- Australia

- /

- Medical Equipment

- /

- ASX:CMP

Some Shareholders May Object To A Pay Rise For Compumedics Limited's (ASX:CMP) CEO This Year

The disappointing performance at Compumedics Limited (ASX:CMP) will make some shareholders rather disheartened. At the upcoming AGM on 26 October 2022, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for Compumedics

How Does Total Compensation For David Burton Compare With Other Companies In The Industry?

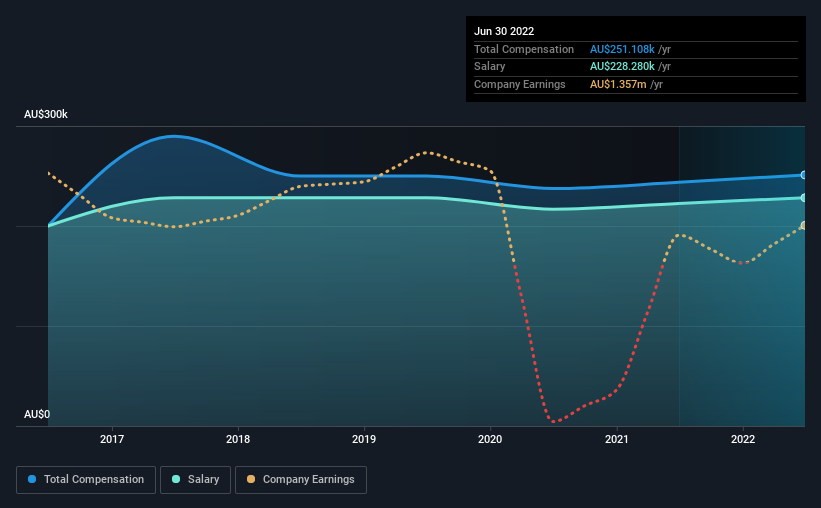

Our data indicates that Compumedics Limited has a market capitalization of AU$43m, and total annual CEO compensation was reported as AU$251k for the year to June 2022. That's just a smallish increase of 3.0% on last year. Notably, the salary which is AU$228.3k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$319m, we found that the median total CEO compensation was AU$534k. This suggests that David Burton is paid below the industry median. Furthermore, David Burton directly owns AU$24m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$228k | AU$223k | 91% |

| Other | AU$23k | AU$21k | 9% |

| Total Compensation | AU$251k | AU$244k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. It's interesting to note that Compumedics pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Compumedics Limited's Growth

Over the last three years, Compumedics Limited has shrunk its earnings per share by 30% per year. It achieved revenue growth of 5.6% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Compumedics Limited Been A Good Investment?

With a total shareholder return of -65% over three years, Compumedics Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is a bit concerning) in Compumedics we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CMP

Compumedics

Engages in the research, development, manufacture, and distribution of medical equipment and related technologies in the Americas, Australia, the Asia Pacific, Europe, and the Middle East.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success