Murray Cod Australia's (ASX:MCA) Returns On Capital Are Heading Higher

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Murray Cod Australia (ASX:MCA) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Murray Cod Australia:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.04 = AU$1.5m ÷ (AU$39m - AU$1.9m) (Based on the trailing twelve months to December 2020).

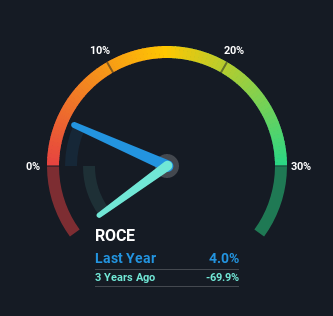

So, Murray Cod Australia has an ROCE of 4.0%. In absolute terms, that's a low return and it also under-performs the Food industry average of 5.8%.

View our latest analysis for Murray Cod Australia

Above you can see how the current ROCE for Murray Cod Australia compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Murray Cod Australia here for free.

What Does the ROCE Trend For Murray Cod Australia Tell Us?

Murray Cod Australia has recently broken into profitability so their prior investments seem to be paying off. Shareholders would no doubt be pleased with this because the business was loss-making four years ago but is is now generating 4.0% on its capital. Not only that, but the company is utilizing 660% more capital than before, but that's to be expected from a company trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

One more thing to note, Murray Cod Australia has decreased current liabilities to 4.8% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. So this improvement in ROCE has come from the business' underlying economics, which is great to see.

The Bottom Line On Murray Cod Australia's ROCE

To the delight of most shareholders, Murray Cod Australia has now broken into profitability. And with the stock having performed exceptionally well over the last three years, these patterns are being accounted for by investors. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

If you want to know some of the risks facing Murray Cod Australia we've found 3 warning signs (1 is concerning!) that you should be aware of before investing here.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Murray Cod Australia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MCA

Murray Cod Australia

Murray Cod Australia Limited, together with its subsidiaries, breeds, grows, and markets freshwater and table fish in Australia.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success