- Australia

- /

- Healthtech

- /

- ASX:DOC

Doctor Care Anywhere Group PLC (ASX:DOC) Held Back By Insufficient Growth Even After Shares Climb 31%

Doctor Care Anywhere Group PLC (ASX:DOC) shares have continued their recent momentum with a 31% gain in the last month alone. The annual gain comes to 179% following the latest surge, making investors sit up and take notice.

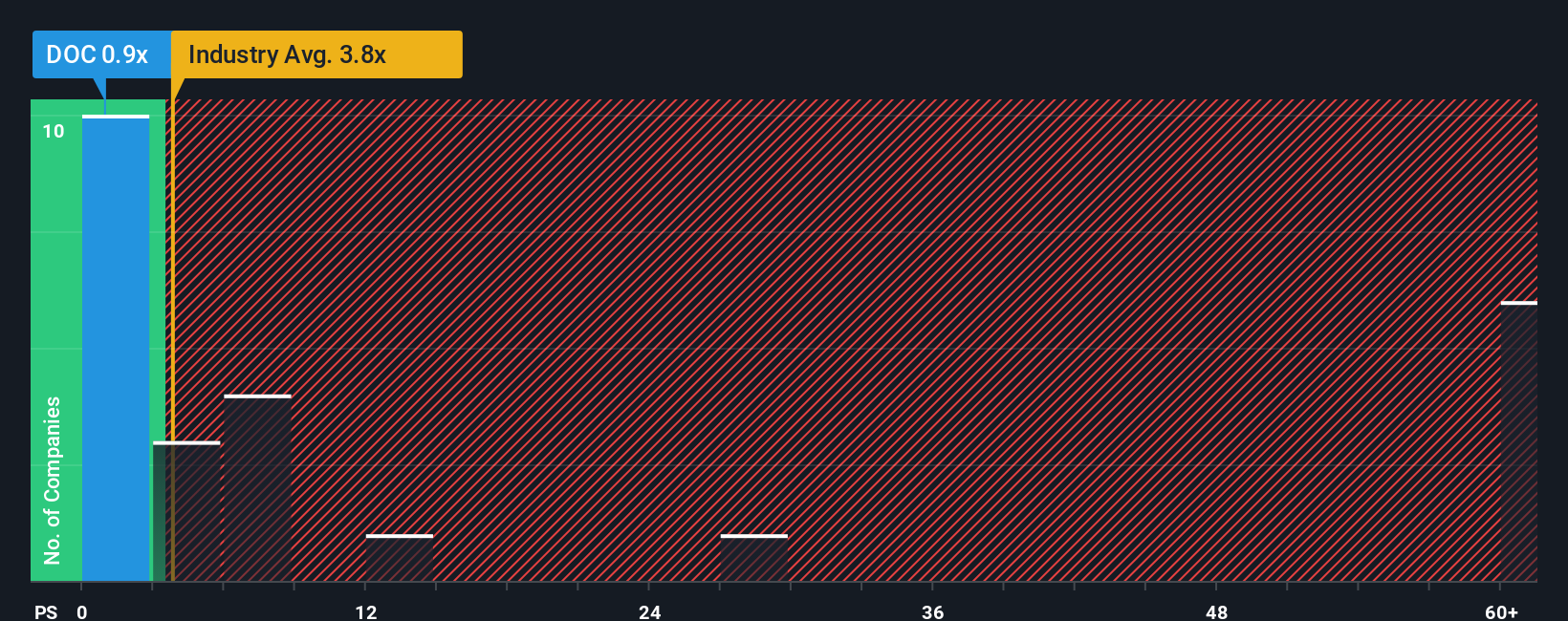

Although its price has surged higher, Doctor Care Anywhere Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Healthcare Services industry in Australia have P/S ratios greater than 7.6x and even P/S higher than 152x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Doctor Care Anywhere Group

What Does Doctor Care Anywhere Group's Recent Performance Look Like?

Doctor Care Anywhere Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Doctor Care Anywhere Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Doctor Care Anywhere Group?

The only time you'd be truly comfortable seeing a P/S as depressed as Doctor Care Anywhere Group's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 14% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 333%, which is noticeably more attractive.

With this information, we can see why Doctor Care Anywhere Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Doctor Care Anywhere Group's P/S?

Even after such a strong price move, Doctor Care Anywhere Group's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Doctor Care Anywhere Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Doctor Care Anywhere Group (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DOC

Doctor Care Anywhere Group

Provides digital healthcare and development services in the United Kingdom and the Republic of Ireland.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026