- Australia

- /

- Oil and Gas

- /

- ASX:NHC

Undervalued Small Caps With Insider Action In Global For April 2025

Reviewed by Simply Wall St

In April 2025, global markets are experiencing a mix of optimism and caution as U.S. equities rise on the back of easing trade tensions, yet economic indicators such as the Flash PMI signal a slowdown in business activity growth to its lowest level in 16 months. Despite these challenges, small-cap stocks have managed to post gains for the third consecutive week, driven by positive corporate earnings and subdued market activity levels. In this environment, identifying promising small-cap stocks often involves looking for companies that demonstrate resilience amid economic uncertainties and potential insider action that may indicate confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.9x | 0.5x | 41.83% | ★★★★★★ |

| Nexus Industrial REIT | 5.3x | 2.7x | 24.38% | ★★★★★★ |

| Tristel | 27.6x | 3.9x | 26.76% | ★★★★★☆ |

| Savills | 23.9x | 0.5x | 43.19% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 3.06% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 44.02% | ★★★★☆☆ |

| Norcros | 24.6x | 0.6x | 27.21% | ★★★☆☆☆ |

| FRP Advisory Group | 12.7x | 2.3x | 7.31% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.5x | 3.8x | 37.43% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.8x | 0.4x | -6.92% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

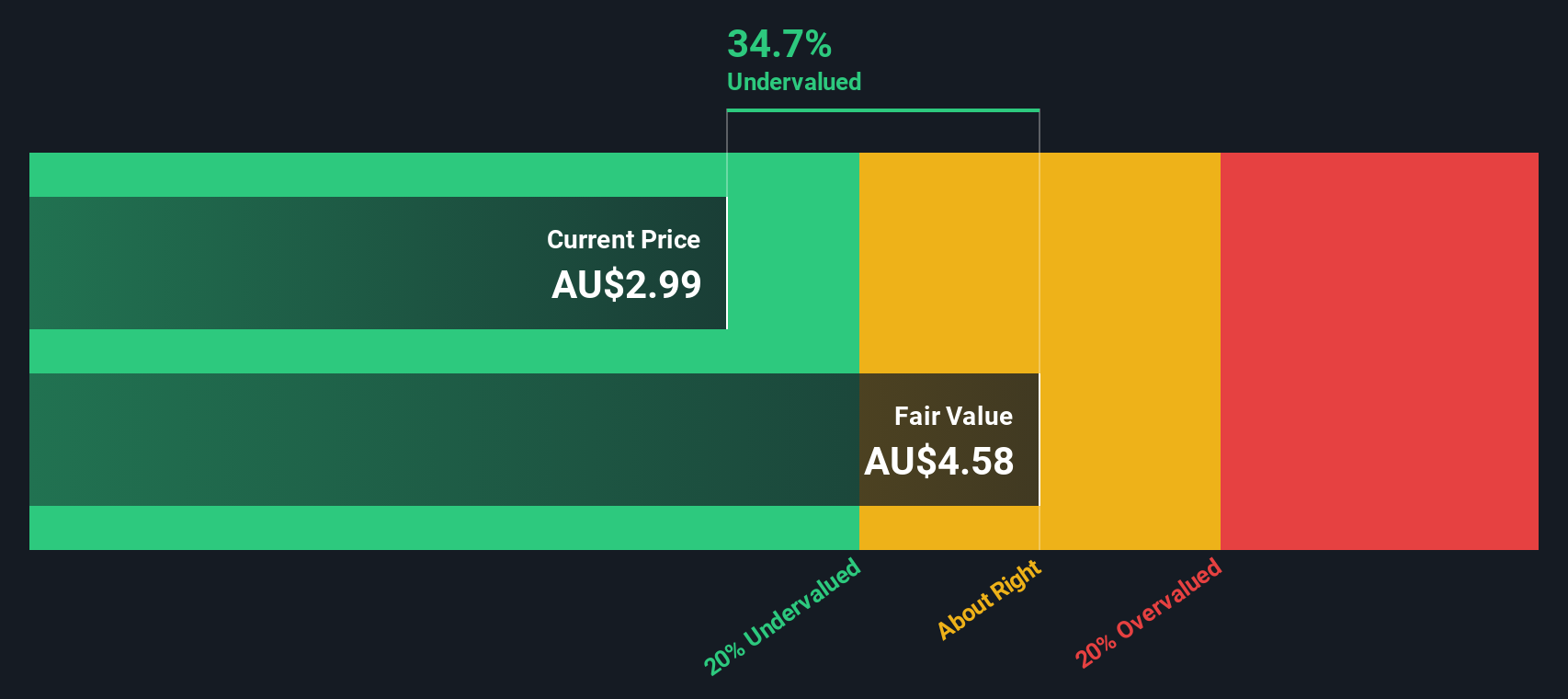

FleetPartners Group (ASX:FPR)

Simply Wall St Value Rating: ★★★★★★

Overview: FleetPartners Group is a company that provides vehicle leasing and fleet management services, with a market capitalization of A$1.25 billion.

Operations: FPR generates revenue primarily through its operations, with costs of goods sold (COGS) forming a significant portion of expenses. Over recent periods, the company has experienced a decline in gross profit margin from 41.40% to 29.20%. Operating expenses are consistently substantial, including general and administrative costs that have shown slight increases over time. Net income margin has seen fluctuations but remains positive in recent quarters.

PE: 7.9x

FleetPartners Group, a smaller player in the market, has caught attention due to its potential for value. Despite earnings forecasted to decline by 6.1% annually over the next three years, insider confidence is evident with share purchases between January and March 2025. However, their reliance on external borrowing poses higher financial risk as operating cash flow doesn't cover debt well. The recent change in share registry location underscores ongoing organizational adjustments without impacting core operations.

- Dive into the specifics of FleetPartners Group here with our thorough valuation report.

Assess FleetPartners Group's past performance with our detailed historical performance reports.

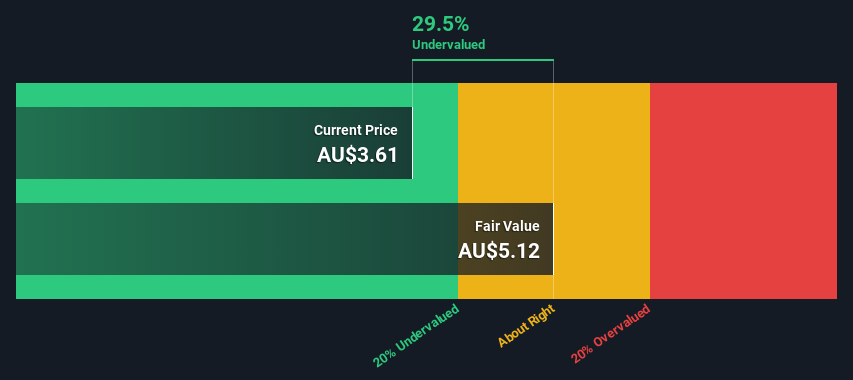

New Hope (ASX:NHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Hope is a diversified energy company primarily engaged in coal mining operations across New South Wales and Queensland, with a market capitalization of A$5.12 billion.

Operations: New Hope's primary revenue streams are derived from its coal mining operations in New South Wales and Queensland. The company has experienced fluctuations in its net income margin, reaching a high of 42.50% and a low of -32.36% over the observed periods. Operating expenses include sales and marketing, which have varied but generally stayed significant relative to other costs.

PE: 5.6x

New Hope, a smaller company in its industry, has recently demonstrated insider confidence, with Robert Millner purchasing 75,000 shares for A$306,084. The company's financial performance is notable with half-year revenue reaching A$1.05 billion and net income at A$340 million. Despite earnings forecasts suggesting a decline of 7.5% annually over the next three years, New Hope's share repurchase program aims to return up to A$100 million to shareholders by March 2026.

- Click here and access our complete valuation analysis report to understand the dynamics of New Hope.

Explore historical data to track New Hope's performance over time in our Past section.

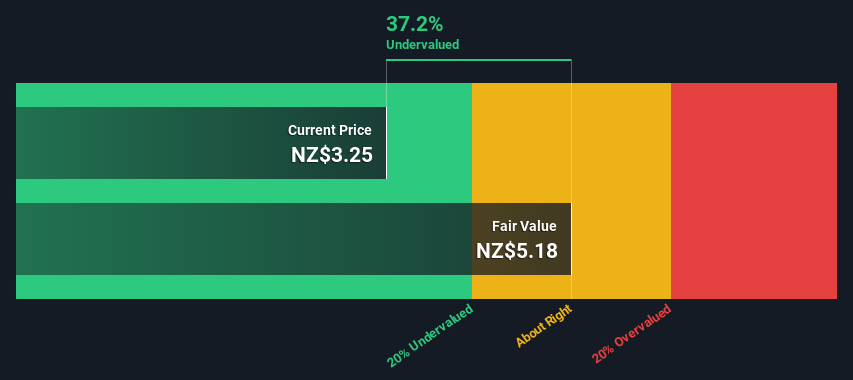

Fletcher Building (NZSE:FBU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fletcher Building is a diversified company engaged in manufacturing and distributing building materials, as well as providing construction services, with a market capitalization of NZ$3.97 billion.

Operations: Fletcher Building generates revenue primarily from its segments in Australia (NZ$1.85 billion), Construction (NZ$1.73 billion), and Distribution (NZ$1.56 billion). The company's gross profit margin has shown variability, reaching 31.22% at its peak during the period reviewed, indicating fluctuations in cost management and pricing strategies over time.

PE: -21.9x

Fletcher Building, a smaller player in the construction sector, has seen insider confidence with recent share purchases. Despite a net loss of NZ$134 million for the half-year ending December 2024, insiders show faith in its potential. The company faces challenges with higher-risk funding due to reliance on external borrowing. Recent board changes introduce experienced leadership, potentially steering future growth. Delisting from OTC equity markets may impact U.S. investor access but doesn't alter local operations or strategic goals significantly.

- Take a closer look at Fletcher Building's potential here in our valuation report.

Gain insights into Fletcher Building's past trends and performance with our Past report.

Where To Now?

- Dive into all 162 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)