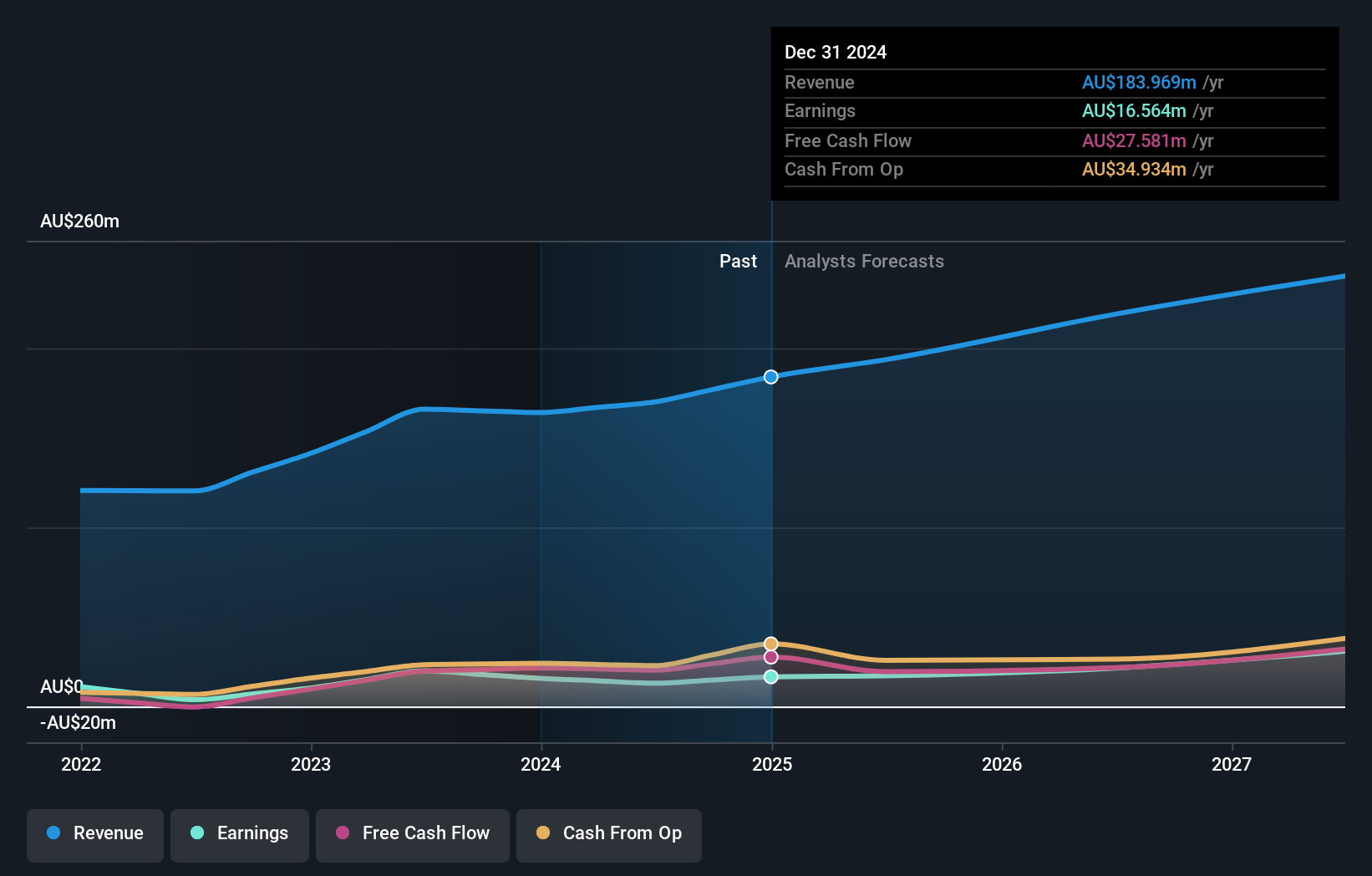

Nanosonics, an Australian growth company with considerable insider buying recently, is poised for significant earnings growth, forecasted at 24% annually over the next three years. This outpaces the broader Australian market's expected growth. Despite a recent dip in half-year sales to A$79.64 million and net income falling to A$6.17 million, insider transactions and a strong revenue forecast of 10.1% yearly growth—double the national average—suggest confidence in its strategic direction. However, its Return on Equity is projected to remain modest at 12.5%.

- Click to explore a detailed breakdown of our findings in Nanosonics' earnings growth report.

- The analysis detailed in our Nanosonics valuation report hints at an inflated share price compared to its estimated value.

OM Holdings (ASX:OMH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OM Holdings Limited is a global investment holding company that operates in mining, smelting, trading, and marketing manganese ores and ferroalloys, with a market capitalization of approximately A$393.63 million.

Operations: The company's revenue is primarily derived from its marketing and trading segment, which generated A$602.07 million, and its smelting operations, which contributed A$388.84 million.

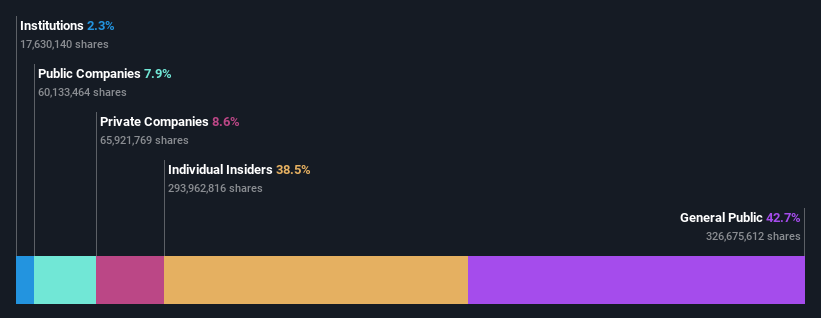

Insider Ownership: 38.4%

OM Holdings, despite a challenging year with sales dropping to US$589.24 million from US$856.55 million and net income falling to US$18.14 million, is expected to see robust earnings growth of 29.8% annually over the next three years, outpacing the Australian market's average. This is coupled with a forecasted revenue increase of 9.8% per year, also above market expectations. However, financial challenges are evident as interest payments are poorly covered by earnings and recent one-off items have significantly impacted results. Additionally, shareholder dilution occurred over the past year and profit margins have decreased from last year's figures.

- Click here to discover the nuances of OM Holdings with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of OM Holdings shares in the market.

Turning Ideas Into Actions

- Explore the 89 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Lotus Resources is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LOT

Lotus Resources

Engages in the exploration, evaluation, and development of uranium properties in Australia and Africa.

Excellent balance sheet with reasonable growth potential.