- Australia

- /

- Oil and Gas

- /

- ASX:WDS

Is Woodside Energy Group’s Valuation Still Attractive After Its Share Price Jumped 16%?

Reviewed by Bailey Pemberton

- Ever wondered if Woodside Energy Group is fairly valued, or if there is an opportunity hiding in plain sight? Whether you are a long-time holder or just keeping tabs, knowing the company's true value can make a big difference to your investment choices.

- The share price has delivered a healthy 16.9% return in the past year and surged 15.6% in the last month, which suggests that investor sentiment and risk perception may be shifting.

- These moves come as global energy markets have remained in the spotlight. Oil and gas companies like Woodside are drawing attention as a result of shifting supply dynamics and a renewed focus on energy security. Policy changes and sector-wide updates have amplified market reactions and provide important context to Woodside's recent momentum.

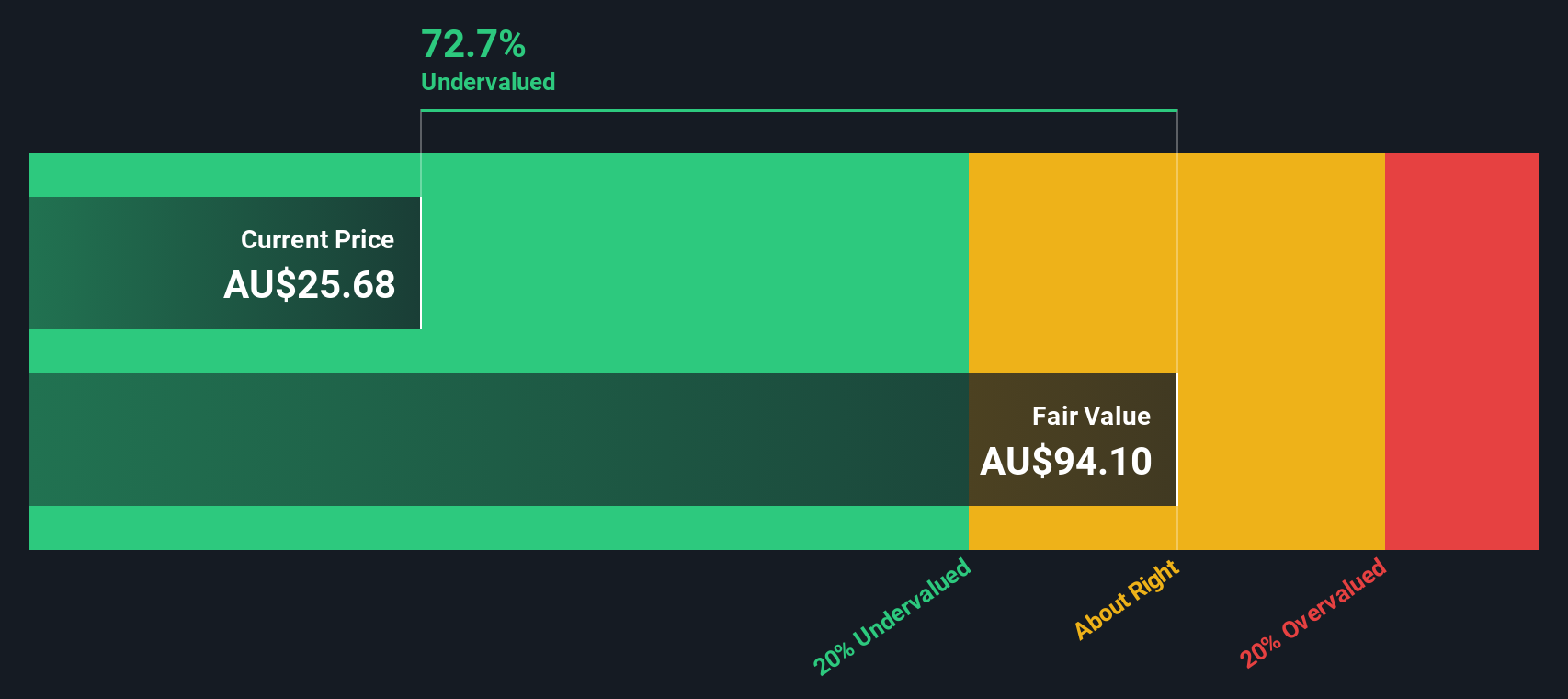

- According to our checks, Woodside scores 5 out of 6 for being undervalued. There is plenty to examine when it comes to valuation. We will break down how we assess value next and share an alternative way to look at valuation at the end.

Approach 1: Woodside Energy Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors understand what a future stream of cash is worth right now, based on assumptions about growth and risk.

For Woodside Energy Group, the latest reported Free Cash Flow is $1.17 Billion. Analysts forecast that Free Cash Flow will grow, with projections reaching $1.83 Billion by 2027. In the longer term, Simply Wall St extends these estimates and suggests that by 2035, Woodside's annual Free Cash Flow could reach around $3.17 Billion. These projections reflect both near-term analyst outlooks and more cautious extrapolations further out.

Based on these cash flow forecasts, the DCF model calculates an intrinsic value of $54.37 per share for Woodside Energy Group. Compared to the current share price, this figure implies the stock is trading at a 51.7% discount, indicating it is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Woodside Energy Group is undervalued by 51.7%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Woodside Energy Group Price vs Earnings

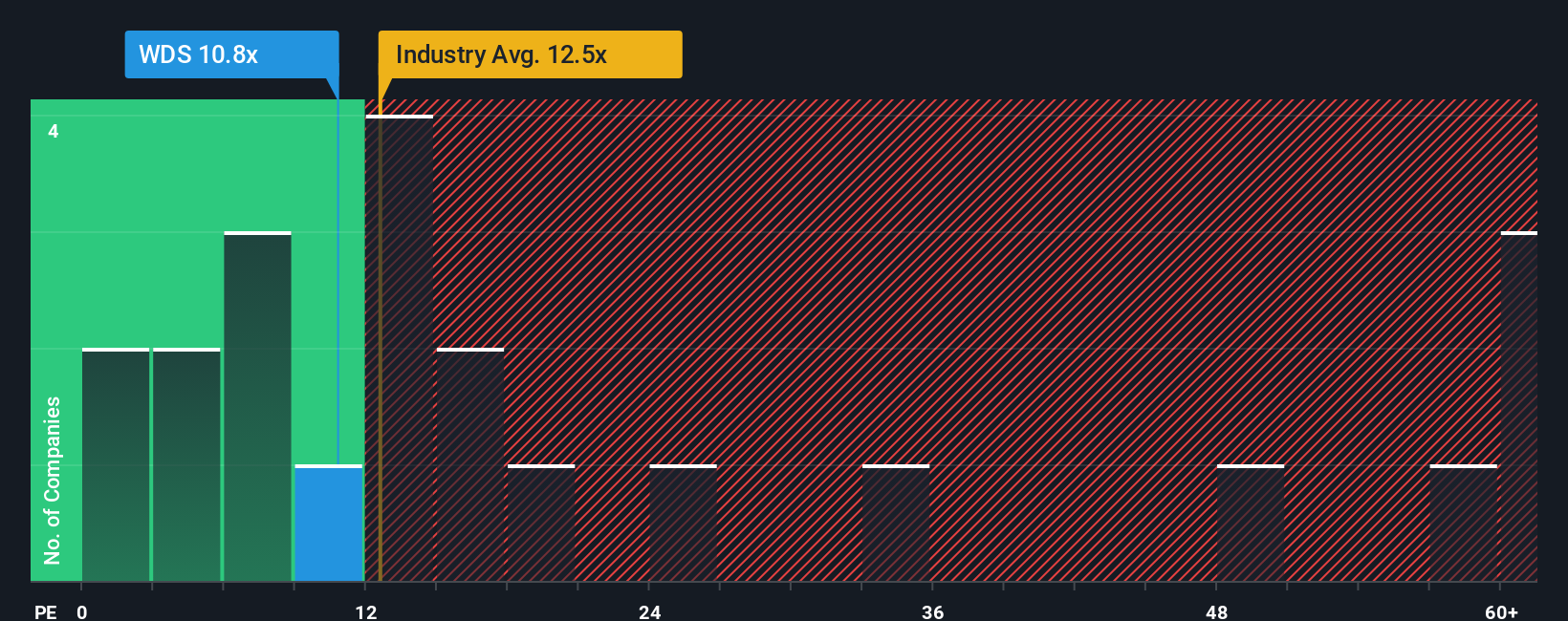

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies, as it measures what investors are willing to pay today for each dollar of current earnings. When a business is consistently profitable, comparing its share price to its earnings can give a clear signal of how the market is valuing its underlying operational success.

A "normal" or "fair" PE ratio is not set in stone. Growth prospects and risk levels play an important role. Faster-growing and less risky companies usually justify higher PE ratios, while lower-growth or riskier businesses tend to have lower ones. For Woodside Energy Group, the current PE ratio stands at 11.05x. This is below both the Oil and Gas industry average of 13.59x and the peer average of 22.52x, indicating the market may be pricing in more risk or less growth.

Simply Wall St uses a proprietary “Fair Ratio” to factor in a company’s growth rate, profit margins, market cap, industry dynamics and risks. Unlike simple peer or industry averages, the Fair Ratio provides a more holistic benchmark that is tailored to Woodside’s unique profile. For Woodside, the Fair Ratio is 12.70x. With its actual PE of 11.05x, the stock appears to be undervalued based on this more precise measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Woodside Energy Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative brings your perspective to life by connecting a company's story—your view on its future, how it makes money, and the challenges it faces—with concrete forecasts for growth, profit, and margins. Narratives link the company’s business context to a financial forecast, leading directly to a fair value. This helps you see instantly whether the price appears attractive based on your own thinking.

On Simply Wall St’s platform, Narratives are easy to create and compare on the Community page, where millions of investors share their scenarios. These Narratives update automatically as new news or results are released, closing the gap between the latest events and your decisions. This allows you to quickly sense-check whether it’s time to buy, sell, or hold by comparing your Fair Value to today’s price.

For example, some investors expect Woodside Energy Group to benefit from renewed LNG deals and long-term energy demand, leading them to project a bullish fair value as high as A$42.16 per share. Others, more cautious about decarbonization and margin pressures, see A$22.76 as reasonable. This reminds us that investing is all about weighing the story you believe against the numbers you expect.

Do you think there's more to the story for Woodside Energy Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodside Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WDS

Woodside Energy Group

Engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives