Eagers Automotive Leads Three Undervalued Small Caps With Insider Actions In Australia

Reviewed by Simply Wall St

Amidst a buoyant Australian market, which has seen a 3.1% rise in the past week and a 10% increase over the last year with earnings projected to grow by 13% annually, investors are keenly watching for opportunities. In this environment, stocks like Eagers Automotive stand out as potentially undervalued small caps, particularly when insider actions suggest confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.5x | 2.7x | 47.40% | ★★★★★★ |

| Healius | NA | 0.6x | 42.05% | ★★★★★☆ |

| Eagers Automotive | 9.6x | 0.3x | 33.79% | ★★★★☆☆ |

| Elders | 22.8x | 0.5x | 43.68% | ★★★★☆☆ |

| Codan | 28.8x | 4.2x | 27.64% | ★★★★☆☆ |

| Strike Energy | 301.9x | 73.9x | 47.97% | ★★★★☆☆ |

| Orora | 18.3x | 0.6x | 45.65% | ★★★★☆☆ |

| RAM Essential Services Property Fund | NA | 5.9x | 38.03% | ★★★★☆☆ |

| Dicker Data | 23.0x | 0.8x | -3.86% | ★★★☆☆☆ |

| Coventry Group | 301.4x | 0.5x | -12.55% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

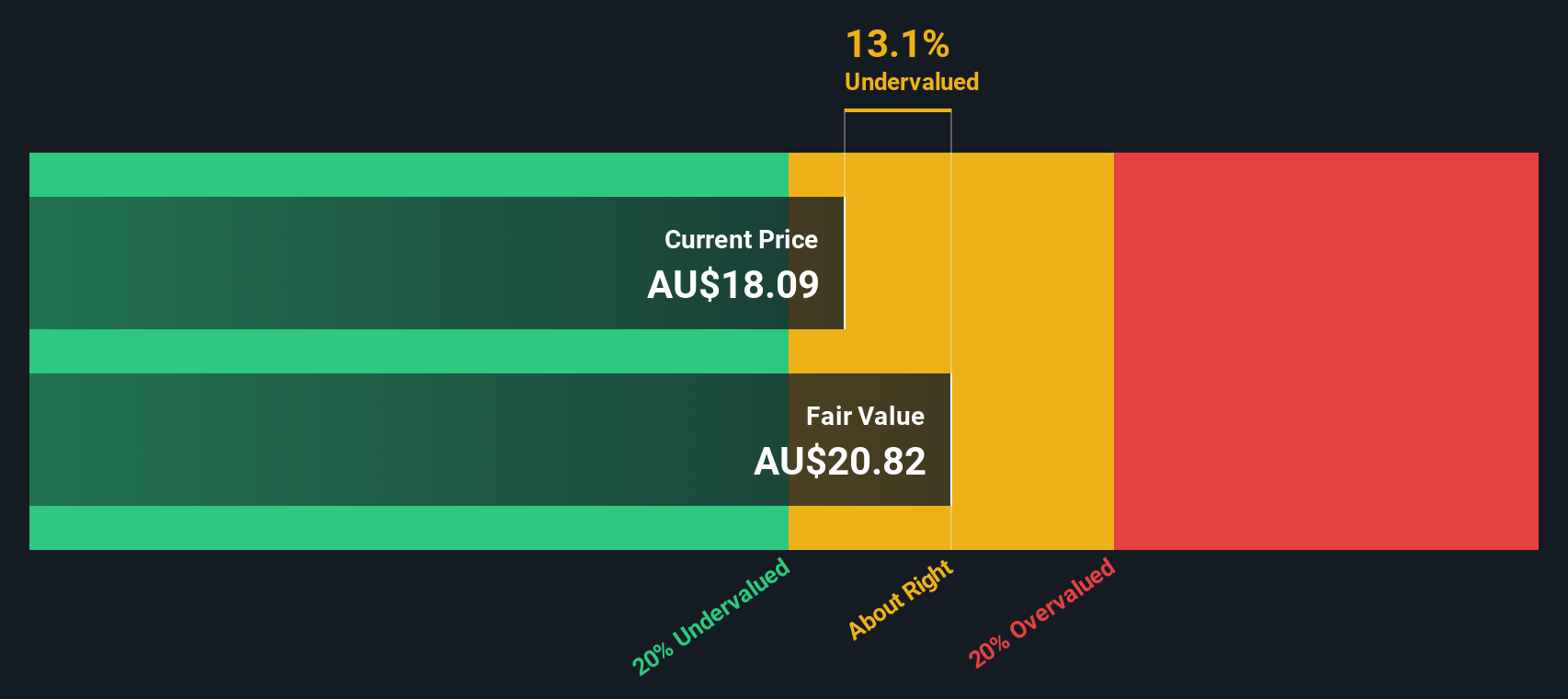

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates primarily in car retailing, with a minor segment in property, maintaining a market capitalization of approximately A$3.41 billion.

Operations: Car Retailing is the primary revenue generator for this entity, contributing A$9.85 billion to its total income. The company's gross profit margin has shown a trend around 0.18% over recent periods, indicating the proportion of revenue exceeding direct costs associated with car retailing before accounting for other operational expenses.

PE: 9.6x

Eagers Automotive, amidst a landscape of fluctuating market valuations, stands out with its strategic maneuvers and financial agility. Recently, the company announced a share repurchase program set to reclaim up to 10% of its issued capital by June 2025—a move reflecting strong insider confidence and commitment to shareholder value. Despite facing a high debt level, Eagers is poised for revenue growth at an annual rate of 5.53%, complemented by aggressive pursuits in mergers and acquisitions as outlined in their recent shareholder communications. This approach not only underscores their proactive stance in market expansion but also aligns with their Next100 Strategy aiming for sustained growth.

- Click to explore a detailed breakdown of our findings in Eagers Automotive's valuation report.

Explore historical data to track Eagers Automotive's performance over time in our Past section.

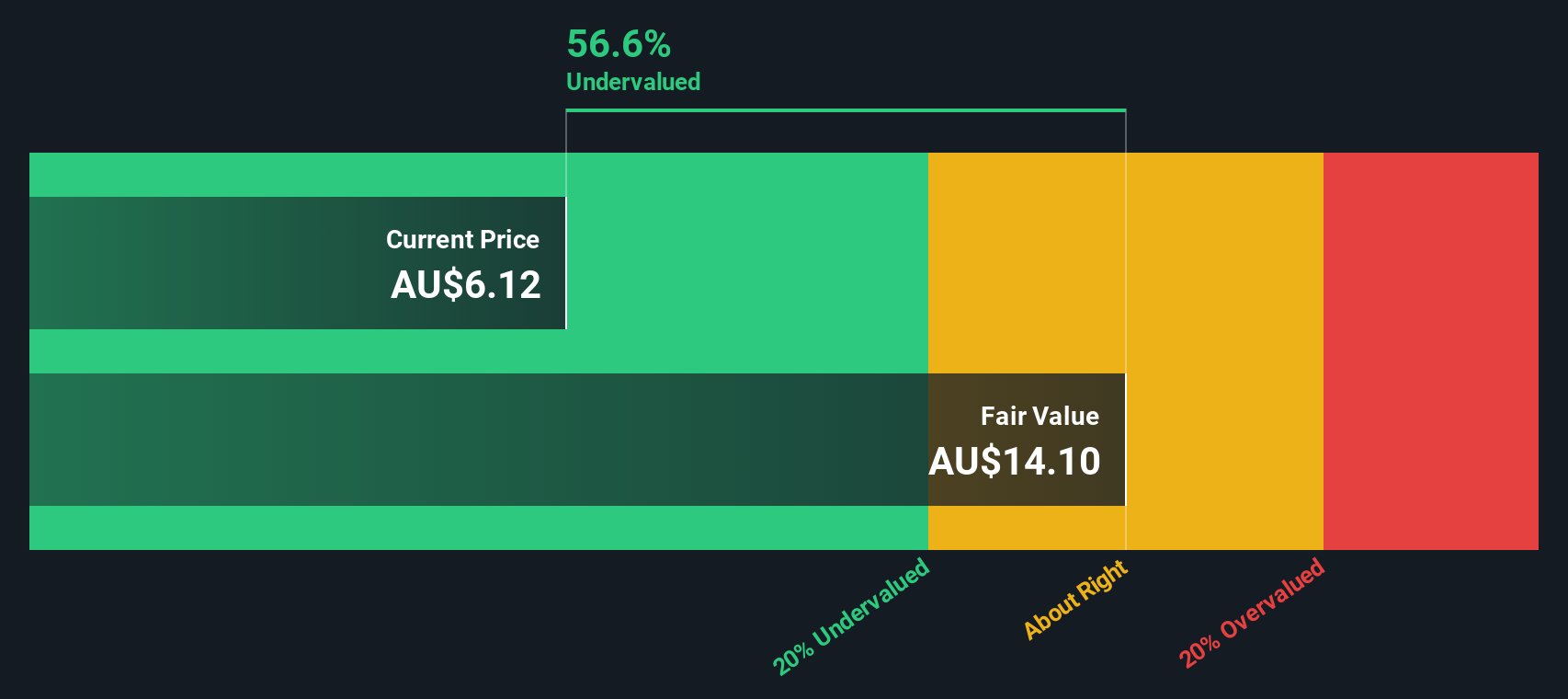

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is a diversified agribusiness company, operating in branch network services, wholesale products, feed and processing services, with a market capitalization of approximately A$1.67 billion.

Operations: The business generates significant revenue from its Branch Network, contributing A$2.54 billion, supported by Wholesale Products and Feed and Processing Services which add A$341.19 million and A$120.14 million respectively. The gross profit margin observed a trend fluctuation, peaking at 0.217% in late 2018 before settling around 0.194% by mid-2024, reflecting variations in cost of goods sold and operational efficiency over the period.

PE: 22.8x

Elders Limited, a firm with a focus on agriculture, has shown resilience despite recent financial turbulence. With sales dropping to A$1.34 billion in the first half of 2024 from A$1.66 billion the previous year and net income falling significantly, they still project an underlying EBIT of A$120 million to A$140 million for the fiscal year. This forecast, coupled with insider confidence reflected in recent share purchases by executives, suggests a belief in future recovery and growth potential amidst challenging conditions.

- Get an in-depth perspective on Elders' performance by reading our valuation report here.

Assess Elders' past performance with our detailed historical performance reports.

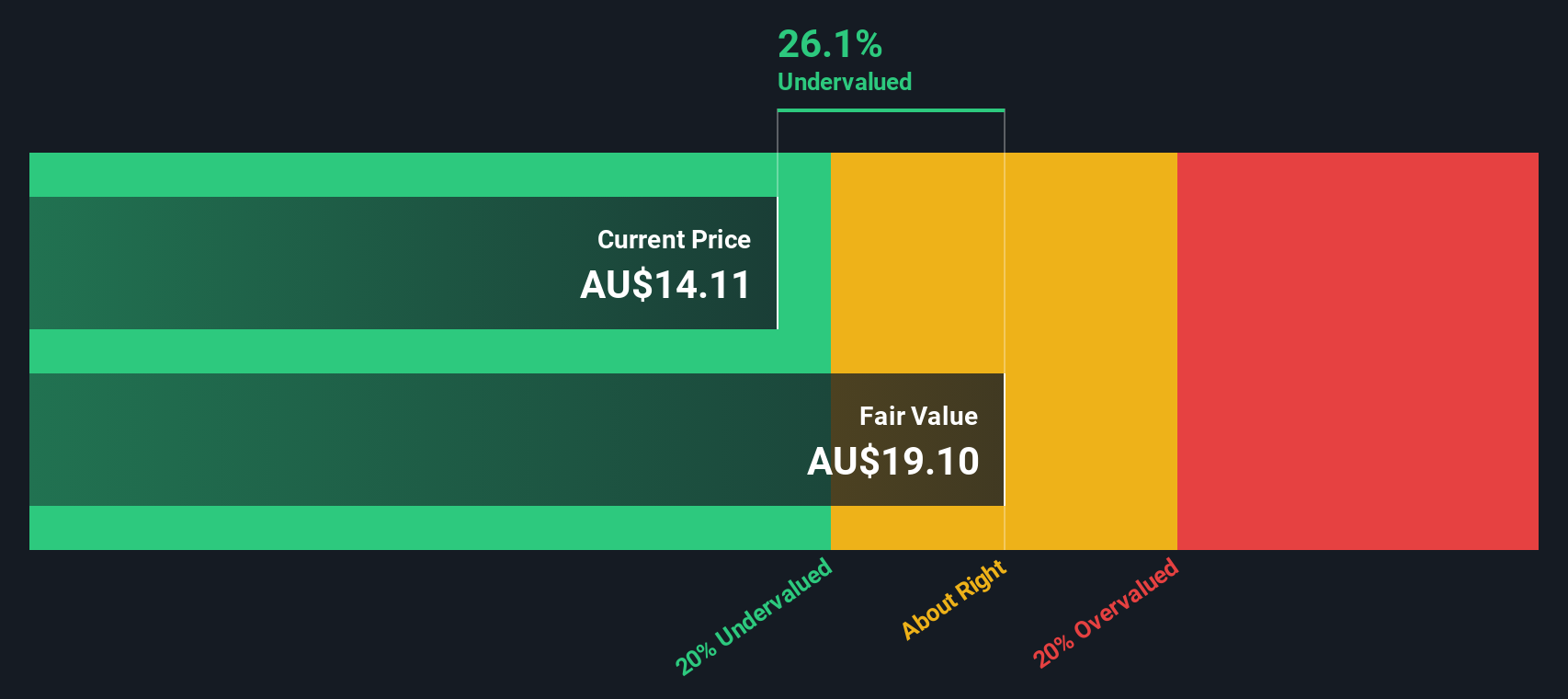

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit margin of 88.47%, after accounting for costs of goods sold at A$26.75 million and operating expenses totaling A$5.95 million.

PE: 17.1x

Recently, Neuren Pharmaceuticals showcased promising results from a Phase 2 trial of NNZ-2591 for Pitt Hopkins syndrome, with significant improvements noted across all targeted efficacy measures. This development could position them favorably in a market devoid of approved treatments. At their Annual General Meeting on May 28, 2024, the re-election of director Patrick Davies was confirmed, reflecting stable leadership. Insider confidence is evident as they have recently purchased shares, signaling belief in the company's trajectory despite its modest market capitalization and reliance on higher-risk funding sources like external borrowing.

- Delve into the full analysis valuation report here for a deeper understanding of Neuren Pharmaceuticals.

Understand Neuren Pharmaceuticals' track record by examining our Past report.

Seize The Opportunity

- Unlock more gems! Our Undervalued ASX Small Caps With Insider Buying screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Undervalued ASX Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neuren Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NEU

Neuren Pharmaceuticals

A biopharmaceutical company, develops drugs for the treatment of neurological disorders.

Flawless balance sheet and undervalued.