Stock Analysis

- Australia

- /

- Construction

- /

- ASX:NWH

Exploring Undervalued Small Caps With Insider Actions In Australia July 2024

Reviewed by Simply Wall St

Over the past year, the Australian market has shown resilience with an 8.6% increase, despite a recent dip of 1.2% over the last week. In this context, stocks that exhibit strong insider buying can be particularly compelling as they may signal unrecognized value and potential for growth in line with the forecasted annual earnings increase of 13%.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.2x | 2.6x | 49.18% | ★★★★★★ |

| Neuren Pharmaceuticals | 17.0x | 11.5x | 47.18% | ★★★★★☆ |

| Healius | NA | 0.6x | 42.04% | ★★★★★☆ |

| Elders | 23.6x | 0.5x | 41.72% | ★★★★☆☆ |

| Eagers Automotive | 9.7x | 0.3x | 33.56% | ★★★★☆☆ |

| Codan | 29.6x | 4.3x | 25.85% | ★★★★☆☆ |

| RAM Essential Services Property Fund | NA | 5.9x | 36.97% | ★★★★☆☆ |

| Dicker Data | 22.2x | 0.8x | -0.40% | ★★★☆☆☆ |

| Gold Road Resources | 16.5x | 4.0x | 46.96% | ★★★☆☆☆ |

| Coventry Group | 300.9x | 0.5x | -12.84% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

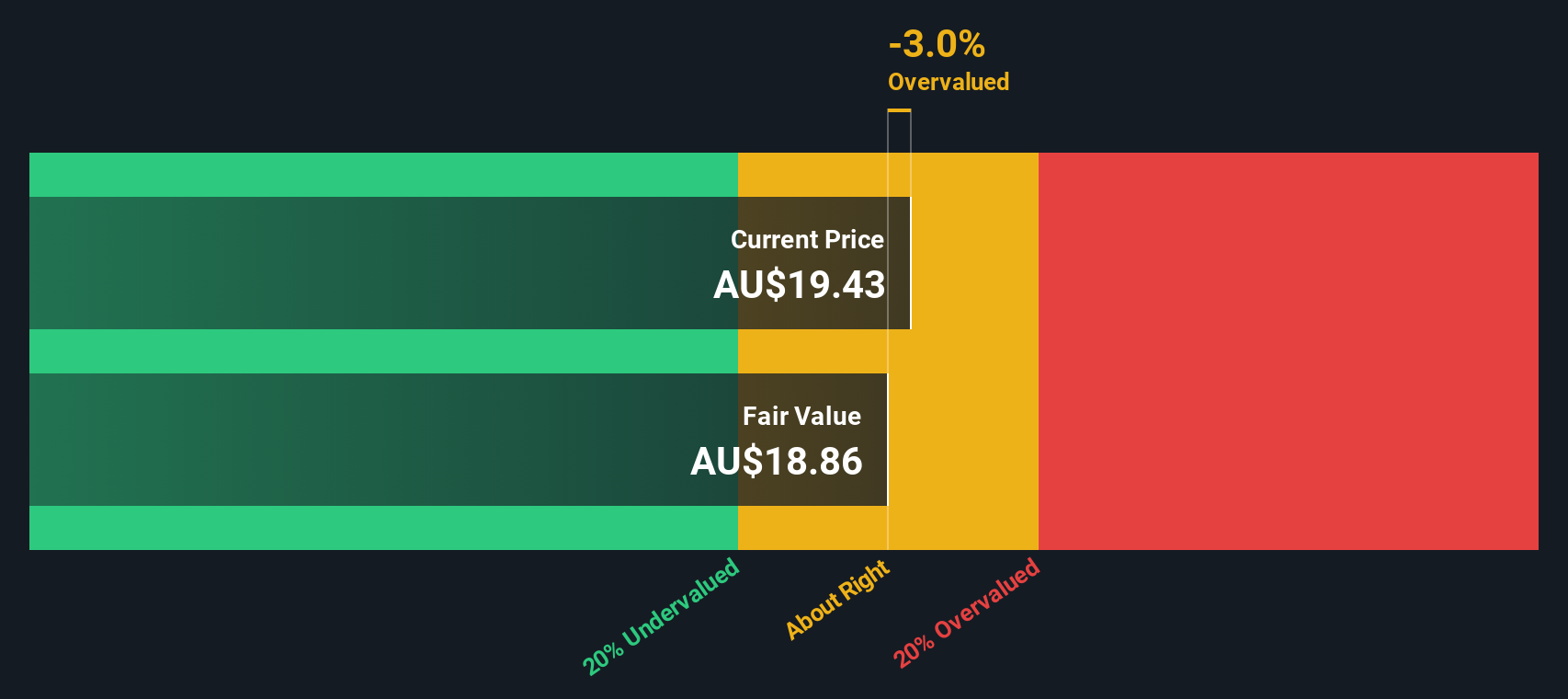

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a technology company specializing in communications, metal detection, and other electronic technologies, with a market capitalization of approximately A$1.02 billion.

Operations: The company generates revenue primarily from communications and metal detection segments, contributing A$291.50 million and A$212.20 million respectively. Over the years, gross profit margin has shown a trend of fluctuation, with a notable figure of 54.42% in the latest recorded period.

PE: 29.6x

Recently, Codan has seen insider confidence with purchases signaling a bullish sentiment on its overlooked market potential. With earnings projected to grow by 16.2% annually, its financial trajectory appears promising despite relying solely on external borrowing—a riskier funding method. This strategic positioning within the Australian market underscores its potential as an undervalued entity ripe for growth-oriented investors seeking diversified exposure in lesser-known yet financially sound companies.

- Click here and access our complete valuation analysis report to understand the dynamics of Codan.

Assess Codan's past performance with our detailed historical performance reports.

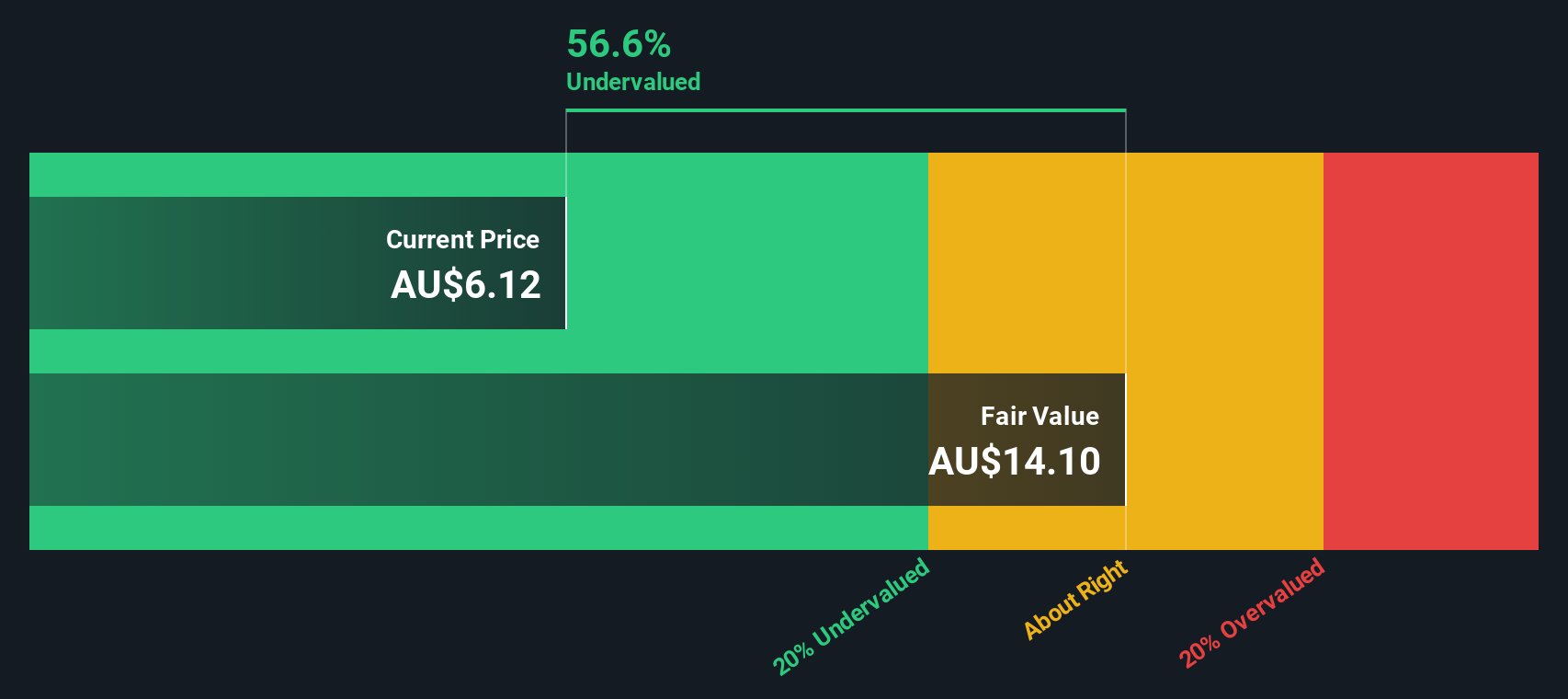

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an Australian agribusiness company with operations spanning branch network services, wholesale products, feed and processing services, and corporate activities, boasting a market capitalization of approximately A$1.42 billion.

Operations: Branch Network, Wholesale Products, and Feed and Processing Services collectively form the primary revenue streams, generating A$3.00 billion annually. Gross profit margin has shown fluctuations over recent periods, with a notable figure of 19.41% as of the latest reporting date in 2024-07-23.

PE: 23.6x

Elders Limited, navigating through a challenging fiscal landscape with a projected earnings growth of 22.8% annually, recently fortified its leadership by appointing Glenn Davis to the board—a move signaling strategic reinforcement. Despite experiencing a dip in profit margins from 3.4% to 2.1%, the company maintains robust revenue projections between A$120 million and A$140 million for FY2024. Insider confidence is reflected in recent share purchases, underscoring belief in the company’s resilience and future prospects amidst its high debt levels.

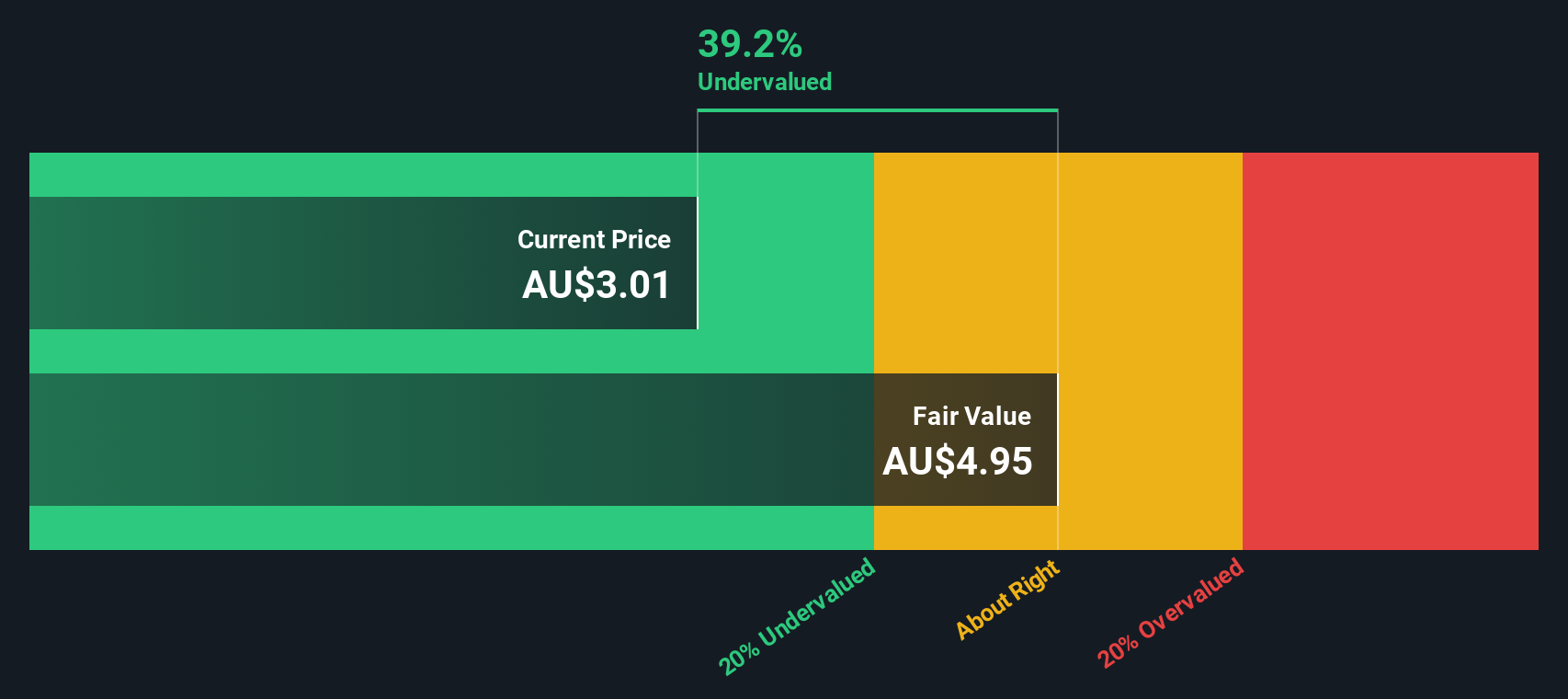

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NRW Holdings is a diversified provider of mining and civil construction services with a market capitalization of approximately A$1.08 billion.

Operations: The company generates its highest revenue from the Mining segment at A$1.49 billion, followed by MET and Civil segments, contributing A$739.07 million and A$593.62 million respectively. Its gross profit margin has shown a notable increase over recent periods, reaching 47.41% by the end of the latest fiscal year reported.

PE: 17.0x

Amidst a backdrop of strategic corporate activities, NRW Holdings recently bolstered its financial position through a follow-on equity offering, raising A$5.26 million at A$2.56 per share. This move, coupled with the company's reaffirmation of its A$2.9 billion revenue forecast for 2024, underscores its stable financial outlook and potential for growth. Notably, insider confidence is evident as they have recently purchased shares, signaling trust in the company’s future prospects despite relying solely on external borrowing—a higher risk funding strategy. This blend of insider activity and fiscal prudence paints NRW Holdings as an intriguing entity within Australia's landscape of undervalued entities poised for appreciation.

- Click to explore a detailed breakdown of our findings in NRW Holdings' valuation report.

Examine NRW Holdings' past performance report to understand how it has performed in the past.

Taking Advantage

- Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 19 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether NRW Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NWH

NRW Holdings

Through its subsidiaries, provides diversified contract services to the resources and infrastructure sectors in Australia.

Flawless balance sheet average dividend payer.