- Australia

- /

- Healthtech

- /

- ASX:CGS

Uncovering 3 Australian Hidden Gems with Strong Potential

Reviewed by Simply Wall St

The Australian stock market is showing resilience, with shares moving toward a modest gain despite global uncertainties and mixed signals from major economies like the U.S. and China. In such an environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often benefit from positive earnings seasons and strategic positioning in key sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cogstate (ASX:CGS)

Simply Wall St Value Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company that focuses on the creation, validation, and commercialization of digital brain health assessments globally, with a market cap of A$470.87 million.

Operations: Cogstate's revenue primarily comes from its Clinical Trials segment, which generated $50.58 million, while the Healthcare segment contributed $2.51 million.

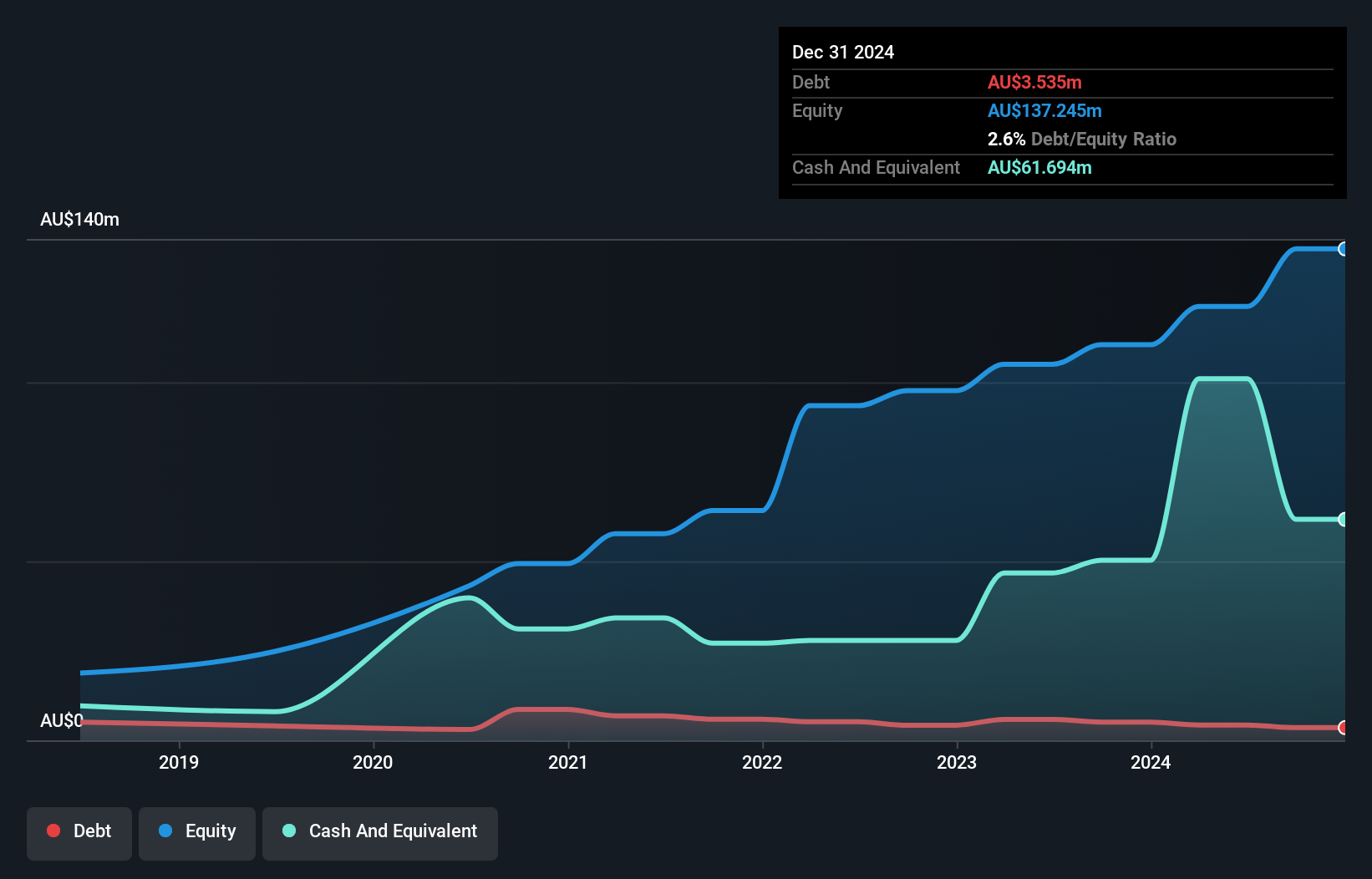

Cogstate, a nimble player in the neuroscience technology space, is making waves with its digital brain health assessments. The company boasts an impressive earnings growth of 86.1% over the past year, outpacing the Healthcare Services industry average of 13.9%. With no debt on its books—down from a debt-to-equity ratio of 16.4% five years ago—Cogstate's financial health is robust. Its price-to-earnings ratio stands at 30.4x, undercutting the industry average of 35.6x, suggesting attractive valuation prospects for investors eyeing growth potential in cognitive assessment markets driven by demographic shifts and AI innovations.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems in Australia with a market capitalization of A$1.26 billion.

Operations: GenusPlus Group generates revenue primarily through its Infrastructure segment, contributing A$405.10 million, followed by Energy & Engineering at A$224.06 million and Services at A$122.11 million. The company's financial performance is significantly influenced by the Infrastructure segment's contribution to its overall revenue model.

GenusPlus Group, a nimble player in Australia's construction sector, is making waves with its strategic focus on renewable energy and infrastructure projects. The company reported A$751 million in sales for the year ending June 2025, up from A$551 million the previous year. Net income also rose to A$35.37 million from A$19.26 million, reflecting robust earnings growth of 83.6% over the past year that outpaces industry averages. While navigating acquisition integration challenges and cost pressures, GenusPlus aims to leverage its diverse project pipeline and recent inclusion in the S&P Global BMI Index to sustain momentum in a competitive market landscape.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

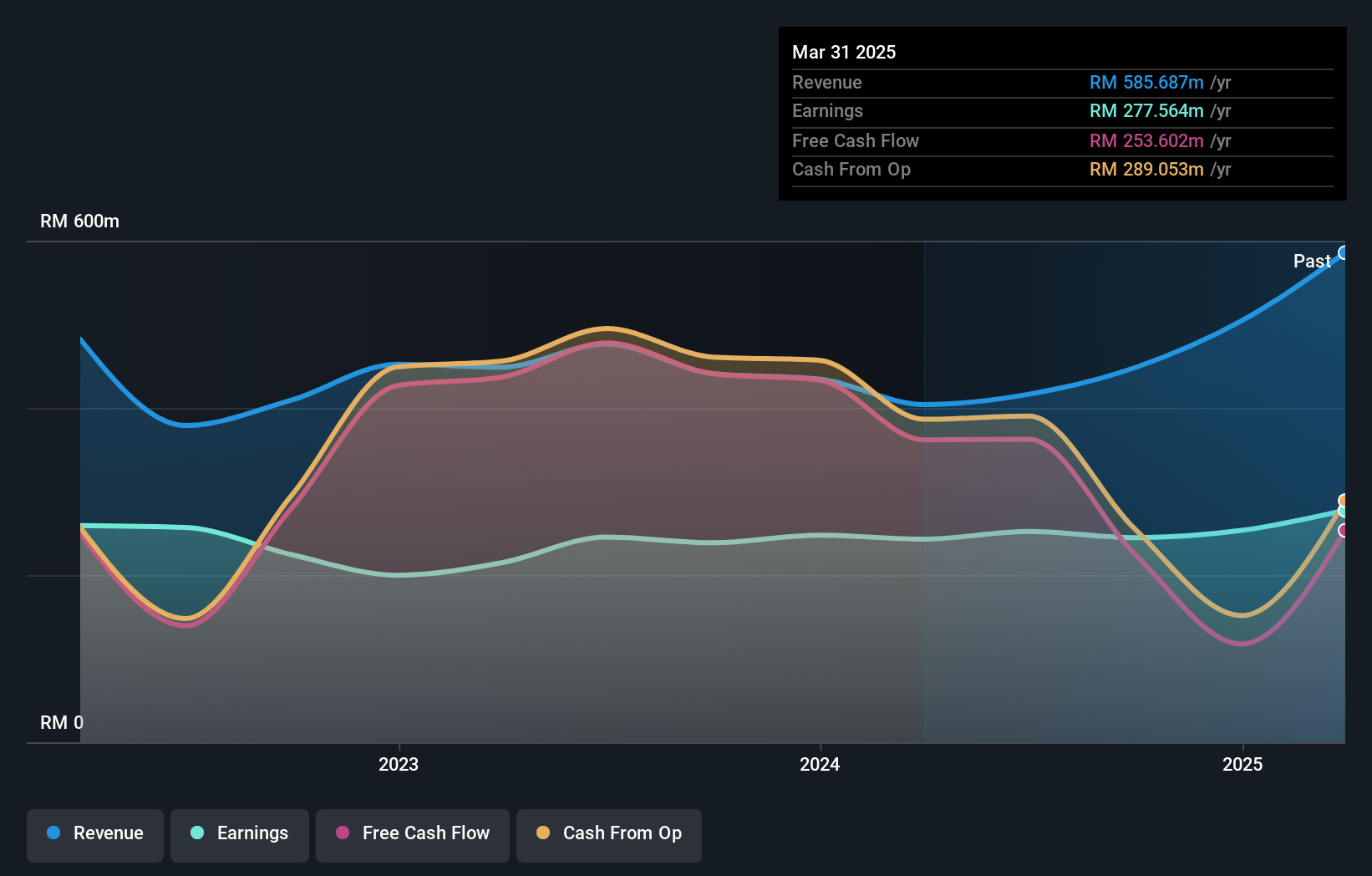

Overview: United Overseas Australia Ltd, with a market cap of A$1.14 billion, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia through its subsidiaries.

Operations: UOS generates revenue primarily from land development and resale, amounting to A$438.18 million, while also earning A$257.51 million from investments. The company's financial structure includes a notable elimination of A$458.50 million.

United Overseas Australia, a relatively small player in the market, presents a compelling case with its strong financial footing. The company boasts a price-to-earnings ratio of 11.1x, notably lower than the Australian market average of 21.7x, indicating potential value for investors. Over the past five years, earnings have grown modestly at 1.7% annually despite an increase in debt-to-equity from 5.5% to 8.8%. In recent news, UOS reported net income of A$44.61 million for the half year ending June 2025 and declared a dividend of A$0.005 per share payable in November this year.

Taking Advantage

- Get an in-depth perspective on all 61 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGS

Cogstate

A neuroscience solutions company, engages in the creation, validation, and commercialization of digital brain health assessments worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives