- Australia

- /

- Healthtech

- /

- ASX:M7T

The Mach7 Technologies (ASX:M7T) Share Price Is Up 303% And Shareholders Are Delighted

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One such superstar is Mach7 Technologies Limited (ASX:M7T), which saw its share price soar 303% in three years. On top of that, the share price is up 63% in about a quarter.

View our latest analysis for Mach7 Technologies

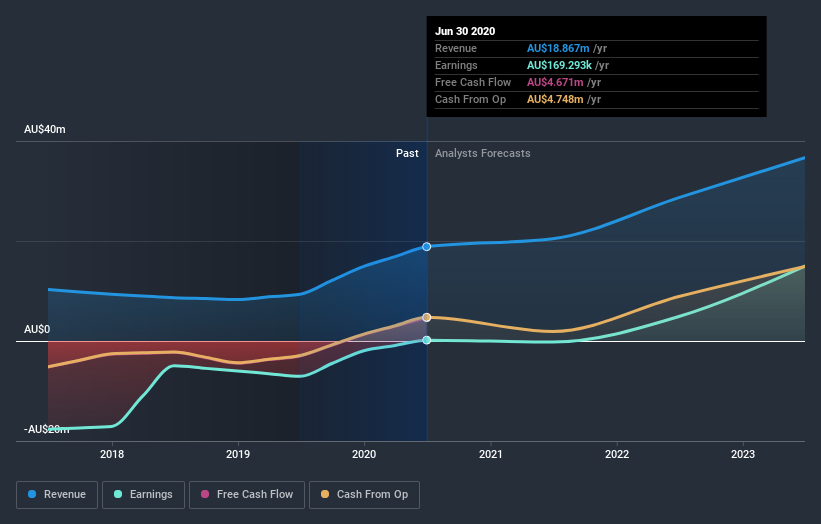

Given that Mach7 Technologies only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Mach7 Technologies saw its revenue grow at 24% per year. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 59% per year, over the same period. Despite the strong run, top performers like Mach7 Technologies have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Mach7 Technologies has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Mach7 Technologies' financial health with this free report on its balance sheet.

A Different Perspective

Pleasingly, Mach7 Technologies' total shareholder return last year was 100%. That's better than the annualized TSR of 59% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Mach7 Technologies on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Mach7 Technologies better, we need to consider many other factors. For example, we've discovered 2 warning signs for Mach7 Technologies that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Mach7 Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:M7T

Mach7 Technologies

Provides enterprise imaging data sharing, storage, and interoperability for healthcare enterprises in North America, the Asia Pacific, the Middle East, Europe, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives