- Australia

- /

- Medical Equipment

- /

- ASX:AHC

With EPS Growth And More, Austco Healthcare (ASX:AHC) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Austco Healthcare (ASX:AHC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Austco Healthcare with the means to add long-term value to shareholders.

View our latest analysis for Austco Healthcare

How Fast Is Austco Healthcare Growing Its Earnings Per Share?

Austco Healthcare has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Austco Healthcare's EPS soared from AU$0.0088 to AU$0.014, over the last year. That's a fantastic gain of 62%.

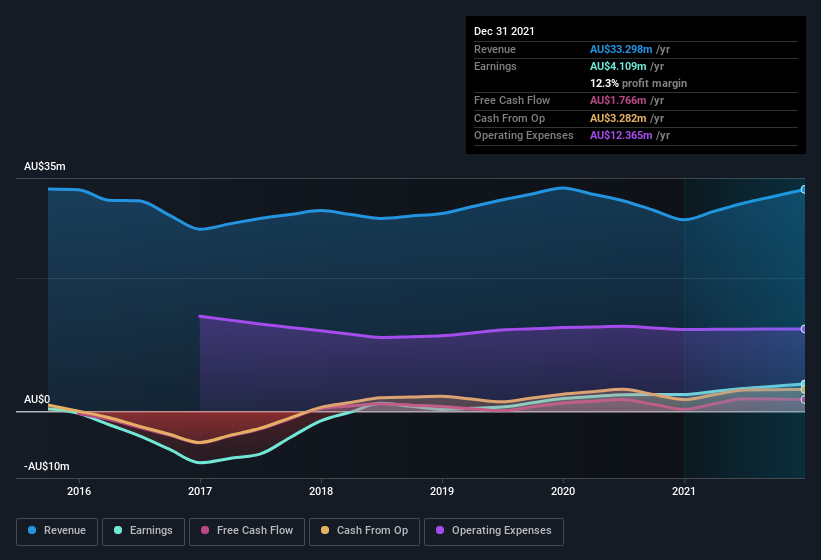

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Austco Healthcare shareholders can take confidence from the fact that EBIT margins are up from 2.3% to 8.5%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Austco Healthcare is no giant, with a market capitalisation of AU$32m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Austco Healthcare Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for Austco Healthcare, is that company insiders spent AU$70k acquiring shares in the last year. While this investment may be modest, it is great considering the lack of insider selling. It is also worth noting that it was Independent Non-Executive Director J. Burns who made the biggest single purchase, worth AU$40k, paying AU$0.15 per share.

On top of the insider buying, we can also see that Austco Healthcare insiders own a large chunk of the company. Actually, with 47% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, Austco Healthcare is a very small company, with a market cap of only AU$32m. That means insiders only have AU$15m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Does Austco Healthcare Deserve A Spot On Your Watchlist?

For growth investors, Austco Healthcare's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. What about risks? Every company has them, and we've spotted 2 warning signs for Austco Healthcare you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Austco Healthcare, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AHC

Austco Healthcare

Engages in the business of development, manufacture, service, supply, and distribution of healthcare communications equipment and software in Australia, New Zealand, Asia, Europe, and North America.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives