- Australia

- /

- Medical Equipment

- /

- ASX:IBX

Here's Why We're Not Too Worried About Imagion Biosystems' (ASX:IBX) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. By way of example, Imagion Biosystems (ASX:IBX) has seen its share price rise 367% over the last year, delighting many shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given its strong share price performance, we think it's worthwhile for Imagion Biosystems shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Imagion Biosystems

Does Imagion Biosystems Have A Long Cash Runway?

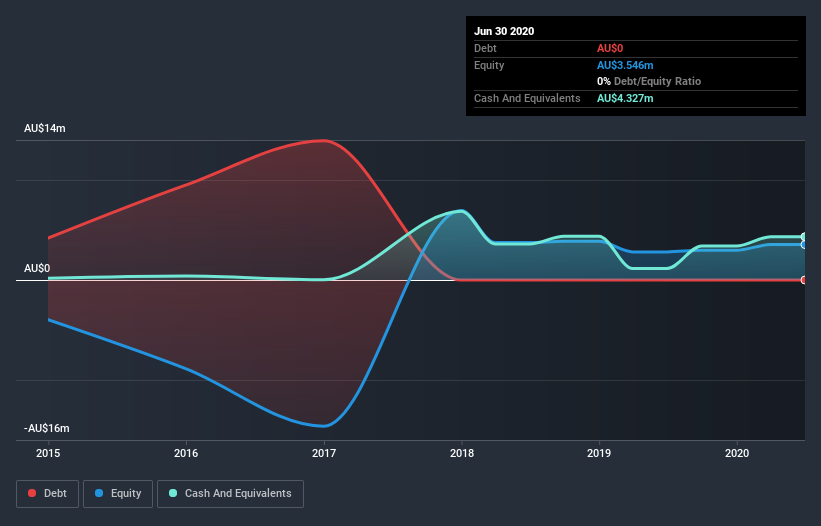

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2020, Imagion Biosystems had AU$4.3m in cash, and was debt-free. Importantly, its cash burn was AU$2.4m over the trailing twelve months. That means it had a cash runway of around 22 months as of June 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

How Well Is Imagion Biosystems Growing?

Happily, Imagion Biosystems is travelling in the right direction when it comes to its cash burn, which is down 63% over the last year. However, operating revenue growth was flat over the period. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. In reality, this article only makes a short study of the company's growth data. You can take a look at how Imagion Biosystems has developed its business over time by checking this visualization of its revenue and earnings history.

Can Imagion Biosystems Raise More Cash Easily?

Imagion Biosystems seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Imagion Biosystems' cash burn of AU$2.4m is about 1.7% of its AU$140m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Imagion Biosystems' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Imagion Biosystems' cash burn. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Imagion Biosystems has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course Imagion Biosystems may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Imagion Biosystems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IBX

Imagion Biosystems

Provides medical imaging technologies using magnetic resonance.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success