- Australia

- /

- Specialty Stores

- /

- ASX:AX1

ASX Dividend Stocks Featuring Accent Group And Two More

Reviewed by Simply Wall St

The Australian market showed signs of recovery on Monday, with the ASX200 gaining 0.60% as positive sentiment from a US Senate deal to end the government shutdown bolstered investor confidence. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst ongoing global uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.93% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.99% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.62% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.12% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.76% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.13% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.69% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.25% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 5.76% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$730.44 million.

Operations: Accent Group Limited generates revenue through its retail segment, which accounts for A$1.30 billion, and its wholesale segment, contributing A$459.71 million.

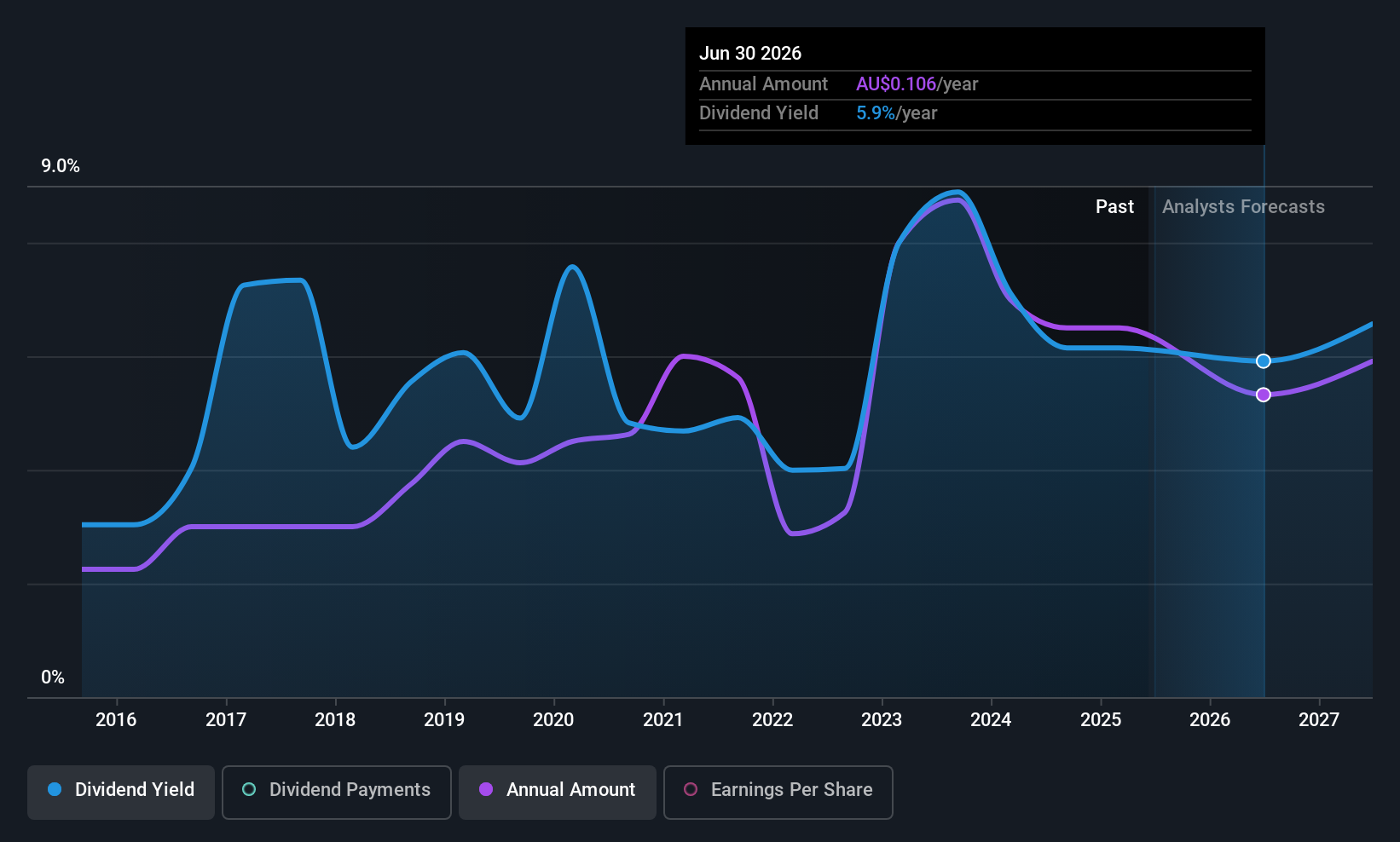

Dividend Yield: 5.8%

Accent Group has experienced a volatile dividend history, with recent payments decreasing to A$0.015 per share. Despite this, its dividends are well-covered by both earnings and cash flows, with payout ratios at 69.2% and 20.6%, respectively. The company's dividend yield is competitive within the Australian market's top quartile of payers. Recent strategic alliances and executive appointments aim to bolster operational efficiency and growth potential, potentially supporting future dividend stability despite past inconsistencies.

- Click here to discover the nuances of Accent Group with our detailed analytical dividend report.

- The analysis detailed in our Accent Group valuation report hints at an deflated share price compared to its estimated value.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$353.63 million.

Operations: Kina Securities Limited generates revenue through its Banking & Finance segment, which includes corporate services, amounting to PGK 441.25 million, and its Wealth Management segment, contributing PGK 50.19 million.

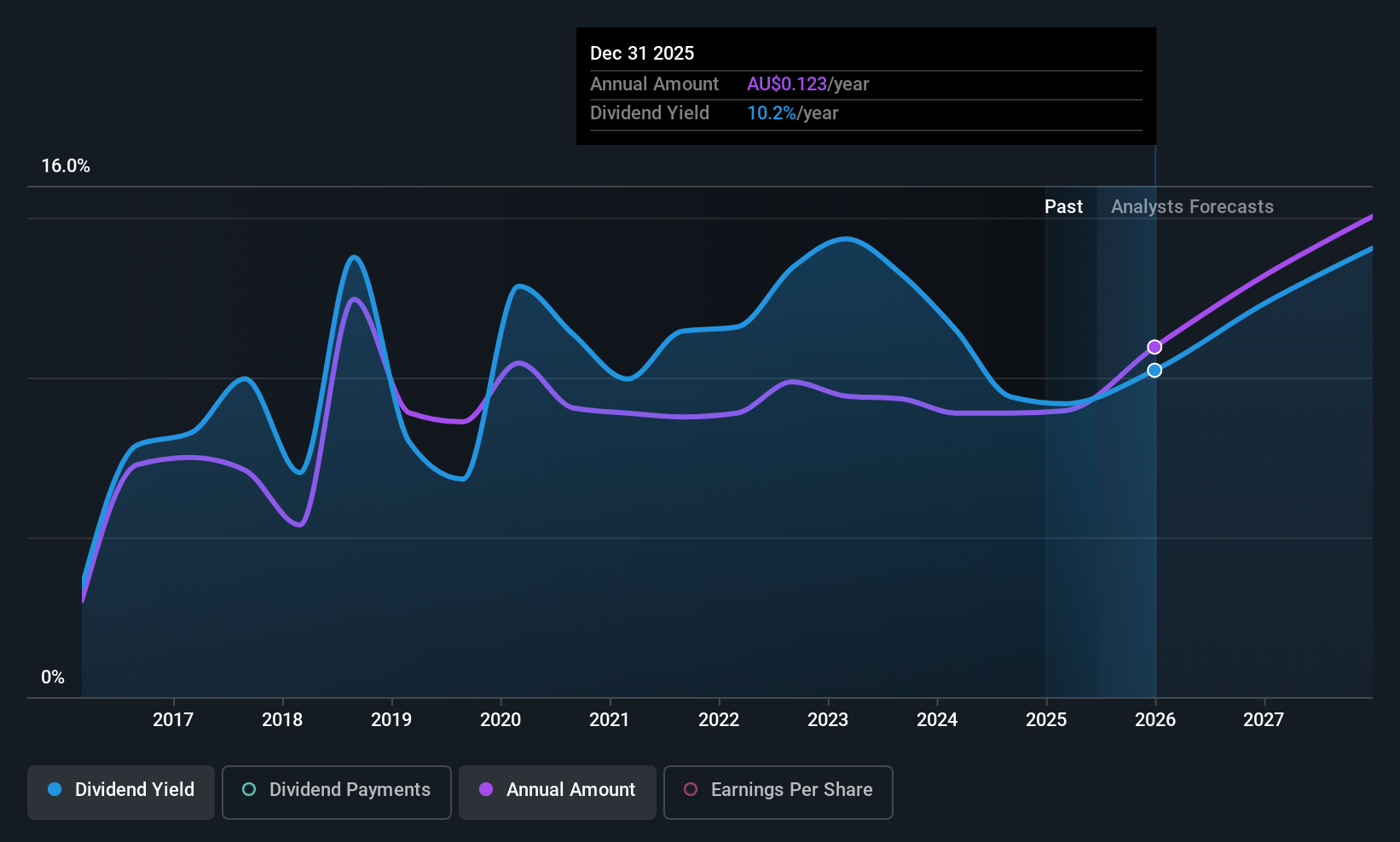

Dividend Yield: 7.7%

Kina Securities has a dividend yield in the top quartile of Australian payers, with recent increases to A$0.045 per share. Despite past volatility, dividends are currently covered by earnings with a 69.9% payout ratio and forecasted to remain sustainable. Earnings have grown significantly, supporting potential future stability. However, the company faces challenges with high bad loan levels and low allowances for them, which could impact financial health and dividend reliability moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of Kina Securities.

- According our valuation report, there's an indication that Kina Securities' share price might be on the cheaper side.

Treasury Wine Estates (ASX:TWE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Treasury Wine Estates Limited is a wine company that operates in Australia, the United States, the United Kingdom, and internationally with a market cap of approximately A$4.65 billion.

Operations: Treasury Wine Estates Limited generates revenue primarily through its Penfolds segment at A$1.10 billion, Treasury Americas at A$1.19 billion, and Treasury Premium Brands at A$697.50 million.

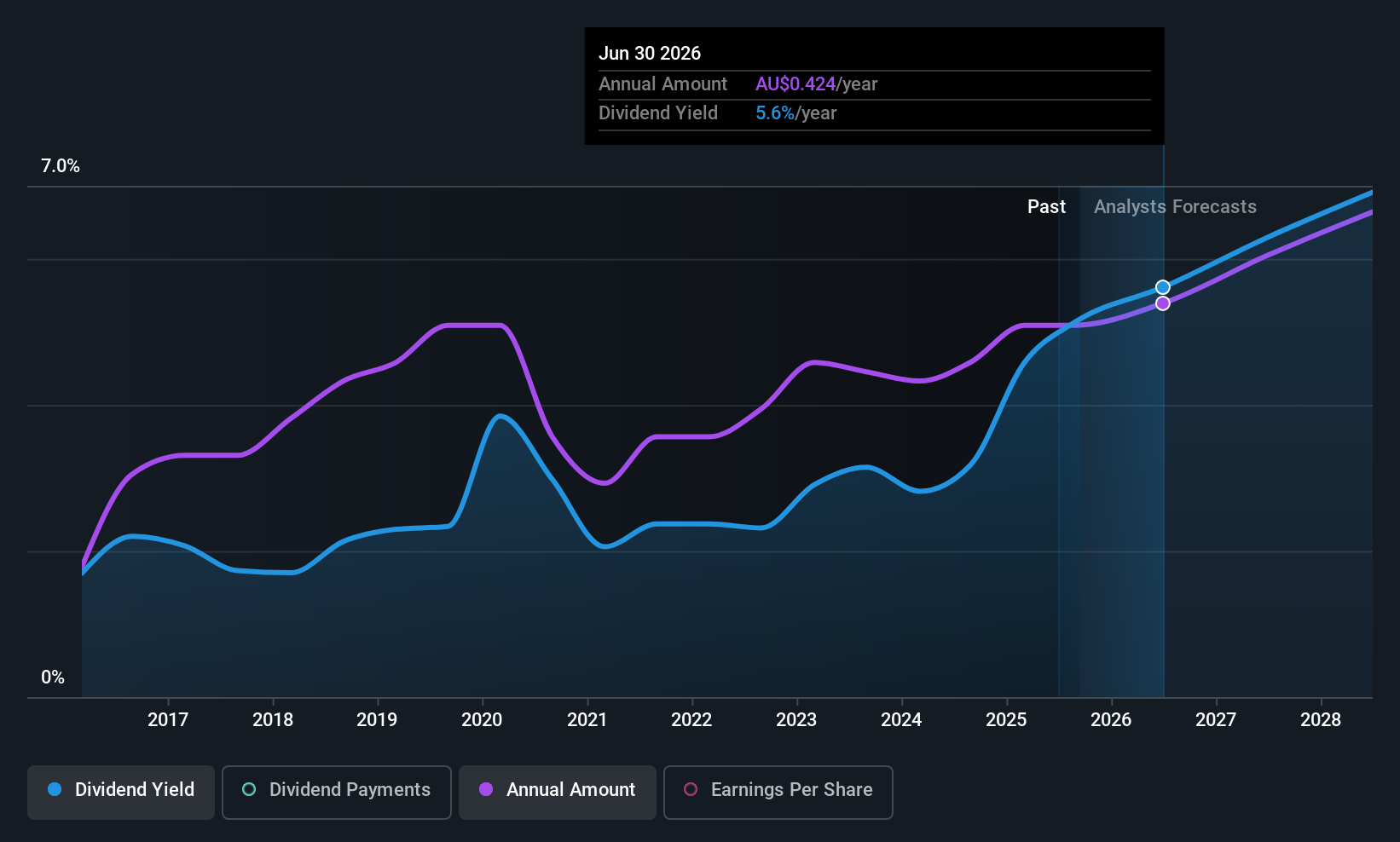

Dividend Yield: 6.9%

Treasury Wine Estates offers a dividend yield in the top 25% of Australian payers, though its dividends have been volatile over the past decade. Recent increases to A$0.20 per share reflect growth, supported by a payout ratio of 74.3%, indicating coverage by earnings and cash flows. The company has announced a share repurchase program worth A$200 million for capital management, despite being dropped from major indices recently, which might affect investor sentiment regarding stability.

- Take a closer look at Treasury Wine Estates' potential here in our dividend report.

- Our valuation report unveils the possibility Treasury Wine Estates' shares may be trading at a discount.

Taking Advantage

- Click this link to deep-dive into the 29 companies within our Top ASX Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives