- Australia

- /

- Oil and Gas

- /

- ASX:STO

Does Santos' CFO Transition Reveal a New Approach to Financial Strategy at ASX:STO?

Reviewed by Sasha Jovanovic

- Santos recently announced that Ms. Sherry Duhe has resigned as Chief Financial Officer, with Mr. Lachlan Harris appointed as Acting CFO to facilitate a handover; Mr. Harris brings over two years of experience as Treasurer and Deputy CFO and has been with Santos since 2010.

- Leadership changes at the CFO level often attract heightened investor attention given their influence over financial strategy, risk management, and execution of corporate objectives.

- With a new Acting CFO in place, we'll examine how this development could impact Santos' operational stability and longer-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Santos Investment Narrative Recap

For shareholders, the core story with Santos centers on its ability to deliver operational growth and reliable cash flows through major LNG projects while balancing substantial capital commitments and regulatory requirements. The CFO transition is unlikely to materially shift the biggest near-term catalyst, the ongoing ramp-up at Barossa LNG, or alter the main risk, which remains project execution and cost control for these large-scale developments.

The recent cancellation of a proposed A$28.8 billion acquisition by the XRG Consortium stands out in light of the CFO change, as it places added importance on internal financial stewardship and execution of Santos’ independent strategy. With significant capital already committed, investor attention remains focused on Santos’ ability to govern spending and deliver margins as further production comes online.

However, it’s important to note that with the current leadership changes, increased scrutiny on project execution and capital management should be front of mind for investors as...

Read the full narrative on Santos (it's free!)

Santos' outlook projects $6.9 billion in revenue and $1.6 billion in earnings by 2028. This is based on a 9.6% annual revenue growth rate and a $0.6 billion increase in earnings from the current $1.0 billion.

Uncover how Santos' forecasts yield a A$7.88 fair value, a 25% upside to its current price.

Exploring Other Perspectives

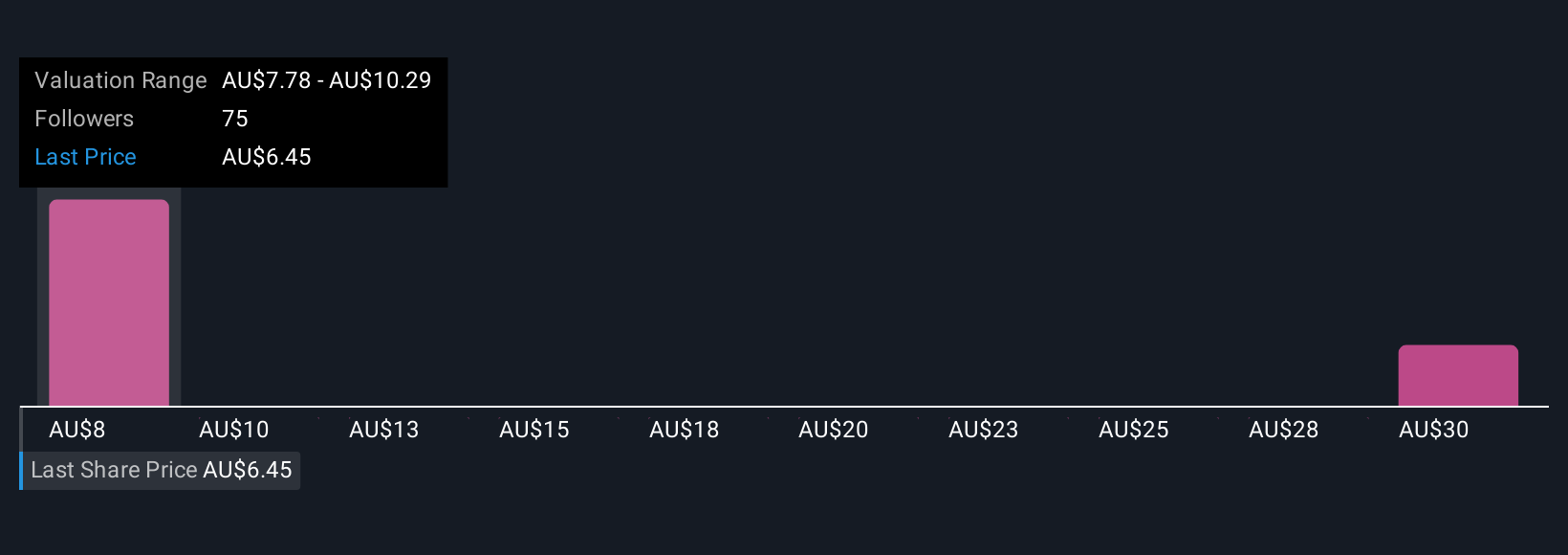

Simply Wall St Community members offered six distinct fair value views for Santos, ranging from A$7.78 to A$32.94 per share. While such wide-ranging opinions exist, the central focus for the company remains effective execution of major projects and disciplined financial management amid this period of leadership transition.

Explore 6 other fair value estimates on Santos - why the stock might be worth over 5x more than the current price!

Build Your Own Santos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santos research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Santos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santos' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STO

Santos

Explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success