Not Many Are Piling Into Wellnex Life Limited (ASX:WNX) Stock Yet As It Plummets 31%

To the annoyance of some shareholders, Wellnex Life Limited (ASX:WNX) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

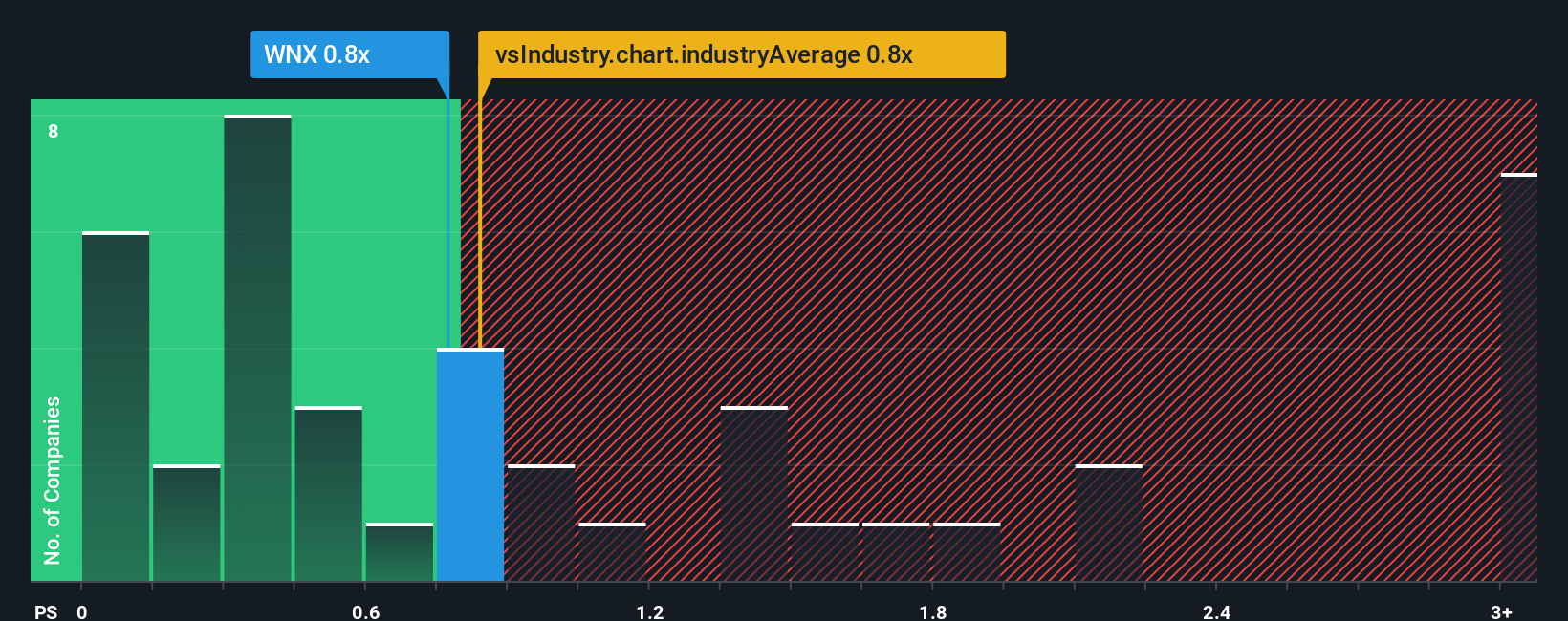

Although its price has dipped substantially, there still wouldn't be many who think Wellnex Life's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in Australia's Food industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Wellnex Life

What Does Wellnex Life's Recent Performance Look Like?

Wellnex Life could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wellnex Life.How Is Wellnex Life's Revenue Growth Trending?

Wellnex Life's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Pleasingly, revenue has also lifted 157% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 34% per year during the coming three years according to the lone analyst following the company. That's shaping up to be materially higher than the 9.2% each year growth forecast for the broader industry.

With this information, we find it interesting that Wellnex Life is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Wellnex Life looks to be in line with the rest of the Food industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Wellnex Life's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Wellnex Life (2 are significant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wellnex Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WNX

Wellnex Life

Develops, markets, and sells health and wellness products in Australia, New Zealand, and the United Kingdom.

High growth potential with slight risk.

Market Insights

Community Narratives