- Australia

- /

- Medical Equipment

- /

- ASX:AVR

Increases to Anteris Technologies Ltd's (ASX:AVR) CEO Compensation Might Cool off for now

The underwhelming share price performance of Anteris Technologies Ltd (ASX:AVR) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 14 May 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Anteris Technologies

Comparing Anteris Technologies Ltd's CEO Compensation With the industry

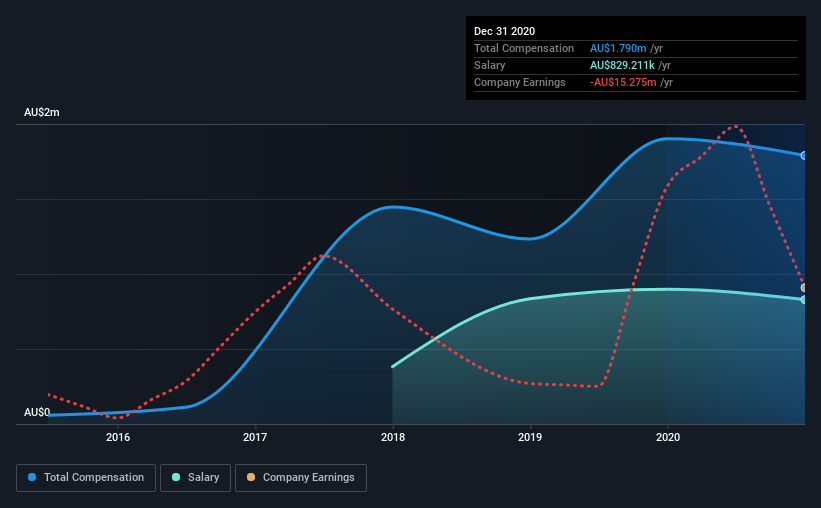

Our data indicates that Anteris Technologies Ltd has a market capitalization of AU$60m, and total annual CEO compensation was reported as AU$1.8m for the year to December 2020. That's a slight decrease of 5.8% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$829k.

For comparison, other companies in the industry with market capitalizations below AU$257m, reported a median total CEO compensation of AU$538k. This suggests that Wayne Paterson is paid more than the median for the industry. Moreover, Wayne Paterson also holds AU$79k worth of Anteris Technologies stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$829k | AU$898k | 46% |

| Other | AU$961k | AU$1.0m | 54% |

| Total Compensation | AU$1.8m | AU$1.9m | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. It's interesting to note that Anteris Technologies allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Anteris Technologies Ltd's Growth Numbers

Anteris Technologies Ltd has seen its earnings per share (EPS) increase by 74% a year over the past three years. Its revenue is down 58% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Anteris Technologies Ltd Been A Good Investment?

Few Anteris Technologies Ltd shareholders would feel satisfied with the return of -71% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Anteris Technologies that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Anteris Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AVR

Anteris Technologies Global

A structural heart company, develops and commercializes minimally invasive medical devices to treat heart valve diseases.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026