- Australia

- /

- Healthtech

- /

- ASX:M7T

Improved Revenues Required Before Mach7 Technologies Limited (ASX:M7T) Shares Find Their Feet

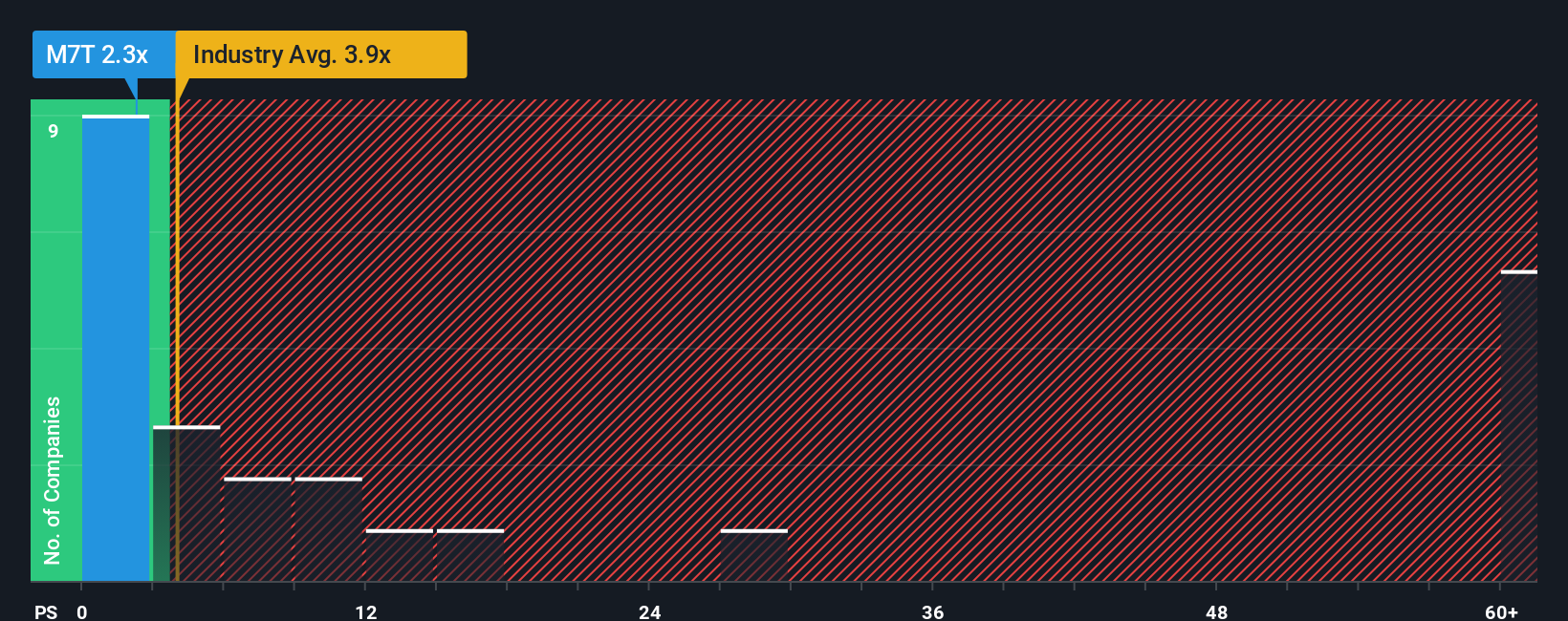

Mach7 Technologies Limited's (ASX:M7T) price-to-sales (or "P/S") ratio of 2.3x might make it look like a strong buy right now compared to the Healthcare Services industry in Australia, where around half of the companies have P/S ratios above 11.4x and even P/S above 142x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Mach7 Technologies

How Mach7 Technologies Has Been Performing

Mach7 Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Mach7 Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Mach7 Technologies' Revenue Growth Trending?

Mach7 Technologies' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Revenue has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 290% each year, which is noticeably more attractive.

With this information, we can see why Mach7 Technologies is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Mach7 Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Mach7 Technologies you should be aware of.

If you're unsure about the strength of Mach7 Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:M7T

Mach7 Technologies

Develops and commercializes medical imaging and data management software solutions for healthcare organizations in North America, the Asia Pacific, the Middle East, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives