- Australia

- /

- Oil and Gas

- /

- ASX:PEN

Will Peninsula Energy’s (ASX:PEN) Strengthened Governance Translate to Sustainable Value for Investors?

Reviewed by Simply Wall St

- Peninsula Energy Limited recently appointed Ms. Tejal Magan, a Chartered Accountant with significant experience in equity capital markets and risk management, as a Non-Executive Director and Chair of the newly consolidated Audit, Risk and Sustainability Committee, following an internal review and board restructuring.

- This move reflects Peninsula Energy’s increased emphasis on integrating sustainability and governance into its core risk oversight functions, aligning board structure with evolving stakeholder priorities.

- We’ll explore how the appointment of Ms. Magan as Audit, Risk and Sustainability Committee Chair strengthens Peninsula Energy’s investment narrative through heightened governance focus.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Peninsula Energy's Investment Narrative?

For anyone considering Peninsula Energy today, the big picture centers on the company’s ambitions to progress the Lance Project to full commercial production and transition toward profitability. The recent appointment of Ms. Tejal Magan as Non-Executive Director and Chair of the newly consolidated Audit, Risk and Sustainability Committee introduces a clear shift toward tighter governance and board oversight, potentially improving how Peninsula addresses risk as it enters a critical operational phase. This change could strengthen investor confidence, particularly around issues like capital management and compliance, but is unlikely to immediately change the near-term catalysts, which remain focused on regulatory approvals, operational milestones at the Lance Project, and securing needed funding following the recent equity offering. Key risks still include execution delays, operational start-up challenges, and dilution from frequent capital raises, though refreshed board expertise may help mitigate governance concerns moving forward.

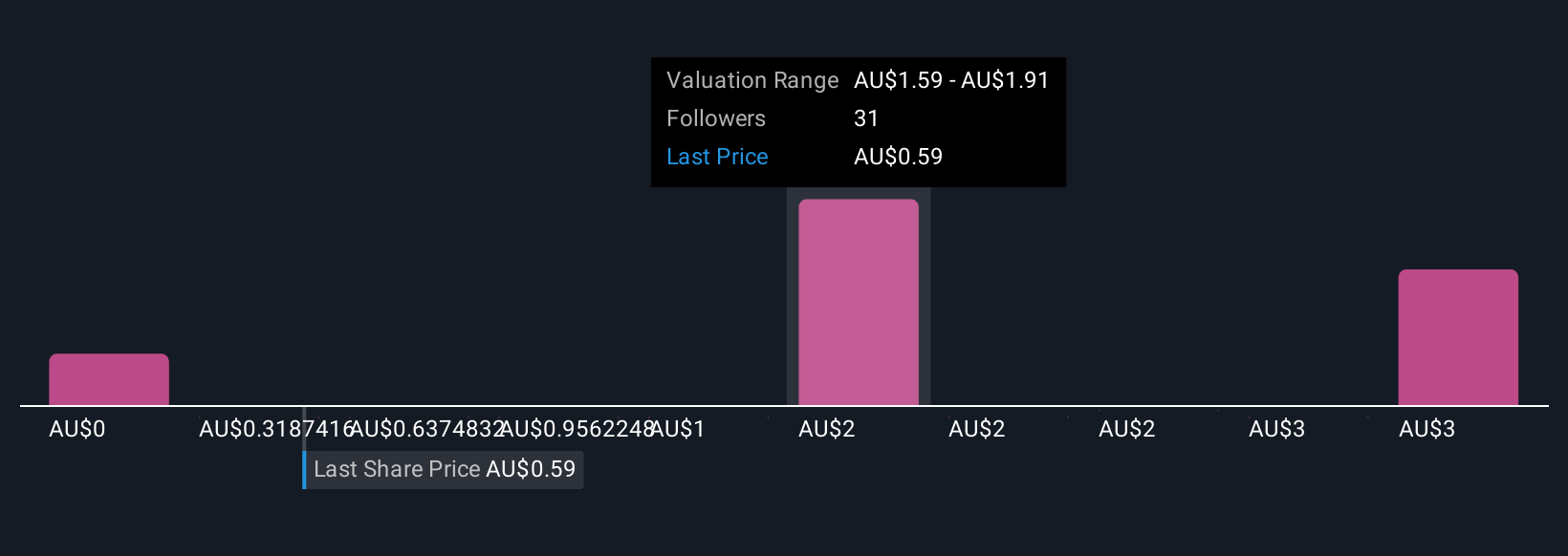

On the other hand, shareholders should consider how continued funding needs may impact their positions. Peninsula Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 11 other fair value estimates on Peninsula Energy - why the stock might be worth 33% less than the current price!

Build Your Own Peninsula Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peninsula Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Peninsula Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peninsula Energy's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PEN

Peninsula Energy

Operates as a uranium exploration company in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives