- Australia

- /

- Oil and Gas

- /

- ASX:PEN

Do Auditor Concerns Over Peninsula Energy's (ASX:PEN) Sustainability Shift Its Strategic Outlook?

Reviewed by Sasha Jovanovic

- Peninsula Energy Limited recently reported its full-year results for the period ended June 30, 2025, posting a net loss of US$12.5 million, slightly higher than the previous year's loss, alongside lower basic and diluted losses per share.

- The company's auditor, BDO Audit (WA) Pty Ltd, expressed doubt about Peninsula Energy's ability to continue as a going concern, highlighting financial sustainability as a key concern for investors.

- With the auditor's going concern doubts in focus, we'll explore how these issues reshape Peninsula Energy's investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Peninsula Energy's Investment Narrative?

For any shareholder in Peninsula Energy, the big-picture belief usually centers around the company’s potential to deliver long-term uranium production growth, driven by regulatory progress and operational milestones at its Lance Project. The recent full-year results revealed losses similar to prior years, but with a notable decrease in basic and diluted losses per share, suggesting progress on cost management. However, the auditor’s going concern warning now puts financial viability squarely on the table and could overshadow catalysts like the Phase 2 operational go-ahead or expanded in-house processing capabilities. While past analysis flagged rapid revenue growth and possible upside to consensus fair value, these positives look increasingly fragile given the new questions around access to capital and ongoing dilution risk. The investment narrative has shifted, making risk management and near-term liquidity even more crucial for shareholders. Yet, the question of future funding and dilution risk should not be underestimated by investors.

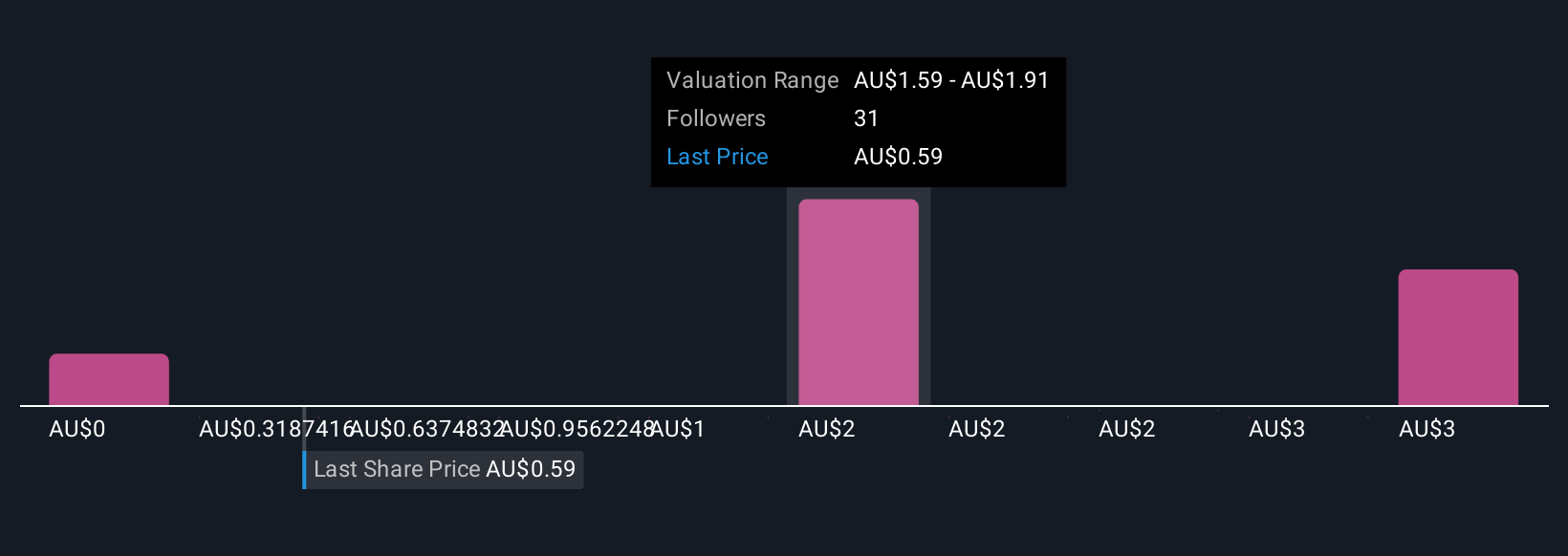

Peninsula Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 11 other fair value estimates on Peninsula Energy - why the stock might be worth less than half the current price!

Build Your Own Peninsula Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peninsula Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Peninsula Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peninsula Energy's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PEN

Peninsula Energy

Operates as a uranium exploration company in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives