How Investors May Respond To Inghams Group (ASX:ING) Cutting Dividend After Lower FY25 Volumes and Revenue

Reviewed by Sasha Jovanovic

- In the past week, Inghams Group reported lower poultry volumes, revenue, and profit for FY25, leading to a dividend reduction and prompting the company to implement cost-cutting and operational adjustments.

- An important insight is that Inghams is prioritizing efficiency measures such as reducing inventory and adjusting production as potential foundations for future financial recovery.

- We'll examine how the company's inventory and production adjustments could reshape its overall investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Inghams Group Investment Narrative Recap

To own shares in Inghams Group, you need to believe in a recovery story: a business with core exposure to everyday protein demand that is currently tackling operational challenges and market headwinds. The latest result, showing falling poultry volumes, revenues and profit, hits the most important near-term catalyst: restoring earnings momentum through efficiency. Right now, the central risk for shareholders is ongoing margin pressure from tougher competition and contract renegotiations; and this risk has not eased based on the most recent update.

Of all the recent announcements, the reduced dividend declared alongside FY25 results is most relevant now. This signals a real response to margin and revenue stress: the company is bolstering its capital position to push through a period of weaker earnings, while operational changes aim to stabilize future performance and potentially set the stage for a rebound in profitability.

But despite these changes, investors should be keenly aware that the company’s dependence on large retail contracts means further volume losses or unfavourable supply agreements could...

Read the full narrative on Inghams Group (it's free!)

Inghams Group's outlook projects A$3.2 billion in revenue and A$110.6 million in earnings by 2028. This reflects a 0.0% annual revenue growth rate and a A$20.8 million earnings increase from the current earnings of A$89.8 million.

Uncover how Inghams Group's forecasts yield a A$2.99 fair value, a 25% upside to its current price.

Exploring Other Perspectives

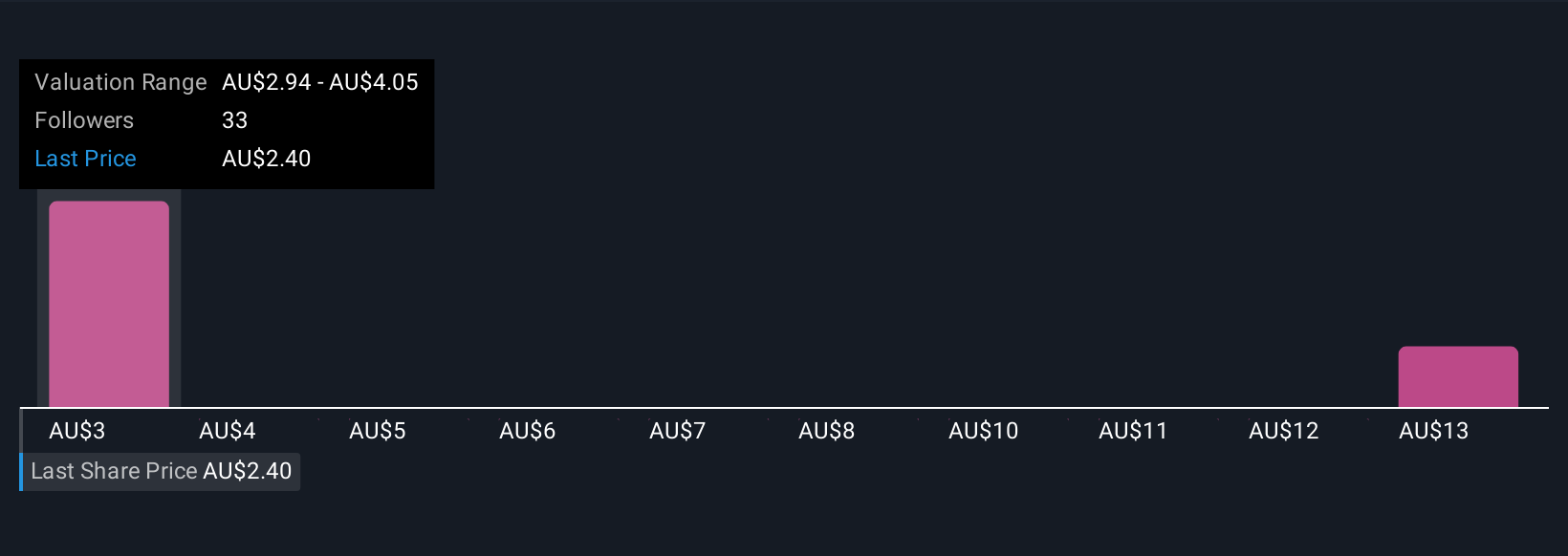

Seven Simply Wall St Community estimates for Inghams’ fair value range from A$2.94 to A$14.14 per share. With tough industry pricing and cost-of-living pressures putting net margins at risk, the full story stretches across a wide spectrum of investor views, have a look and compare your own outlook.

Explore 7 other fair value estimates on Inghams Group - why the stock might be worth over 5x more than the current price!

Build Your Own Inghams Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inghams Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inghams Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inghams Group's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ING

Inghams Group

Engages in the production and sale of chicken and turkey products under the Ingham’s brand primarily in Australia and New Zealand.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives