- Australia

- /

- Medical Equipment

- /

- ASX:EYE

Further Upside For Nova Eye Medical Limited (ASX:EYE) Shares Could Introduce Price Risks After 38% Bounce

Nova Eye Medical Limited (ASX:EYE) shareholders are no doubt pleased to see that the share price has bounced 38% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

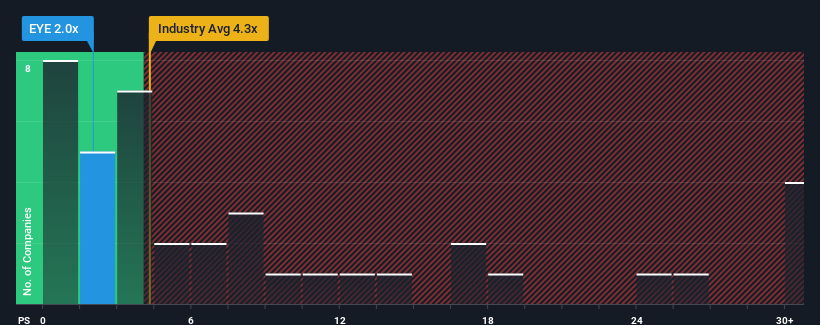

In spite of the firm bounce in price, Nova Eye Medical may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Medical Equipment industry in Australia have P/S ratios greater than 4.3x and even P/S higher than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Nova Eye Medical

What Does Nova Eye Medical's Recent Performance Look Like?

Nova Eye Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Nova Eye Medical's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Nova Eye Medical would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 21% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Nova Eye Medical's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Nova Eye Medical's P/S

Even after such a strong price move, Nova Eye Medical's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Nova Eye Medical's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 4 warning signs for Nova Eye Medical (1 makes us a bit uncomfortable!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nova Eye Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EYE

Nova Eye Medical

Designs, develops, manufactures, markets, and sells surgical devices for the treatment of glaucoma in Australia, the United States, Europe, the Asia Pacific, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives