- Australia

- /

- Capital Markets

- /

- ASX:PVL

ASX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Australian stock market is experiencing turbulence, with the ASX 200 expected to continue its downward trend following a significant selloff, influenced by global economic pressures and investor reactions. Despite these challenging conditions, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, these stocks can offer affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.79 | A$99.02M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.495 | A$306.97M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.575 | A$771.88M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.92 | A$134.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$190.52M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.85M | ★★★★★★ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Powerhouse Ventures (ASX:PVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Powerhouse Ventures Limited is a venture capital firm focusing on seed/startup, early venture, and incubation in growth capital companies, with a market cap of A$11.48 million.

Operations: The company's revenue is derived entirely from its investment in and incubation of start-up companies, amounting to A$1.09 million.

Market Cap: A$11.48M

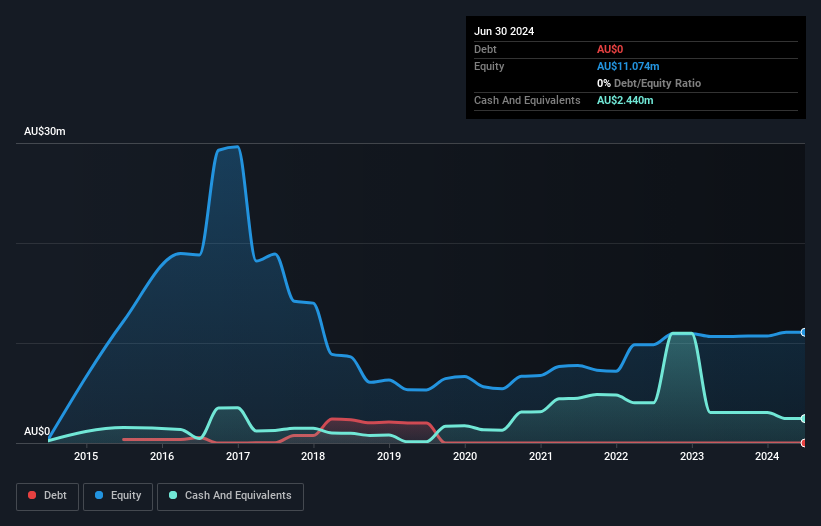

Powerhouse Ventures Limited, with a market cap of A$11.48 million, operates as a venture capital firm focusing on early-stage investments but remains pre-revenue with less than US$1 million in revenue. The company has no debt and its short-term assets significantly exceed liabilities, indicating financial stability. However, it faces challenges such as high share price volatility and negative earnings growth over the past year despite having achieved profitability over the last five years. Shareholder dilution has occurred recently, and while management is experienced, the board lacks tenure which may impact strategic direction.

- Click here to discover the nuances of Powerhouse Ventures with our detailed analytical financial health report.

- Understand Powerhouse Ventures' track record by examining our performance history report.

Red Sky Energy (ASX:ROG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Sky Energy Limited is an oil and gas exploration and development company that focuses on acquiring, drilling, and developing resources in the United States and Australia, with a market cap of A$65.07 million.

Operations: Red Sky Energy Limited has not reported any revenue segments.

Market Cap: A$65.07M

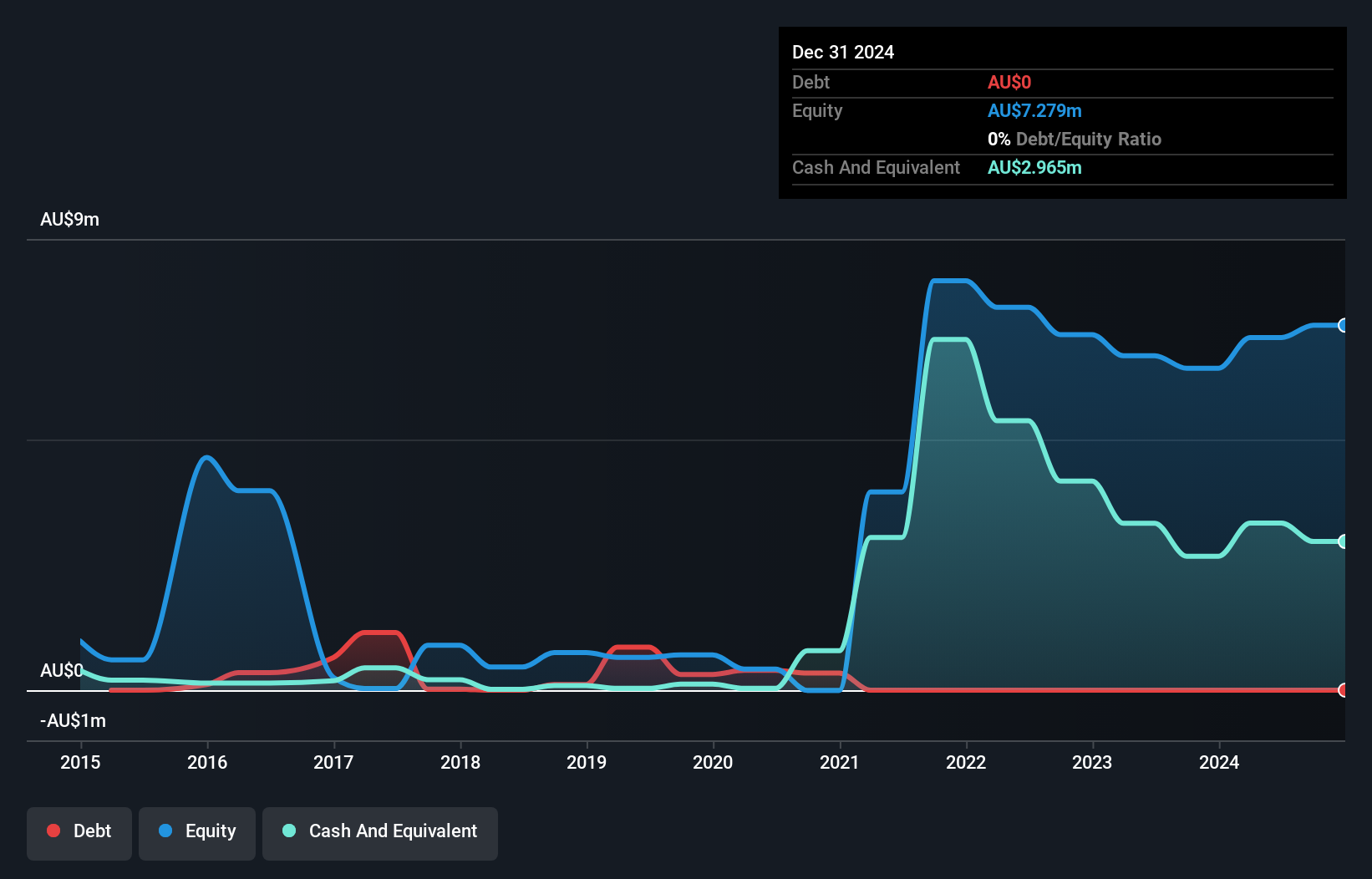

Red Sky Energy Limited, with a market cap of A$65.07 million, is pre-revenue and unprofitable but has reduced losses over the past five years by 5.1% annually. The company benefits from being debt-free and having short-term assets of A$3.5 million that exceed both its short-term liabilities (A$596.5K) and long-term liabilities (A$849.8K). Despite high share price volatility, Red Sky maintains a positive cash runway for over three years even as free cash flow decreases by 14.6% per year. However, shareholders have experienced dilution recently with increased shares outstanding by 2.3%.

- Click to explore a detailed breakdown of our findings in Red Sky Energy's financial health report.

- Examine Red Sky Energy's past performance report to understand how it has performed in prior years.

Veris (ASX:VRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Veris Limited offers surveying and spatial data services mainly in Australia, with a market cap of A$24.95 million.

Operations: The company generates A$92.59 million from its segment focused on providing comprehensive spatial data solutions.

Market Cap: A$24.95M

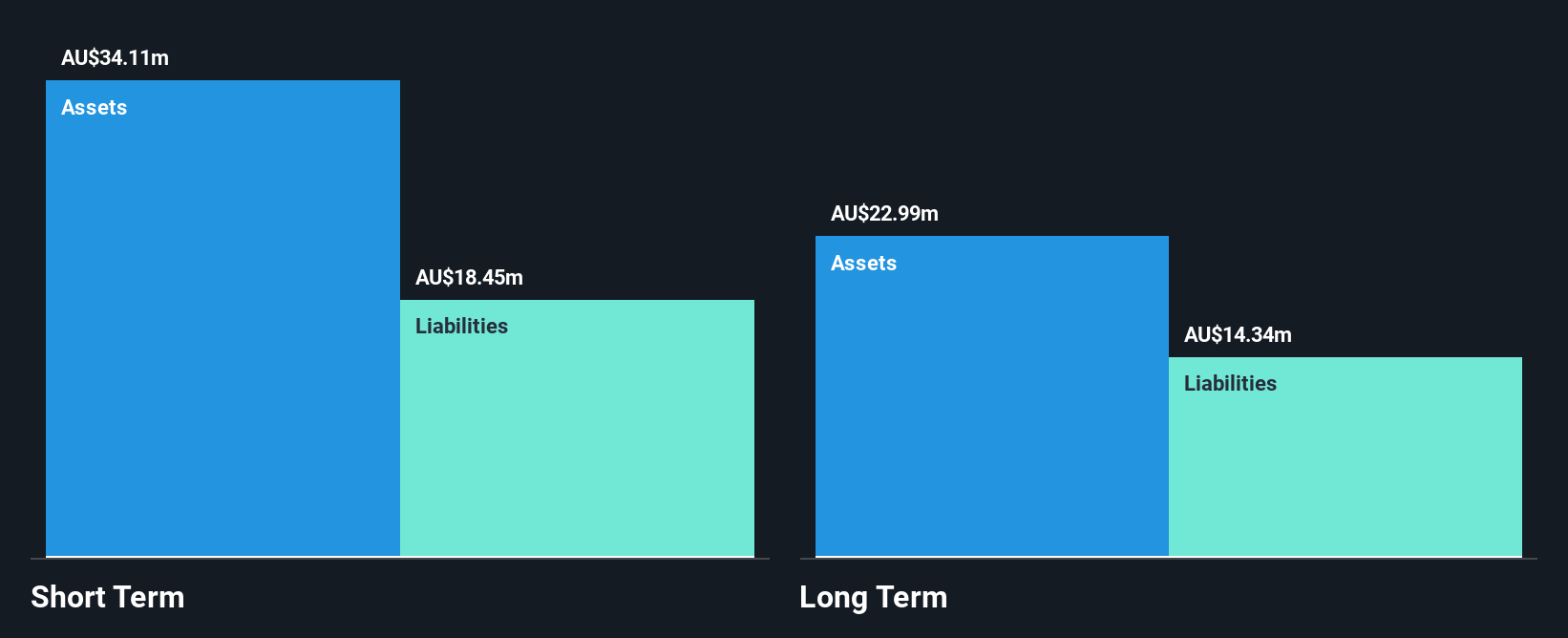

Veris Limited, with a market cap of A$24.95 million, generates significant revenue from its spatial data services. Despite being unprofitable, it maintains a positive free cash flow and has a cash runway exceeding three years. The company's debt reduction over the past five years and more cash than total debt indicate financial prudence. While its share price is volatile, Veris trades at 62.4% below estimated fair value and has not diluted shareholders recently. The management team is relatively new with an average tenure of 1.9 years, but the board's experience averages 3.5 years, providing some stability in governance.

- Dive into the specifics of Veris here with our thorough balance sheet health report.

- Examine Veris' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1,051 ASX Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PVL

Powerhouse Ventures

A venture capital firm specializing in seed/startup, early venture, incubation in growth capital companies.

Flawless balance sheet slight.

Market Insights

Community Narratives