The Australian market is experiencing a flat start, with futures indicating a marginal dip and local banks like Commonwealth Bank and Suncorp Group reporting strong profits that could influence the bourse's performance. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite being considered somewhat outdated. By focusing on those with solid financial foundations and clear growth potential, investors can uncover opportunities that offer both stability and potential upside in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.48 | A$297.67M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.04 | A$252.05M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.16 | A$334.56M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited is engaged in the production and sale of South Sea pearls in Australia and Indonesia, with a market capitalization of A$65.35 million.

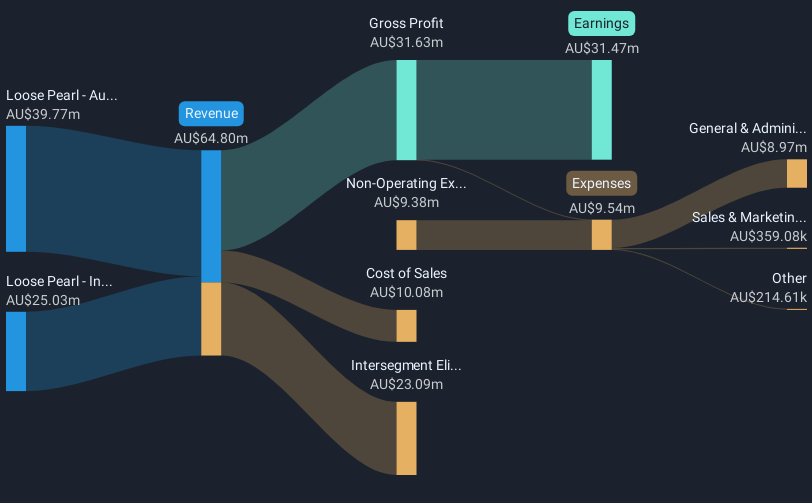

Operations: The company's revenue is derived from the sale of loose pearls, generating A$39.77 million in Australia and A$25.03 million in Indonesia.

Market Cap: A$65.35M

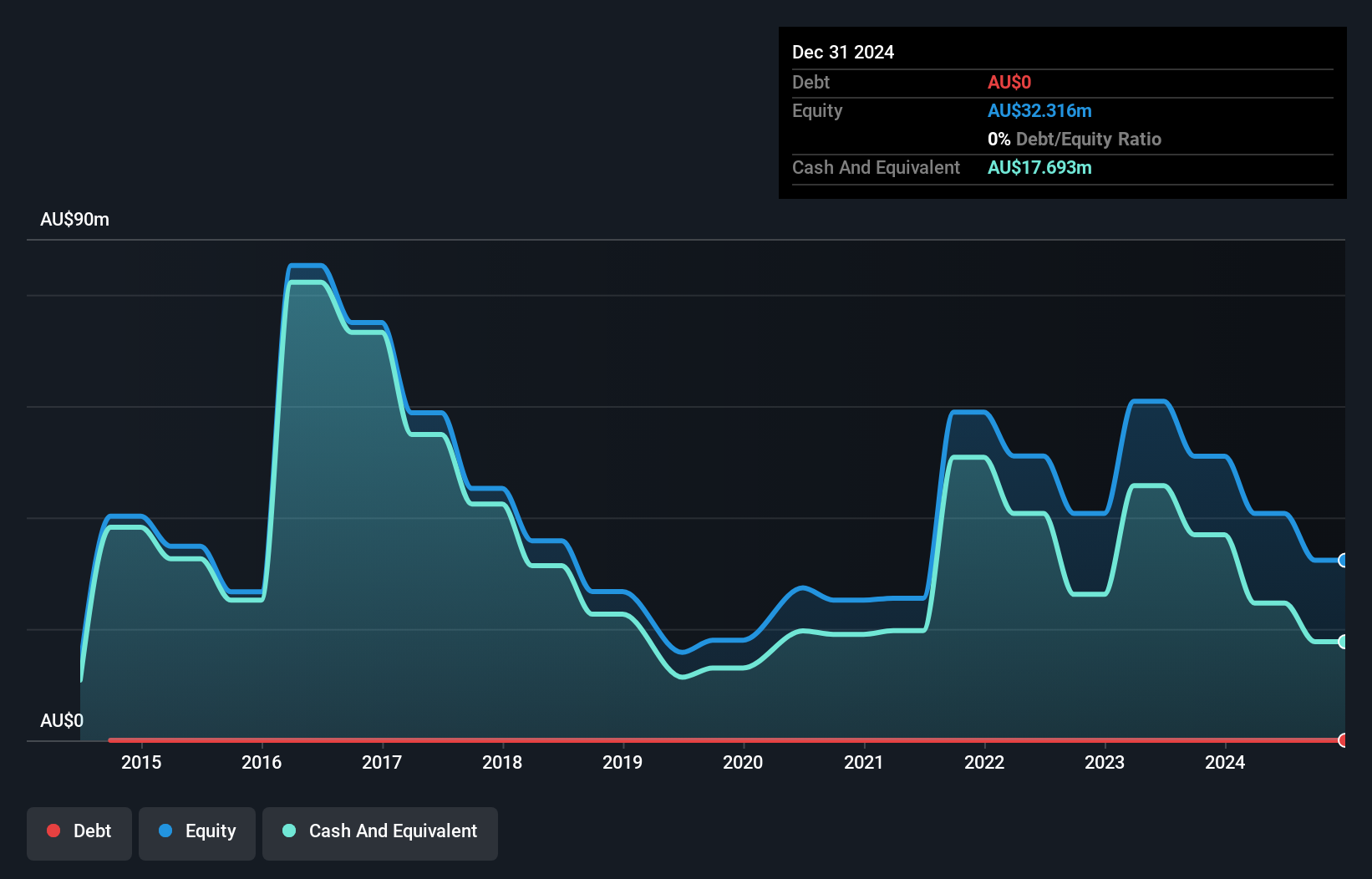

Atlas Pearls Limited, with a market cap of A$65.35 million, has demonstrated significant financial growth and stability. The company has become profitable over the past five years, with an impressive earnings growth of 246.3% in the past year alone, outpacing its five-year average of 65.8%. Its net profit margin improved substantially from last year to 75.5%, and it operates debt-free, eliminating concerns over interest payments or debt coverage. Atlas Pearls is trading significantly below its estimated fair value and boasts an experienced management team with a seasoned board of directors, enhancing investor confidence in its operational leadership.

- Click to explore a detailed breakdown of our findings in Atlas Pearls' financial health report.

- Learn about Atlas Pearls' historical performance here.

ImpediMed (ASX:IPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ImpediMed Limited is a medical technology company that manufactures and sells bioimpedance spectroscopy (BIS) technology medical devices in the United States and Europe, with a market cap of A$107.36 million.

Operations: The company's revenue primarily comes from its medical segment, generating A$10.32 million.

Market Cap: A$107.36M

ImpediMed Limited, with a market cap of A$107.36 million, operates in the medical technology sector with revenues of A$10.32 million from its medical segment. Despite being unprofitable and having a negative return on equity, ImpediMed's short-term assets significantly exceed both its short-term and long-term liabilities, providing financial stability. The company is debt-free and has not diluted shareholders in the past year, maintaining investor value. Although it faces challenges with an inexperienced board and management team, earnings are forecast to grow substantially at 64.37% per year, indicating potential for future growth within the penny stock landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of ImpediMed.

- Examine ImpediMed's earnings growth report to understand how analysts expect it to perform.

Sunrise Energy Metals (ASX:SRL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sunrise Energy Metals Limited is involved in metal recovery and exploration of mineral tenements in Australia, with a market cap of A$24.81 million.

Operations: The company's revenue segment is primarily from Metals, amounting to A$0.33 million.

Market Cap: A$24.81M

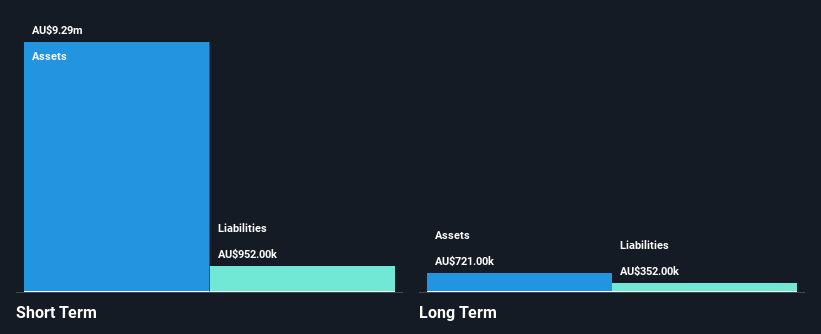

Sunrise Energy Metals Limited, with a market cap of A$24.81 million, is pre-revenue and currently unprofitable but has been reducing losses by 40.3% annually over the past five years. The company benefits from a seasoned management team with an average tenure of 9.6 years and a similarly experienced board. Financially stable, it boasts no debt and has short-term assets (A$9.3M) that cover both short-term (A$952K) and long-term liabilities (A$352K). Shareholders have not faced dilution recently, while the company maintains sufficient cash runway for over a year based on its free cash flow position.

- Unlock comprehensive insights into our analysis of Sunrise Energy Metals stock in this financial health report.

- Understand Sunrise Energy Metals' track record by examining our performance history report.

Key Takeaways

- Reveal the 1,030 hidden gems among our ASX Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATP

Atlas Pearls

Produces and sells south sea pearls in Australia and Indonesia.

Flawless balance sheet slight.

Market Insights

Community Narratives