This article will reflect on the compensation paid to Robert Read who has served as CEO of MedAdvisor Limited (ASX:MDR) since 2015. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for MedAdvisor

How Does Total Compensation For Robert Read Compare With Other Companies In The Industry?

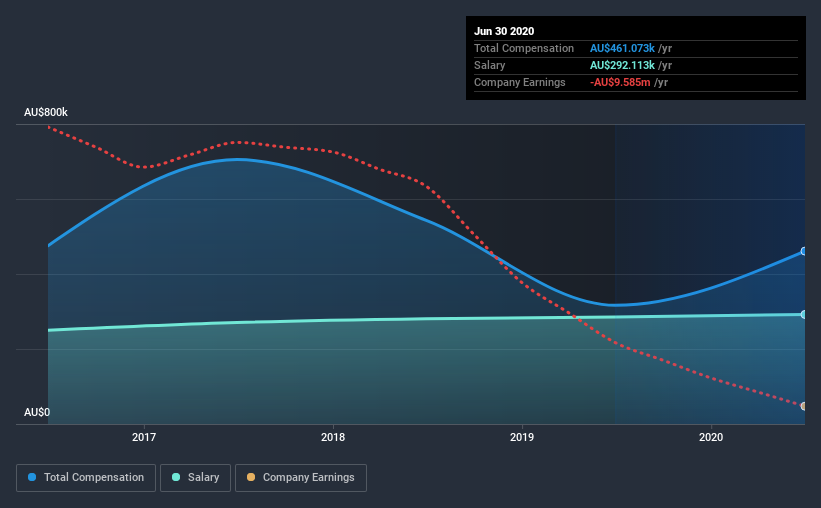

At the time of writing, our data shows that MedAdvisor Limited has a market capitalization of AU$128m, and reported total annual CEO compensation of AU$461k for the year to June 2020. We note that's an increase of 46% above last year. In particular, the salary of AU$292.1k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under AU$259m, the reported median total CEO compensation was AU$458k. This suggests that MedAdvisor remunerates its CEO largely in line with the industry average. Moreover, Robert Read also holds AU$987k worth of MedAdvisor stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$292k | AU$285k | 63% |

| Other | AU$169k | AU$31k | 37% |

| Total Compensation | AU$461k | AU$316k | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. There isn't a significant difference between MedAdvisor and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

MedAdvisor Limited's Growth

MedAdvisor Limited has reduced its earnings per share by 21% a year over the last three years. Its revenue is up 16% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has MedAdvisor Limited Been A Good Investment?

With a total shareholder return of 4.8% over three years, MedAdvisor Limited has done okay by shareholders. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we noted earlier, MedAdvisor pays its CEO in line with similar-sized companies belonging to the same industry. But revenue growth over the last year can't be ignored. Meanwhile, we would have liked to see shareholder returns post more substantial growth. Additionally, shareholders would want to keep their eyes on EPS, since growth has been negative for the metric for the last three years. But we don't think the CEO compensation is a problem, although shareholders might want to see more growth before agreeing that Robert should get a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for MedAdvisor (1 is concerning!) that you should be aware of before investing here.

Switching gears from MedAdvisor, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade MedAdvisor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AHE

Adheris Health

Provides pharmacy-driven patient engagement solutions in Australia, the United States, and the United Kingdom.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026