- Australia

- /

- Healthtech

- /

- ASX:BMT

Investors Don't See Light At End Of Beamtree Holdings Limited's (ASX:BMT) Tunnel And Push Stock Down 28%

Beamtree Holdings Limited (ASX:BMT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

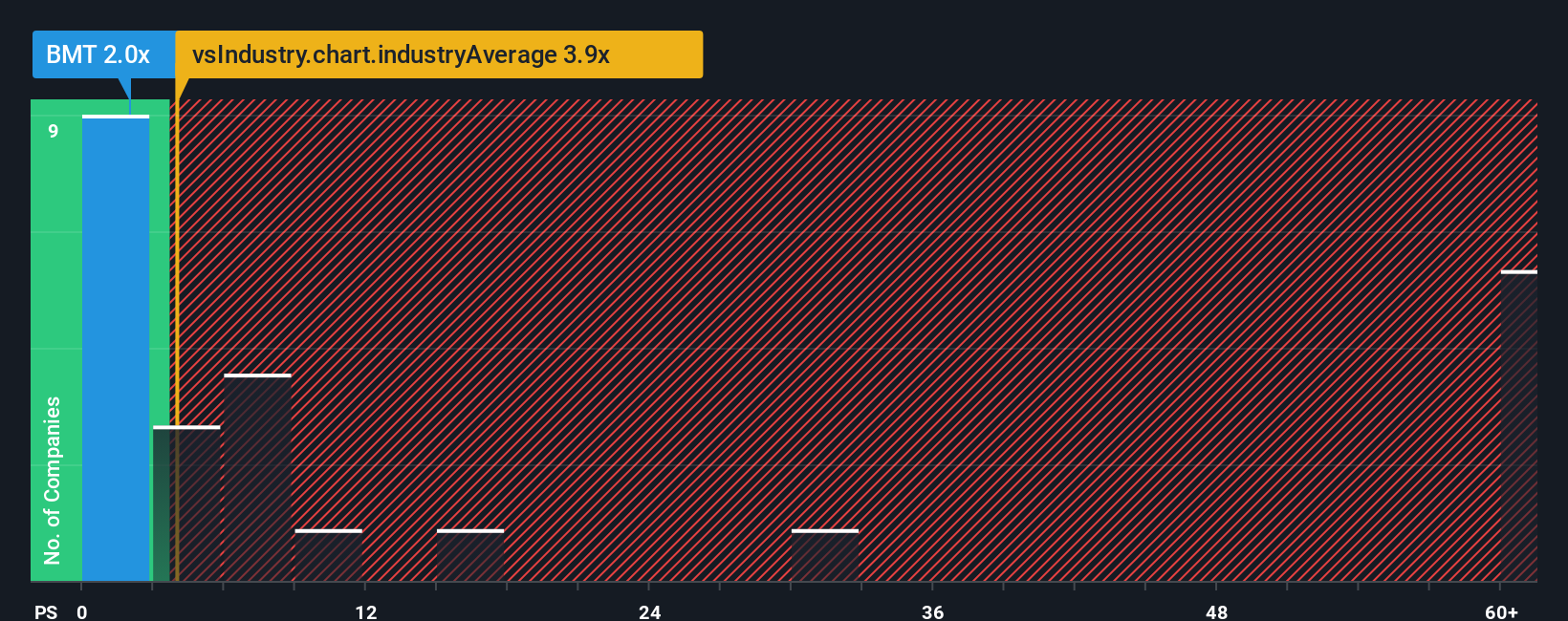

After such a large drop in price, Beamtree Holdings may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Healthcare Services industry in Australia have P/S ratios greater than 7.8x and even P/S higher than 153x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Beamtree Holdings

What Does Beamtree Holdings' Recent Performance Look Like?

Beamtree Holdings could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Beamtree Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Beamtree Holdings' Revenue Growth Trending?

Beamtree Holdings' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.6%. This was backed up an excellent period prior to see revenue up by 73% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% per year over the next three years. With the industry predicted to deliver 212% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Beamtree Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Beamtree Holdings' P/S

Beamtree Holdings' P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Beamtree Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Beamtree Holdings that you should be aware of.

If you're unsure about the strength of Beamtree Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beamtree Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BMT

Beamtree Holdings

Provides artificial intelligence-based decision support software and data insight solutions, and other software services to the healthcare industry in Australia and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives