Elders (ASX:ELD) Is Up 8.8% After Earnings Beat and Delta Agribusiness Acquisition—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 16, 2025, Elders Limited reported full-year financial results, with sales rising to A$3.20 billion and net income increasing to A$50.29 million compared to the previous year, reflecting strong performance across key business units amidst varying seasonal conditions.

- A standout aspect of the announcement was the completion of the Delta Agribusiness acquisition, which management expects will broaden Elders’ geographic reach and generate significant synergies for the business.

- We’ll explore how Elders’ solid earnings growth and Delta Agribusiness acquisition may influence its medium-term investment case.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Elders Investment Narrative Recap

For investors to remain confident in Elders Limited, it’s important to believe that the company’s transformation projects and geographic diversification, especially following the Delta Agribusiness acquisition, can drive sustained earnings growth while navigating ongoing agricultural and competitive pressures. The latest earnings report supports this story, with higher sales and net income, but recent news does not materially change the company’s major short term catalyst (integration of the Delta acquisition) or alter the biggest current risk: margin pressure from competition and challenging seasonal conditions.

Of the recent developments, the completion of the Delta Agribusiness acquisition stands out for its potential to unlock revenue growth and scale, directly addressing one of Elders’ key catalysts: broadening its market presence and technical capabilities as it pushes for operational efficiency gains.

On the other hand, investors should be mindful that continued margin pressure driven by intense regional competition remains a risk that could ...

Read the full narrative on Elders (it's free!)

Elders' outlook anticipates A$4.5 billion in revenue and A$156.2 million in earnings by 2028. This projection reflects an 11.7% annual revenue growth and an increase in earnings of about A$89 million from the current A$67.1 million level.

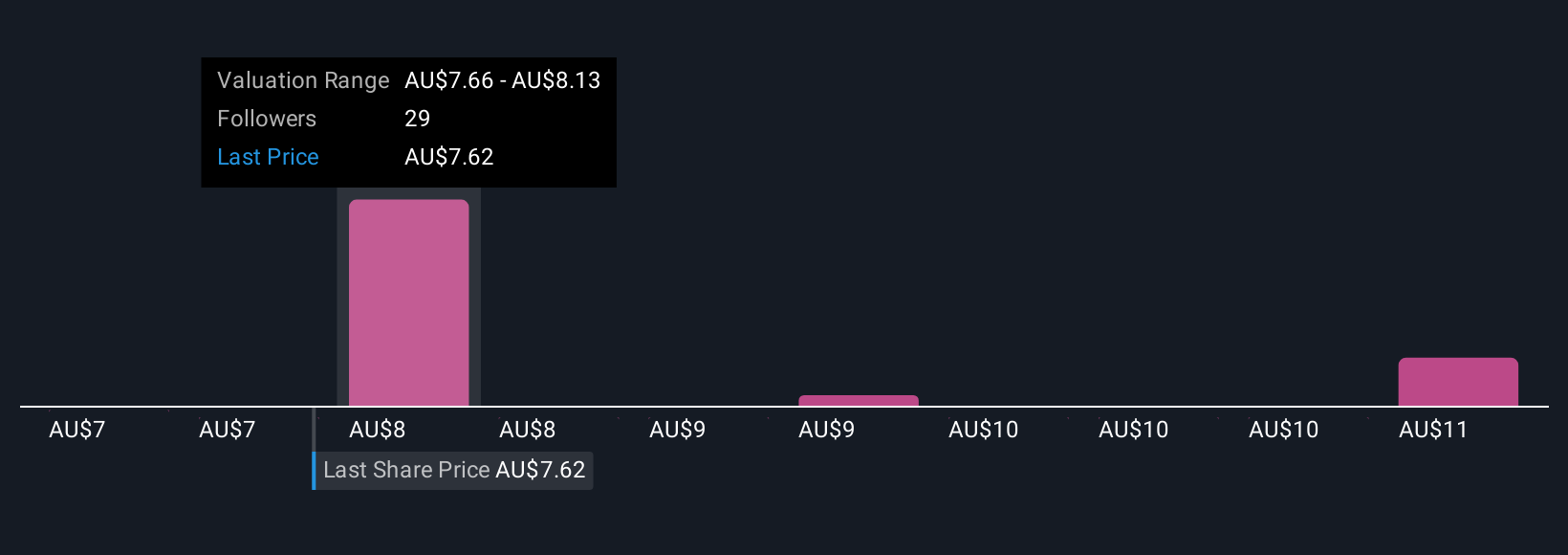

Uncover how Elders' forecasts yield a A$8.07 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Six community-sourced fair value estimates for Elders Limited range from A$6.72 to A$11.65 per share, showing broad divergence in opinion among Simply Wall St Community members. While integration of the Delta Agribusiness acquisition is seen as a medium-term growth driver, margin pressure from local competition may impact outcomes more widely than some expect.

Explore 6 other fair value estimates on Elders - why the stock might be worth as much as 57% more than the current price!

Build Your Own Elders Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elders research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elders research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elders' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Engages in the provision of agricultural products and services to rural and regional customers primarily in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives