- Australia

- /

- Medical Equipment

- /

- ASX:ANN

Ansell (ASX:ANN) Valuation: How New Safety Innovation Initiatives Could Influence the Investment Case

Reviewed by Simply Wall St

Ansell (ASX:ANN) has just opened its first Ansell Xperience & Innovation Studio, known as AXIS, in Alpharetta, Georgia. The move is part of the company’s broader push to advance workplace safety solutions in response to shifting industry standards and emerging risks.

See our latest analysis for Ansell.

The buzz around Ansell’s new AXIS studio comes on the back of a strong run for shareholders. After a solid 20.2% gain in the last 90 days and an 18.9% total shareholder return over the past year, momentum appears to be back in Ansell’s corner. This reflects both recent innovation and shifting investor sentiment.

If market leadership in safety innovation resonates with you, now’s the time to discover See the full list for free.

With shares surging and new initiatives underway, the question now is whether Ansell remains undervalued or if recent growth and innovation are already reflected in the current price. Investors will need to consider whether there is still a buying opportunity or if the market has fully priced in potential future gains.

Most Popular Narrative: 0.9% Undervalued

With Ansell’s last close at A$36.07, the most-followed narrative points to a fair value just over A$36.40, nearly matching the current share price. This narrow gap hints that most analysts believe the stock’s current momentum already reflects anticipated growth and operational improvements.

Ongoing automation, ERP rollout, and productivity investments (APIP), along with the successful KBU integration, are expected to drive further cost reductions, manufacturing efficiency, and operational leverage. This could result in EBIT margin expansion and stronger free cash flow.

Want to know the secret sauce behind this narrative’s almost dollar-for-dollar valuation? The answer involves big upgrades in profitability, aggressive efficiency moves, and some surprising long-term forecasts. Curious which expectations are packed into today’s price? See exactly what’s fueling these bold analyst assumptions.

Result: Fair Value of $36.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from rising raw material costs and the growing competition from lower-cost manufacturers could challenge this positive outlook.

Find out about the key risks to this Ansell narrative.

Another View: Sizing Up via Market Multiples

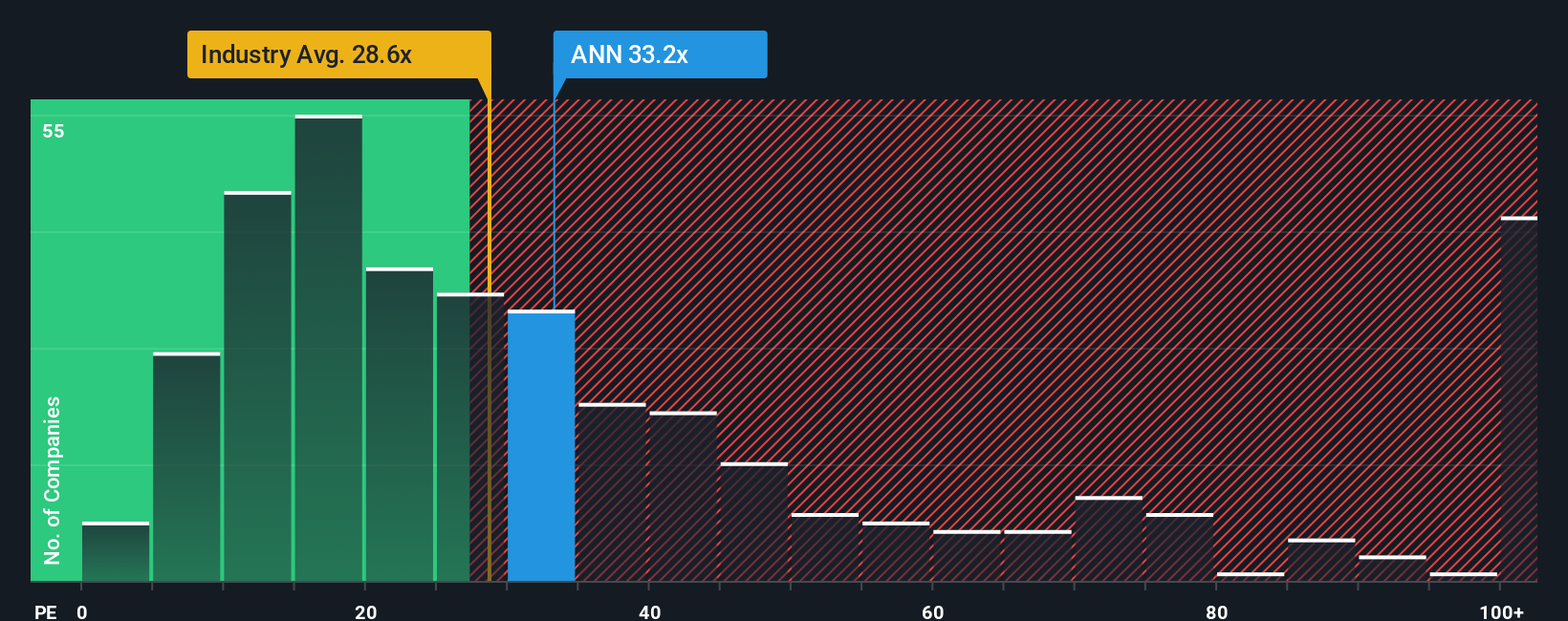

Looking at Ansell through its price-to-earnings ratio adds a twist. The company trades at 33.4 times earnings, which is pricier than the 28.6x global industry average and above the estimated fair ratio of 31.5x. While it appears affordable compared to peers at 42.1x, the stock’s premium to industry benchmarks suggests investors are betting on future growth materializing. With both valuation stories in mind, could one be underappreciating hidden risks or upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ansell Narrative

If you want to deep dive into the numbers or think a different story is unfolding, you have the tools to shape your own in just a few minutes. Do it your way

A great starting point for your Ansell research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when there are so many innovative and value-rich stocks out there. Give your investing strategy a serious boost by checking out these powerful ideas:

- Capture high yields for your portfolio and experience the potential of stable income by reviewing these 21 dividend stocks with yields > 3% with strong fundamentals behind their payouts.

- Capitalise on emerging breakthroughs in medicine and technology as you browse these 34 healthcare AI stocks which are reshaping patient care innovation and diagnostics.

- Jump on market inefficiencies by targeting these 853 undervalued stocks based on cash flows that may be overlooked by others and see where the next bargain may be hidden.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANN

Ansell

Designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions in the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives