- Australia

- /

- Consumer Services

- /

- ASX:KME

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As Australian shares trend toward a flat open, despite recent rallies in the U.S. markets, investors are taking a cautious approach amidst global economic uncertainties. Penny stocks, while often considered relics of past market eras, remain relevant for those seeking opportunities in smaller or newer companies that can offer both affordability and growth potential. In this article, we will highlight several penny stocks that demonstrate financial strength and could be promising candidates for investors looking to uncover under-the-radar prospects with long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.65 | A$125.01M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.72 | A$419.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.74 | A$460.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.37 | A$794.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.335 | A$802.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.695 | A$220.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$155.64M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.745 | A$140.55M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 471 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Kip McGrath Education Centres (ASX:KME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kip McGrath Education Centres Limited offers tutoring services across Australasia, Europe, the United States, North America, the United Kingdom, and internationally with a market cap of A$28.45 million.

Operations: The company generates revenue of A$32.71 million from its Education & Training Services segment.

Market Cap: A$28.45M

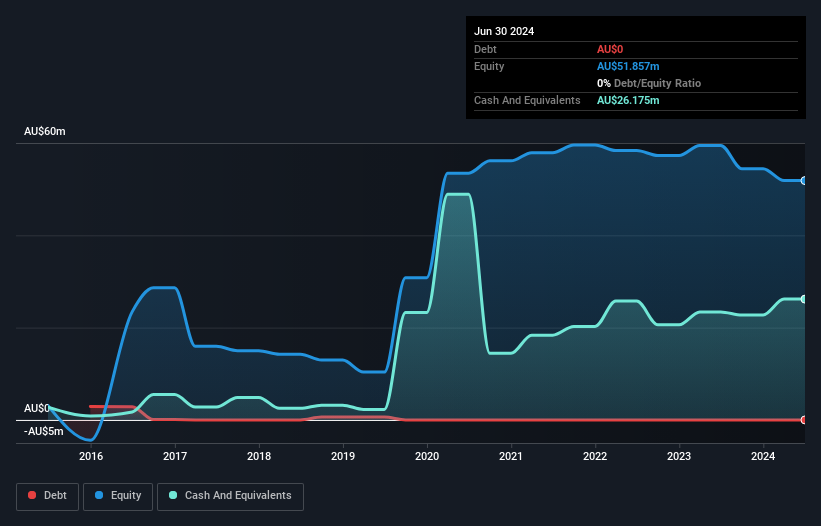

Kip McGrath Education Centres, with a market cap of A$28.45 million and revenue of A$32.71 million, shows promising attributes for penny stock investors. The company has no debt and strong short-term asset coverage over liabilities, indicating financial stability. Recent earnings growth of 67.1% outpaces both its five-year average decline and the broader Consumer Services industry growth rate, though its Return on Equity remains low at 8.2%. Management stability is evident with an experienced leadership team despite recent executive changes. The Price-To-Earnings ratio suggests it may be undervalued compared to the Australian market average.

- Take a closer look at Kip McGrath Education Centres' potential here in our financial health report.

- Gain insights into Kip McGrath Education Centres' historical outcomes by reviewing our past performance report.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mach7 Technologies Limited offers enterprise imaging data sharing, storage, and interoperability solutions for healthcare enterprises globally, with a market cap of A$80.02 million.

Operations: The company's revenue is derived from Software Licenses (A$17.32 million), Professional Services (A$3.92 million), and Maintenance and Support (A$12.28 million).

Market Cap: A$80.02M

Mach7 Technologies, with a market cap of A$80.02 million, presents both opportunities and challenges for penny stock investors. Despite being unprofitable and not expected to turn profitable in the next three years, it maintains a solid cash runway exceeding three years based on current free cash flow. The company is debt-free, with short-term assets of A$34.9 million comfortably covering its liabilities. Revenue streams from software licenses (A$17.32 million), professional services (A$3.92 million), and maintenance support (A$12.28 million) are forecast to grow by 14.15% annually, though past losses have increased at 10.4% per year over five years.

- Navigate through the intricacies of Mach7 Technologies with our comprehensive balance sheet health report here.

- Gain insights into Mach7 Technologies' outlook and expected performance with our report on the company's earnings estimates.

Tanami Gold (ASX:TAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tanami Gold NL, with a market cap of A$64.63 million, is involved in the exploration and evaluation of gold properties in Australia through its subsidiaries.

Operations: Tanami Gold NL does not report distinct revenue segments.

Market Cap: A$64.63M

Tanami Gold NL, with a market cap of A$64.63 million, offers potential as a penny stock investment due to its strong asset position and lack of debt. The company's short-term assets (A$32.9 million) significantly exceed both its short-term (A$896K) and long-term liabilities (A$4.3 million), indicating financial stability despite being pre-revenue and unprofitable with increasing losses over the past five years at 44% annually. Its experienced board, averaging 12.9 years in tenure, provides seasoned oversight; however, the absence of revenue streams poses challenges for growth comparison within the industry.

- Click here and access our complete financial health analysis report to understand the dynamics of Tanami Gold.

- Evaluate Tanami Gold's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 471 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kip McGrath Education Centres might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KME

Kip McGrath Education Centres

Provides tutoring services in Australasia, Europe, the United States, North America, the United Kingdom, Europe, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives